Your all-in-one tool for effortless budgeting and tracking.

MoneySMARTS, integrated within the Moorr platform, is your essential tool for financial clarity, designed to simplify budgeting and tracking while aligning with your lifestyle, money, property, and wealth ambitions.

With innovative features and personalised insights, MoneySMARTS empowers you to take control and make informed financial decisions confidently—keeping you one step ahead in today’s dynamic financial landscape.

Which is why we are excited to introduce to you… MoneySMARTS 2.0.

MoneySMARTS was built to simplify money management and help Australians take control of their finances with ease and confidence. Originally developed to support clients at Empower Wealth, MoneySMARTS has evolved into a rules-based system that prioritises simplicity, habit-building, and financial clarity.

With the 2.0 release, this tool integrates powerful new features, offering an all-in-one solution within the Moorr platform. From tracking expenses to building a surplus and achieving financial goals, MoneySMARTS 2.0 is designed to streamline every step.

Watch the video above as Ben walks through the origins of the MoneySMARTS system, the core features in the 2.0 release, and how to use these tools to take charge of your money, save time, and build lasting financial habits.

Since MoneySMARTS first became available as an online tool on our platform in 2017, the number of users, as well as the amount of feedback we’ve received on the tool, has increased tremendously. In MoneySMARTS 2.0, our aim was to address the feedback in the most concise way possible, whilst also preparing MoneySMARTS for some exciting changes in Moorr’s future pipeline.

(Replay) Discover Moorr’s Brand New MoneySMARTS 2.0 with Bryce, Ben & Alric!

Join us as we unveil MoneySMARTS 2.0, a game-changing money management tool designed to help you manage your money effortlessly and stay in control of your financial journey. Bryce and Ben, along with Moorr’s Product Manager Alric, will be here to guide you through the platform’s new features and show you practical ways to make the most of MoneySMARTS 2.0!

A key criticism of the MoneySMARTS area was that if users wanted to make full use of the platforms powerful tools, they would need to have the balances of their Bank Account Cards recorded correctly, in addition to having checkup data recorded. This meant users had to enter this information twice per monthly interval – once on the monthly checkup, and once on the Card balances.

Furthermore, users mentioned that recording a single Primary Account balance could be cumbersome and insufficient, especially as there are often multiple bank accounts associated with a single profile, and this was recorded as a singular in MoneySMARTS, but recorded individually on a Card level.

This checkup update uses our historical tracking functionality to push and pull updates into your checkup area directly into Cards. This means that when you update an account balance via MoneySMARTS checkups, the account balance will also update directly into the historical records of your Bank Account Cards. Similarly, if a balance is already available on the specified checkup date on the Bank Account Card, this balance will be prefilled into the MoneySMARTS checkup area.

In summary, this update ensures that the values recorded in MoneySMARTS are now directly recorded into your MyFINANCIAL Cards. and vice versa, setting us up for a more automated Moorr platform in the near future.

MoneySMARTS 2.0 Check Ups are designed to record and retrieve just the bank balances on the specified Check Up dates, for example on the 1st of every month. This means that if you have other values entered in the historical logs for your bank account or credit card MyFINANCIAL Cards, these will not be retrieved, as they are not reflective of the ‘Opening Balances’ on the 1st of the month.

This approach was taken as we are preparing Moorr to be able to automatically retrieve, read and display information on specific dates.

Checkups you’ve previously recorded will still be retained and displayed, however you’ll also see an option to ‘Track using card balances’.

If you choose this option, it’ll instead use the bank accounts and credit cards that have been specified as being trackable in MoneySMARTS as at the check up date.

If there are none designated, you’ll be directed to set this up (see Track in MoneySMARTS field below), or asked to create the respective MyFINANCIAL Cards, if none are detected.

If you run a large number of bank accounts or have multiple offsets in your household, you can choose which of these you’d like to track, and only those chosen will be shown within MoneySMARTS checkups.

This allows you the flexibility of including/excluding accounts that you may or may not deem relevant for the purposes of planning your household budget and surplus.

We’ve added a quick way to adjust this field in a bulk manner across your current bank accounts and credit cards via the ‘Set Up MoneySMARTS Tracking’ button. You can read more about this tool and how it function here.

Tweaks and changes to your MyFINANCIAL data will no longer retrospectively be applied in MoneySMARTS during the same period.

User feedback was that changes in their financial circumstances are retrospectively reflected on MoneySMARTS. This meant that if you had originally set a goal to have a set surplus captured for the year, but there were changes to your targeted surplus due to changes in your financial position part-way through the year, the values in the tables and charts on the page would also be incorrectly adjusted.

Now, with the ability to properly historically track your numbers in the platform via your MyFINANCIALS, we’re able to report and adjust your overall MoneySMARTS Surplus values on a monthly interval basis.

What this means is that though your annual surplus may adjust based on the latest position your MyFINANCIALS data represents, the previous months’ tracking information will be retained, to show how you tracked according to the monthly target surplus for those particular months.

When you change a Start Date within a current period, Moorr automatically adjusts the period’s data to reflect your new chosen Start Date to include the 12 months’ of checkups required from the new Start Date. Note that because of how historical tracking works in Moorr, this means if you’ve changed the day you normally checkup (e.g. from the 15th of the month to the 1st), your new checkups will be from the 1st of the month, and thus will only display the actual bank balance and credit card balances on that specific date.

This is done because the balance of your checkups should reflect the opening balances of the respective accounts on the specified dates. This is foundational for future planned functionality in Moorr, which involves pulling balances directly from your bank accounts on specific dates.

The previous ‘Yearly Remaining Provisions’ graph in MoneySMARTS 1.0 was displaying an incorrect representation of the Yearly Remaining Provisions, given that changes to your data were not reflected here. We’ve now corrected this graph to the intended representation as per the Money Made Simple Again book.

Before we jump into explaining the workings of the Yearly Remaining Provisions Total, it’s helpful to remember that with the MoneySMARTS system – it’s a 12-month target view of money in and money out. Effectively meaning every current dollar you have (Savings), every future dollar you earn (income) and every dollar going out (expenses) makes up your 12-month calculations and view of your finances – the MoneySMARTS System.

Your Yearly Remaining Provisions Total is effectively a representation of your ‘Provisions Jar’ broken down on a rolling monthly basis. Your ‘Monthly Allocated Provisions Spending’ is the amount you allocate to your Provisions Jar each month. For example, an amount of $500 per month is your Monthly Allocated Provision Spending, based on an annual provision allocation of $6,000. As the months progress, you add funds into this Jar based on your monthly allocation, and as you spend money, you reduce the balance in your Provisions Jar.

Expanding on this example, if your actual Provisions Spent during your first month was $300, your Yearly Remaining Provisions Total would increase by $200, indicating that you underspent during that month($500 minus $300). This $200 left over in your Provisions Jar would then carry forward to the next month and be added to your new month’s $500 allocation ($500 plus $200 = $700).

If you spend $600 in the second month—exceeding your usual $500 monthly allocation—your Yearly Remaining Provisions Total would be calculated as $700 (carried-forward Yearly Remaining Provisions Total) minus $600, leaving you with a $100 in your Provisions Jar.

During months when you have higher expenses due to large-ticket items, such as a major holiday airfare, your Yearly Remaining Provisions Total might temporarily dip into negative territory. However, and most importantly, as long as you adhere to your overall Provisions Jar allocation, your Yearly Remaining Provisions Total should gradually recover, provided you don’t overspend.

It’s perfectly fine if your Yearly Remaining Provisions Total hovers around the $0 mark, as this indicates you’re on track with your planned provision spending. However, keeping this total positive should be your goal, as any unspent provisions at the end of the year can result in an additional surplus cash position providing additional financial savings & flexibility.

[insert diagram/illustration of table + graph overlay to show the example of the above]

The Remaining Provision Balance displayed under the Provisions Jar component reflects the amount remaining on an annual basis, whereas your Yearly Remaining Provisions Total represents the allocation to your Provisions Jar on a rolling monthly basis.

For example, some MoneySMARTS users might have large provisions allocated—say $30,000 per year—across all their expense cards they have allocated under the Provisions Jars. However, your actual cash in the bank might only be $20,000 at the start of the MoneySMARTS 12-month period (understanding that new money earnt will also be coming in each month). The MoneySMARTS system understand this and is designed to accommodate this by provisions money on a monthly basis, even though this allocation is based on an annual calculation.

This approach helps you better track your cashflow by incorporating your anticipated Provisions as monthly values into your monthly target surplus calculations.

[illustrative example]

Previously, in MoneySMARTS 1.0, the Yearly Remaining Provisions Chart reflected the latest annualized value of your Provisions Jar balance, calculated as the starting allocation minus the amount spent during the period. However, under this version, changes to your financial circumstances weren’t captured historically, which affected your overall calculations for the entire period. The problem with that approach was that any adjustments made later in the period were retroactively applied, making it seem as though the changes were in place from the start, meaning it was hard to really see the progress you are making towards your targeted monthly surplus.

For example, if a user initially set a $5,000 annual provision spend, but during the 12-month period, they increased their annual Provisions Jar allocation to $15,000pa in month 10, MoneySMARTS 1.0 would incorrectly treat this $15,000 as if it had been allocated from month 1. This approach distorted the Yearly Remaining Provisions Chart by overestimating the available funds.

In contrast, the new MoneySMARTS 2.0 Yearly Remaining Provisions chart, is now consistent with the chart outlined in the Money Made Simple Again book, which tracks changes on a rolling monthly basis. This means that if you increase your Provisions Jar allocation to $15,000pa in month 10, it adjusts your Monthly Allocated Provisions Spending by an additional $833.33 per month (an increase of $10,000 spread over the remaining 12 months) from month 10 onwards, rather than allocating an additional $5,000 for each of the remaining two months. This approach avoids distorting your targeted monthly surplus.

Note: If this $10,000 was a figure you initially missed in setting up your 12-month MoneySMARTS targets, and you wanted to include this $10,000 to apply from the start of the period, the good news is that you can now update your historical records in your MyFINANCIAL Expense Card or cards. This allows you to set the correct starting value for your Provisions Jar, ensuring that the entire MoneySMARTS period accurately reflects your financial plan.

Furthermore, with the upgrade to MoneySMARTS 2.0, whenever there is a significant new financial change to your numbers, we’d recommend you perform a MoneySMARTS Rollover to reset your next 12-months range, even if you haven’t completed a full 12 month period.

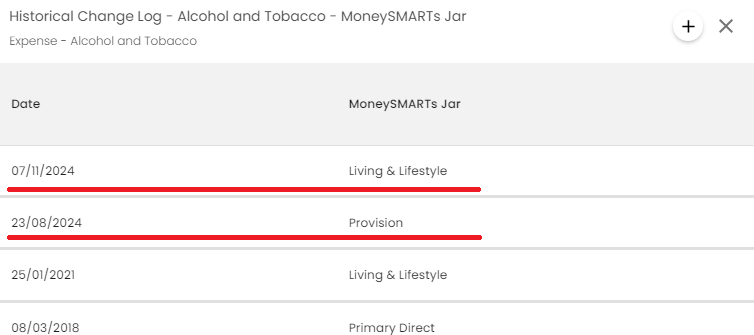

In MoneySMARTS 1.0, if you’d archived a provision or changed a jar within a period, it wouldn’t be shown at all and you’d lose track of the spending that occured within this provision, as well as the original amount allocated to this expense.

In MoneySMARTS 2.0, this is displayed in a separate area underneath the standard provision jar widget. This shows any provision expenses that were either archived or changed from a provision jar to a different jar within the displayed period, shown as ‘Active from’ the start date of the period to the date the expense ceased to be a provision, or was archived.

This has been included to help you reconcile your figures, as changes to your historical figures are now always included in MoneySMARTS and will reflect as such in the check up reporting table.

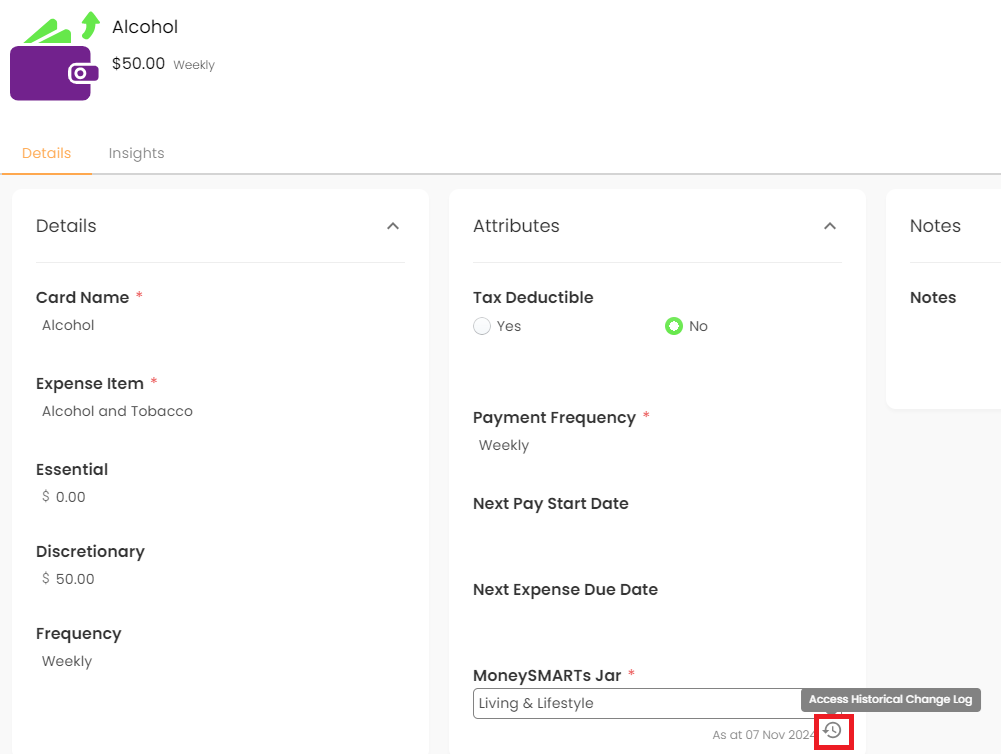

Data in MoneySMARTS 2.0 is displayed based on the Historical Data contained within your MyFINANCIAL Cards. This includes allocations to your Jars, which are also historically tracked.

If the most recent changes have not displayed on your MoneySMARTS page, please follow the below steps before contacting our support:

If you scroll to the bottom of the MoneySMARTS page, you would also noticed a few tables and charts for the astute money managers. We’ve also made some smaller tweaks to some of these insights to help provide a better understanding and experience for our Moorr users.

The checkup table and charts will now show each monthly interval as a defined period, rather than just ‘June 2023’ as an example.

We found users had trouble interpreting what monthly interval certain provision transactions fell in. For instance, if a checkup start date was set on the 10th of June, transactions that fell between 1-9 June would fall under the prior monthly interval of May, though some users expected this to be reported in the June column instead.This should make provision tracking a bit clearer for users.

The reporting table now reflects the specific dates for each monthly interval, as well as an opening and closing balance. Note: the closing balance for the month is determined by the opening balance of the following month.

You can also click on a term in the table to display its definition.

We often get questions around what is reflected as the ‘Current Surplus’ on the MoneySMARTS dashboard vs the change in net cash position a user and why they might be different.

As such, we’ve added a small tooltip insight to display the total cash movement from start to end of period, distinguishing it from the overall MoneySMARTS ‘current surplus’ (which his the accumulated actual surplus position, factoring in the provisions overspent/underspend).

Yes, absolutely! All these new updates are on both mobile and web.

There’s only one exception and that’s the annual rollover feature. The annual rollover requires a little bit more input from the users so unfortunately, there’s simply not enough space on a mobile screen to support this. Hence, for the best user experience, the rollover is only available on the web version.

Good news is none of your existing data is affected or lost.

For any historically entered check-ups, your information will be retained as singular account balance records. You’ll be able to still view and edit these, though for past records, you’ll also be able to choose to use the check-up process.

The checkups display the balances of the bank accounts or credit cards as at the specified check up date.

This means that balances between two checkup dates will not be shown.

MoneySMARTS 1.0 was developed in 2017 and initially worked on displaying only the latest figures on the MoneySMARTS page.

Let’s say for example you had a start date of 1st January 2023 with a MoneySMARTS period between 1st January 2023 – 31st December 2023. If you’d made changes to your loan repayments or income in November 2023, you’d see these changes reflected all the way back to January 2023, resulting in an incorrect display of your MoneySMARTS position as of January 2023 all the way through to November 2023.

MoneySMARTS 2.0 works to correct this, and now utilises historical tracking (like the rest of the insights in Moorr) to much more accurately record and reflect your financial position at any point during the MoneySMARTS period.

Because of this, you’ll more than likely see differences to your figures, both in past and current MoneySMARTS Periods.

The primary reason for this is normally that the historical entries for your income, expense or borrowings items likely did not occur until later in the period. To fix this, double check your historical entries under the cards, notably the as at dates for the values, ownership and jar, and add the correct entries to the right historical dates.

The Accumulated Actual Surplus is based on the calculation: Current Month’s Ending Net Cash Position – Current Month’s Yearly Remaining Provisions Total – Starting Net Cash Position. This specific calculation recognises that provisions for the month are not necessarily all spent, and in some months more than the allocated monthly provision is spent.

Now let’s say for example you had an unforecasted expense of an additional $10,000 in July 2024 on your holiday provision. If you’d paid in cash, you’d expect to see a direct decrease in your Account Balance by the $10,000 during that month, or if purchased on credit, for the Credit Card balance to increase by $10,000 for that month.

If your Ending Cash balance still increased even though you were expecting the total net position to decrease during the month, this additional balance increase is recognised as additional surplus.

Because you have still managed to increase your account balance for that month and the months thereafter, the accumulated actual surplus reflects this position – that you have managed to overspend on your yearly provisions yet still managed to increase your overall net cash position over time.

MoneySMARTS 2.0 leverages the historical data within MyFINANCIALS, paving the way for bank connectivity in the future. This enhancement ensures that all check-up balances are automatically updated and recorded in your MyFINANCIAL Cards’ historical change logs whenever you perform an update.

However, it’s important to note that future-dated check-ups will not appear until the specified date arrives.

For example, if today is 20 November 2024 and your next check-up is scheduled for 1 December 2024, the December check-up will only become visible on 1 December. This approach ensures that the balances accurately reflect the actual bank data as of the check-up date.

Recording balances prematurely could result in overstating or understating the actual figures for 1 December, potentially leading to an inaccurate representation of your financial data.

Don’t worry! Your provision data hasn’t disappeared.

This is likely because your Start Date has not been set correctly, which is common amongst users who only use the page for tracking their Provision Transactions but hadn’t utilised the full fledged check-up functionality in the past. Because the Start Date was not correctly set, the page is simply displaying data for an older period. In these cases, you’ll get the below error message:

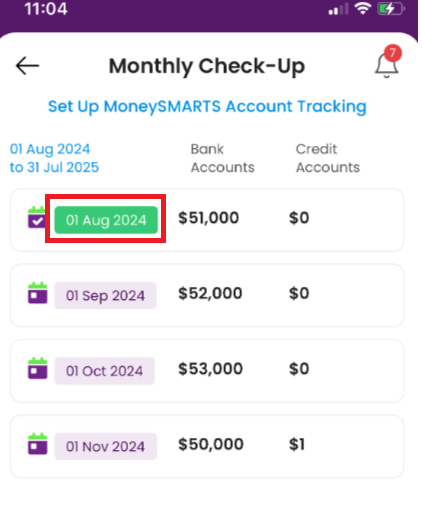

To change your start date, it’s easy. If you’re on the Web, simply click the ‘Start Date’ field and change it to a new date. If you’re on the Mobile App, simply click the Green Date, like below, to change the Start Date.

You can also follow the steps in this Youtube video.

Open Banking and integrating bank feeds is a project that we are regularly reviewing.

This feature will enable live updates for transactions in and out of your bank account directly into Money SMARTS in the future. However, it’s a substantial undertaking that will require much time and resources to complete, so it’s not a feature that we are actively working on at the moment.

We will keep our community posted when we’ve decided to get started on this feature.

We understand the importance of having a goal that you can track! Our Product Team is also looking at designing a tool and feature that will support and motivae our aspiring Moorr users.

If you’re keen to implement MoneySMARTS but not sure where to start, then reach out to us! Our Support Team is stoked to tackle any queries you’ve got about Moorr. Whether you’re battling to sort out tricky expenses, reckon you’ve found a bug, or perhaps you’ve got a great idea for the app, we’re all ears!

Let's Stay Connected

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.