Great, the cash rate is tipped to go up again. Can I even afford anything anymore? Should I take up a second job? Should I start a family this year? Maybe I should push back our wedding. Should I quit this job that I love and get a higher-paying job? Do I have to sell off my car? Should I sell off my property? Sounds familiar?

There’s a lot of noise out there at the moment, and with a likely increase in cash rates in the coming months and an already high cost of living, you are not alone if you’re asking those questions.

In fact, it’s probably not an exaggeration to say that this might be the reason for a lot of sleepless nights and relationship breakdowns in Australia at the moment.

Australians are a hardworking bunch. We want to make sure that we don’t leave it until the very last minute when we would have nothing left and struggle to put food on the table. That’s why many of us are asking those questions, which is really all about: What can I do NOW to make sure that we won’t be in trouble in the FUTURE?

But… how do you know if you’re making the right call?

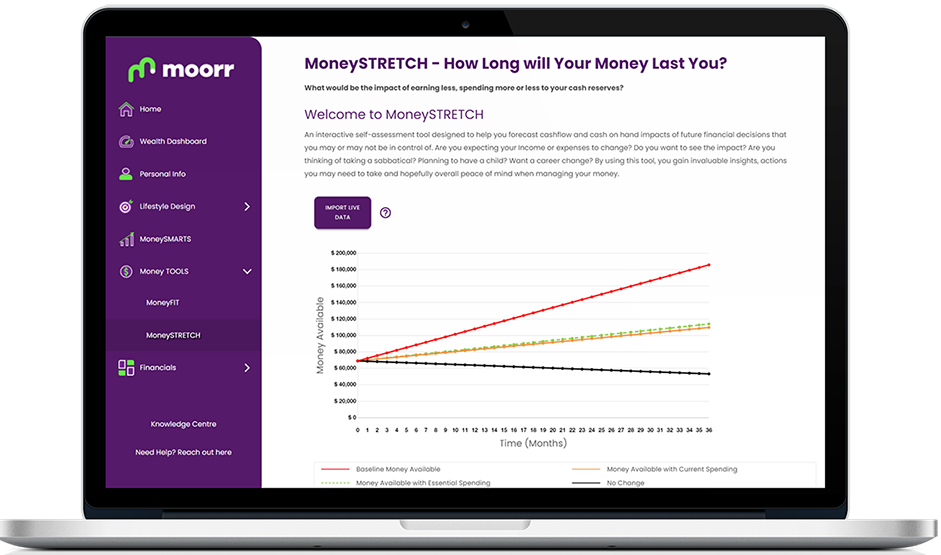

That’s where 👉 MoneySTRETCH comes in.

In a nutshell, this tool lets you know how long your money will last if there’s a change in your circumstances.

And yes, it can pretty much cater to all of the questions above. For example, if interest rates go 2% or 3% higher, you can enter the expected repayment value to see the impact on your current and future financial position down to the exact cent and month. Can you last another 36 months at your current spending level if interest rates are at 9% as another example.

One of our users, Dennis A, mentioned that MoneySTRETCH is a super important tool that they’ve been using recently, especially due to the increasing interest rates. “People are saying, ‘Oh, I can’t afford this. I can’t afford my rent anymore. I can’t afford my mortgage anymore.’ Being able to use the MoneySTRETCH tool, we can see if that’s real or if it’s just something in our minds that isn’t quite true.”

The true power of MoneySTRETCH lies in its sandboxing ability. Once you’ve entered your bills and spending, it allows you to continuously tweak things without impacting the original data you’ve entered.

This is exactly why it is commonly used by our users in times of financial uncertainty.

So, how does it really work? Let’s look at this example:

You’ve entered your details, and MoneySTRETCH shows you that you’re in good hands at the moment. However, if you can’t stand it at work anymore and are thinking of taking another role with much lower pay, your savings will be depleted within 28 months. So what do you do?

Naturally, you would review your expenses and determine where the trim is needed.

… Oh, that yearly holiday expense of $7,000 … What if we skip it this year?

… That weekly dine-out date… What if we change it to monthly and eat at home more?

… That electricity bill that hasn’t been reviewed since 2015… What if we shop around and find a cheaper deal?

Out of all these tweaks to your expenses, which ones are the ones that really matter and move the dial?

This is the tool that tells you that.

Because it’s based on your own actual input, it’s an evidence-based report that you can rely on. That’s why the more details you enter, the more accurate the projection will be.

Another Moorr user, Ben D, said he used this tool when he was considering a change in his career to see if his income drops significantly, what that’s going to do and how far out he can go. He said, “That’s been a game changer for me. That’s helped me see our projection, and based on our discretionary spending or mandatory spending, whatever you want to call it, you can actually adjust that and then see how much extra you’ve got to go before things become a problem. So that’s MoneySTRETCH. I think that’s a brilliant part of the platform. Very helpful.”

“It gives us a sense of confidence that it’s under control,” adds Ben.

If you’re interested to learn more about this tool and Moorr, head to www.moorr.com.au.

MoneySTRETCH is just one of the many tools on our free money management platform called Moorr. To start using it, it’s really quite simple:

- Create your free account in Moorr and log in: https://my.moorr.com.au/

- Input your details – There are not a lot of mandatory fields. But the more details you put in, the more accurate the projections are.

- Head to MoneySTRETCH section of the platform, import your data and begin tweaking it. Watch MoneySTRETCH tutorial video here:

https://www.youtube.com/watch?v=ol0vocKqcr0

How are our users using Moorr?

Ben D.

Dennis A.