MoneySMARTS is a powerful money management system designed to help you save more and gain better control over your finances.

It goes beyond mere budgeting or banking setups, offering a structured and rules-based solution. The system is user-friendly, time-efficient, and adaptable to various household configurations. It works throughout different life stages, from adolescence to post-retirement.

MoneySMARTS empowers you to plan, organise, and manage your money with certainty and confidence. It fills the gap in financial literacy education and has garnered positive feedback from users.

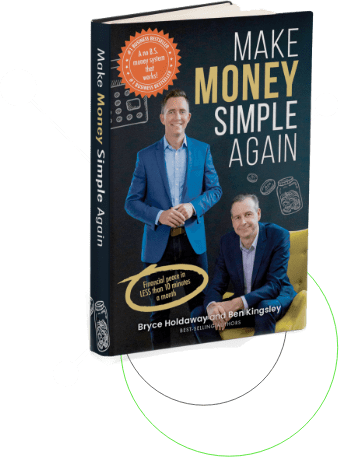

In our best selling book, Make Money Simple Again, you’ll learn the fundamentals and components of the system before diving into the 7-step implementation process. This book is free for download! Check it out here.

If you’re already familiar with the 7-Step process, then buckle up and get ready to experience the incredible benefits of implementing MoneySMARTS via Moorr!

The first step toward building wealth is believing in the goal. You must want to achieve this and believe in your ability to achieve financial discipline and self-control.

Once you’re clear with your motivation, you’ll be ready to embrace this change.

If possible, combine your finances by setting up a joint bank account. This will allow your combined money to work harder for you, improving your overall outcome. If you prefer separate accounts, you can still use the MoneySMARTS system with virtual jars to track your surplus amounts.

At this stage, gather all your financial documents including payslips, bank statements, and credit card statements. And easy way is to simply log in to your bank account and download the CSV file for each of your bank account. Not sure how to do that? Click here to find out.

Checklist for information required to start MoneySMARTS:

How can Moorr Help?:

All you need to do to get started…

Organise your financial documents and sort through the numbers. Record your income, savings, assets, and outstanding debts. Find out how much you are spending on expenses such as groceries, insurance, home maintenance etc.

Having a clear understanding of your finances is essential in crafting a successful money management plan!

How can Moorr Help?:

This is the hardest (and most time consuming) part when you’re doing it manually. But the great news is, our Transactions Feature can do all the above for you!

Break down your spending into:

Once you’ve got the list of expenses, decide how much of the expense is essential living expenses and how much is discretionary (nice to have but not needed to continue living).

Identify and calculate your surplus money, which will be crucial in building your own lifestyle by design. Knowing how much you can allocate to your financial goals is the key to success.

How can Moorr Help?: Let’s track your spending!

Again, Moorr’s Transactions Feature simplified this section immensely!

Once you’ve completed all this, check out your Dashboard on Moorr. This is the coolest part because it tells you how much surplus you have and more! Here’s a screenshot on how it looks like.

To run MoneySMARTS successfully, you will need to ensure you have the banking set up properly. Yes, this involves going online or calling your banks to set or change your account but trust us, it’ll be worth every cent (literally!)

If you own the book – refer to the extensive instructions in Chapter 3, pages 30-46 and Chapter 5, pages 94-101. Here’s the underlying rules:

Alright, now let’s look at how we can optimise your spending!

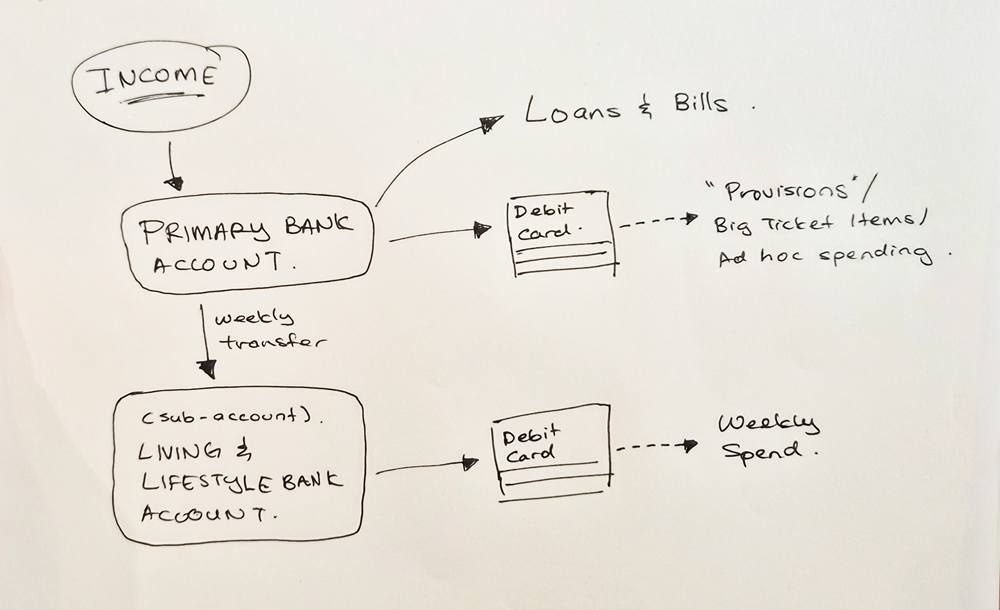

Here’s a rough guide of how your banking structure would look like if you’re a beginner or you’re not comfortable with credit cards.

All your income (PAYG, investments etc)

should go into one primary bank account.

If you have a mortgage, this will be a 100% offset account.

If you don't, it'll be a high interest savings account.

Make sure your weekly allowance is transferring

each week into your Living & Lifestyle account

– so you have your 7-day float up and running.

Create a separate sub-Bank Account for weekly allowances.

Your loans repayment and bills payment

should be set up as direct payments.

Do not bring this debit card out.

Keep it at home and only use it

when you plan to spend on those

Provision expenses.

Use the debit card for all of your provision spending.

Make sure to take note how much you've spent so

you can keep track of how much provision you've left!

(Moorr Mobile app can simplify this 😉)

IMPORTANT: This must be a debit card.

The highest money leakage is usually in our

regular spending so this needs to be a

debit card to stop that leakage.

If you run out of funds in this account,

you know that you are overspending!

Hence stopping that unconscious spending!

Try and identify non-essential expense items

in this category. By cutting back on these, you

could save extra per week, which could be

used towards your goal.

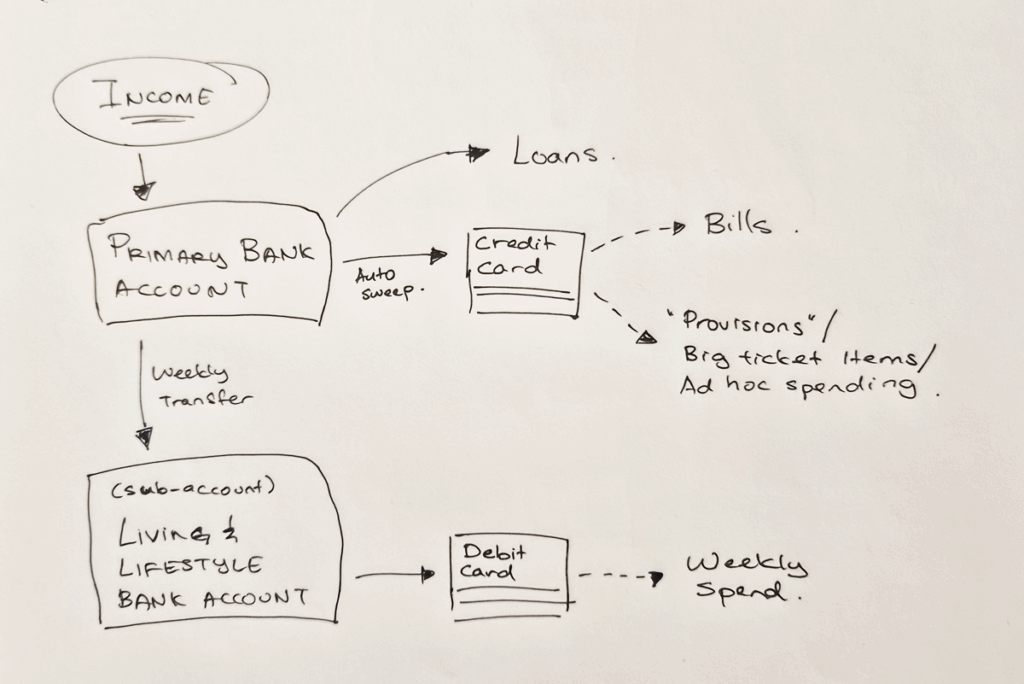

If you’ve been doing budgeting for some time or are comfortable with credit cards (and has the discipline for it), then this would be the ideal set up for MoneySMARTS.

Why credit card helps? Well, that’s because interest is calculated daily so we want to make sure your cash stays in the offset account for as long as possible, hence, saving you those daily interest payment.

Just remember one thing: Set up an autosweep for your credit card payment. Any outstanding balance on your credit card should be paid off automatically so you don’t incur any credit card interest.

All your income (PAYG, investments etc)

should go into one primary bank account.

If you have a mortgage, this will be a 100% offset account.

If you don't, it'll be a high interest savings account.

Make sure your weekly allowance is transferring

each week into your Living & Lifestyle account

– so you have your 7-day float up and running.

Create a separate sub-Bank Account for weekly allowances.

Your loans repayment should be

set up as direct payments.

Set up an autosweep for your credit card payment.

Any outstanding balance on your credit card

should be paid off automatically so you don't

incur any credit card interest.

Interest is calculated daily so we want

to make sure your money stays in the

offset account for as long as possible,

hence, saving you those daily interest payment.

Keep your bill spending down and shop for better deals!

Make sure to take note how much you've spent so

you can keep track of how much provision you've left!

(Moorr Mobile app can simplify this 😉)

IMPORTANT: This must be a debit card.

The highest money leakage is usually in our

regular spending so this needs to be a

debit card to stop that leakage.

If you run out of funds in this account,

you know that you are overspending!

Hence stopping that unconscious spending!

Try and identify non-essential expense items

in this category. By cutting back on these, you

could save extra per week, which could be

used towards your goal.

Monthly check-ups allow you to track and understand your money and cashflow position in a shorter timeframe to give you clearer insights into how well you are progressing and controlling your money.

In short, you are assessing the cashflow for the month – money in and money out – and tracking it against your yearly targets.

For book owners jump to Chapter 6, pages 107-125.

How can Moorr Help?: Monthly Checkup!

This check-up should take less than 10 minutes a month! To see the full reporting and insights, you only need to in Moorr:

Learn more about our Transactions Feature here >

As you embark on your financial journey, remember that flexibility is key. Be open to adjustments and improvements that will help you reach your goals faster. Increase your surplus money by reducing discretionary spending and stay grounded in reality while working towards your goals. You can refer to Step 4 on some suggestions on how to optimise your spending.

Tweaking is all about fine tuning your numbers throughout the course of the yearly program. If a bills item has gone up and will remain up, tweak it to reflect the ongoing costs.

Soon enough, you’ll be a seasoned MoneySMARTS user, and your money will be on autopilot, saving surplus and preventing unconscious overspending. Keep at it, and financial freedom will be yours to enjoy!

For book owners refer to Chapter 6, pages 127-129.

How can Moorr Help?: The best way to do this is to get a trendline of your spending

If you noticed any of these scenarios:

Review and ask yourself if you can optimise this and get more accurate with your spending and updating Moorr. Stay grounded in reality, but never lose sight of the ultimate goal— living your lifestyle by design. Moorr is here to support you every step of the way, providing the tools and resources you need to succeed.

Rollover is all about planning for the next 12 months of money in and money out. This annual review is very important to ensure you think about what you are going to need for money on a regular basis and also on an ad-hoc basis.

The rollover function is about reviewing your overall performance and resetting some of your numbers and most importantly the surplus you are planning to trap for this period!

For book owners go to Chapter 6, pages 132-134.

How can Moorr Help?: Annual Rollover

We’ve made it super easy for you to do an Annual Rollover on Moorr! Simply head to the rollover section on the MoneySMARTS page and follow the prompts.

And don’t miss out on all the amazing insights you can get on your dashboard! Here are some suggestions to give you a better insight on what you’ve achieved so far and what you can do in the next 12 months:

MoneySMARTS is an in-house built money management system. It’s a rules based system and all about making use of smart banking structures to ensure you don’t unconsciously overspend.

The principle is simple, but implementation can be complicated depending on your unique situation. That is why we’ve written a whole book about it! (And it became a best seller too 😎)

So if you are keen to find out how MoneySMARTS can work in your own household, choose an “adventure” that fits you best below, and the free book will land in your inbox within the next 5 minutes.

Once you’ve got a system in place to trap more surplus, what should you do next?

Well, that’s really up to you! Invest it, save it, or use it to pay down non-productive debt.

Whatever it is, rest assured that you now have the freedom to choose!

Spend money on the things you want without guilt and save for the future with confidence. You can have the best of both worlds. Achieve more, with Moorr

So much to realise & gain,

nothing to lose.

Onboard with your hopes,

dreams & finances.

Start planning & living your

Lifestyle-by-Design.

*It’s 100% free. No Strings Attached.

So much to realise & gain,

nothing to lose.

Onboard with your hopes,

dreams & finances.

Start planning & living your

Lifestyle-by-Design.

*It’s 100% free. No Strings Attached.

We only send you awesome stuff =)

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.