Home Office Expenses: What the ATO Now Requires (and How to Stay Compliant)

The ATO has made some big changes to how you can claim home office deductions — and let’s just say, they’ve made the rules a bit trickier.

The ATO has made some big changes to how you can claim home office deductions — and let’s just say, they’ve made the rules a bit trickier.

But don’t stress — Julia’s created a detailed spreadsheet to help you stay compliant and avoid the common traps. Whether you’re using the actual cost method or the cents-per-hour rate, this tool will help you work out what’s best for your situation and how to track it properly — starting from 1 March 2023.

💡 Tip: These rules are stricter than ever, so if you want to keep claiming your home office expenses, make sure your records are set up exactly the way the ATO expects.

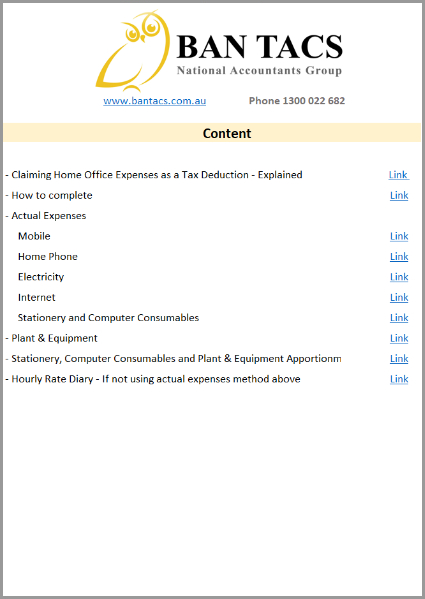

📥 Julia’s Home Office Spreadsheet

- Available exclusively to Empower Wealth clients.

- If you’re a client, reach out to the Empower Wealth Tax Advisory Team and they’ll share the spreadsheet with you.

- If you’re not an EW client, you can purchase it directly from the BAN TACS website here >>