We’ve released Card Insights on Assets and Borrowings cards recently. Now, we’re excited to give you a sneak peek into our upcoming feature – the Income Progress timeline! At Moorr, we strive to provide tools that truly empower you on your financial journey, and this enhanced timeline is a testament to that commitment.

What to expect?

The features:

The upcoming feature include:

- Income progress chart in Income Cards

Platform: Web App only

Expected Release Date: April 2024

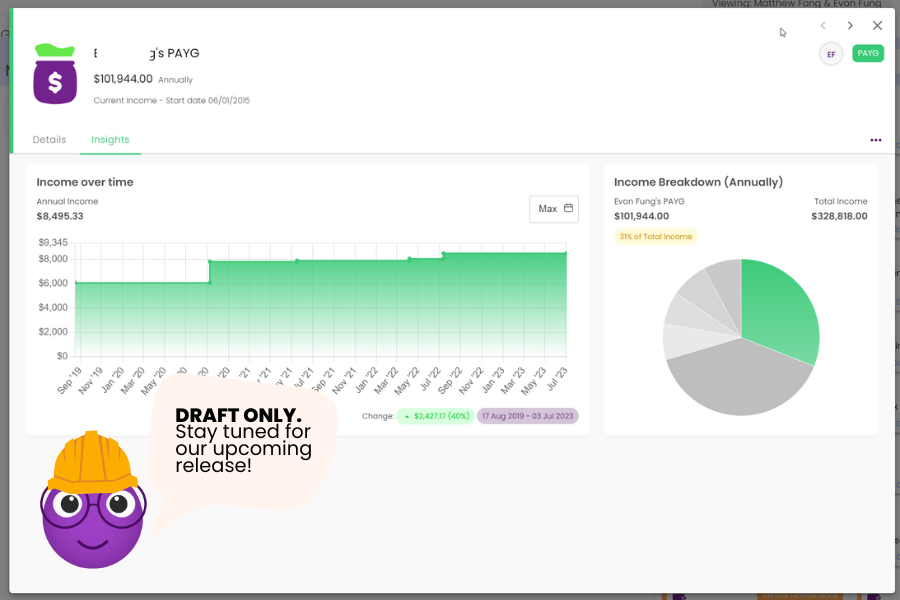

Income Progress Timeline

With precision filtering options ranging from 12 months to maximum duration, the X-axis showcases monthly increments, allowing for a detailed view of your financial journey. This feature provides a nuanced representation of your income, breaking down changes into monthly values for easy comprehension. And the Y-axis reflects the $ value.

Now, since you will income growth happens almost immediately, we have opted for a step-line style approach to ensure a realistic representation of the user’s income level. Stay tuned for a visually enhanced and insightful financial tracking experience!

Why is it cool to track the growth in your income?

1. Celebrate Your Achievements

The Income Progress timeline allows you to visually track and celebrate the milestones in your income growth. Whether it’s a pay raise, a successful investment, or a side hustle taking off, Moorr helps you acknowledge and revel in your financial victories.

2. Strategic Decision-Making

Understanding the patterns in your income growth provides invaluable insights for making strategic financial decisions. Identify peak earning periods, assess the impact of investments, and plan for the future with confidence, all through the intuitive interface of Moorr.

3. Motivation in Action

Seeing the tangible progress in your income serves as a powerful motivator. It fuels your financial ambitions, encourages disciplined money management, and inspires you to set and achieve new financial goals.

How this insight will be helpful:

1. Financial Planning Precision

With the Income Progress timeline, precision in financial planning is at your fingertips. Visualise your income trajectory and align your budgeting, savings, and investment strategies with a clearer understanding of your financial landscape.

2. Goal Setting Made Smarter

Set realistic and achievable financial goals with the aid of historical income data. Whether you’re saving for a home, planning a dream vacation, or aiming for early retirement, Moorr’s Income Progress timeline helps you chart a course towards your aspirations.

3. Enhanced Financial Literacy

As you explore the nuances of your income growth, you’re naturally enhancing your financial literacy. The Income Progress timeline becomes a dynamic learning tool, deepening your understanding of how various factors impact your overall financial health.