At Moorr, we’re always working to improve how you track and manage your financial position. A key focus has been integrating actuals and transactions into the platform, allowing you to compare your real-time financial position with your budgeted values.

With the upcoming addition of transactions in cards and Open Banking, we’ve made changes to clarify how values in the portal are defined. These updates will help you better understand your financial data and get the most out of Moorr.

What’s Changing?

We’ve updated key terminology across Income, Expenses, Assets, and Borrowings to provide clearer distinctions between budgeted and actual values:

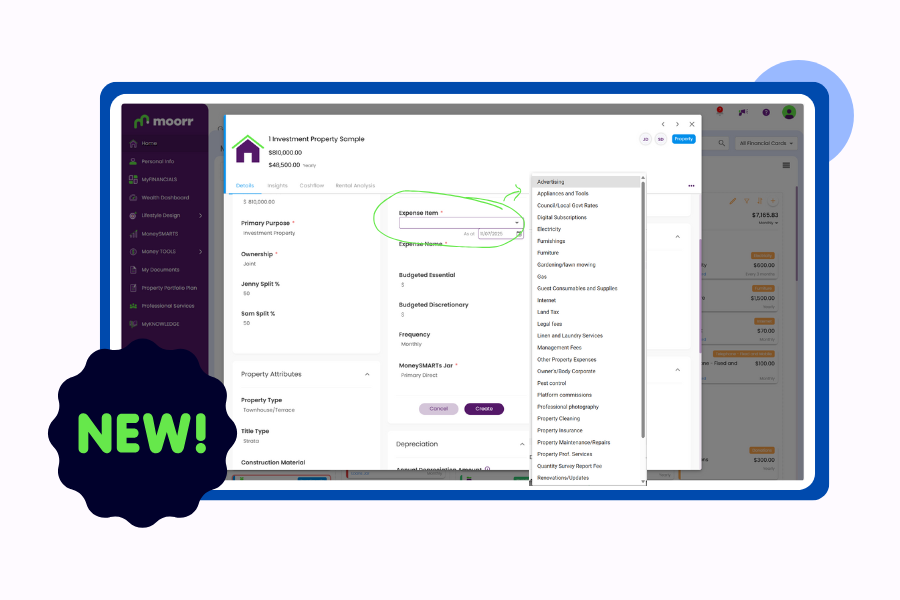

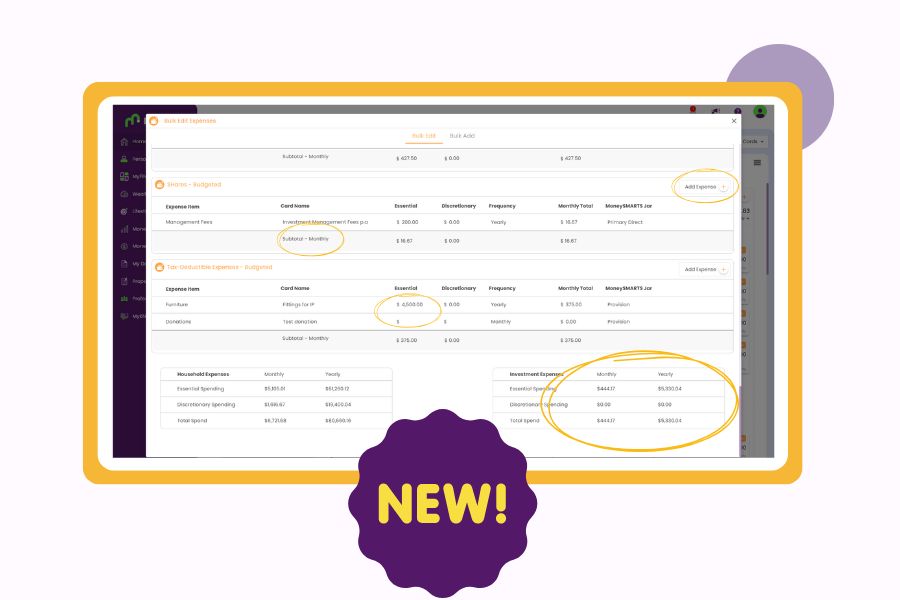

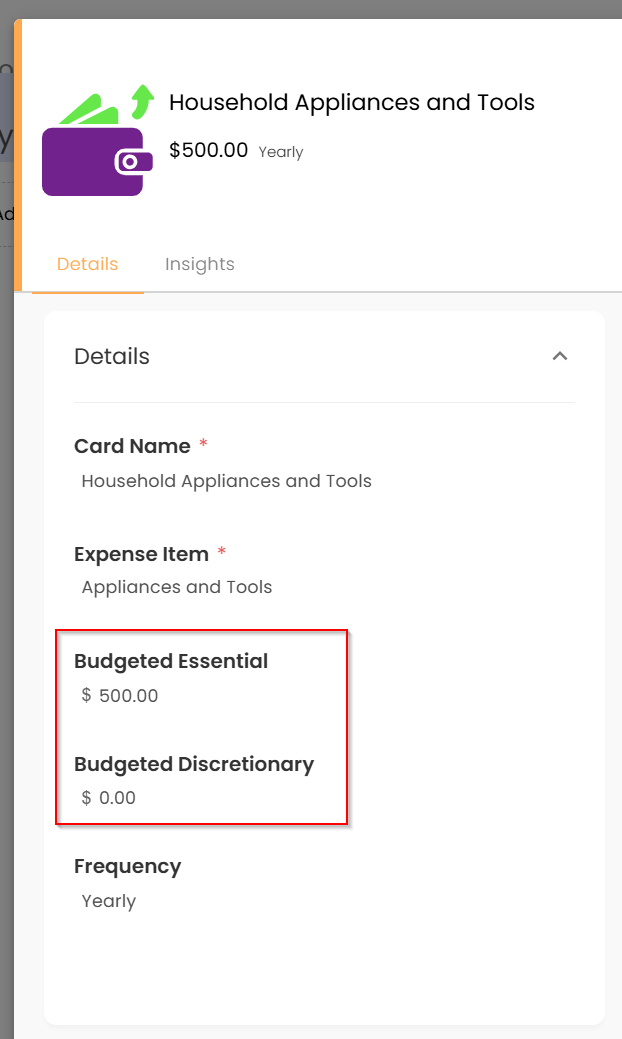

Expenses

Essential & Discretionary → Budgeted Essential & Budgeted Discretionary

(These are your budgeted targets, not actual spending, especially with transaction tracking coming soon.)

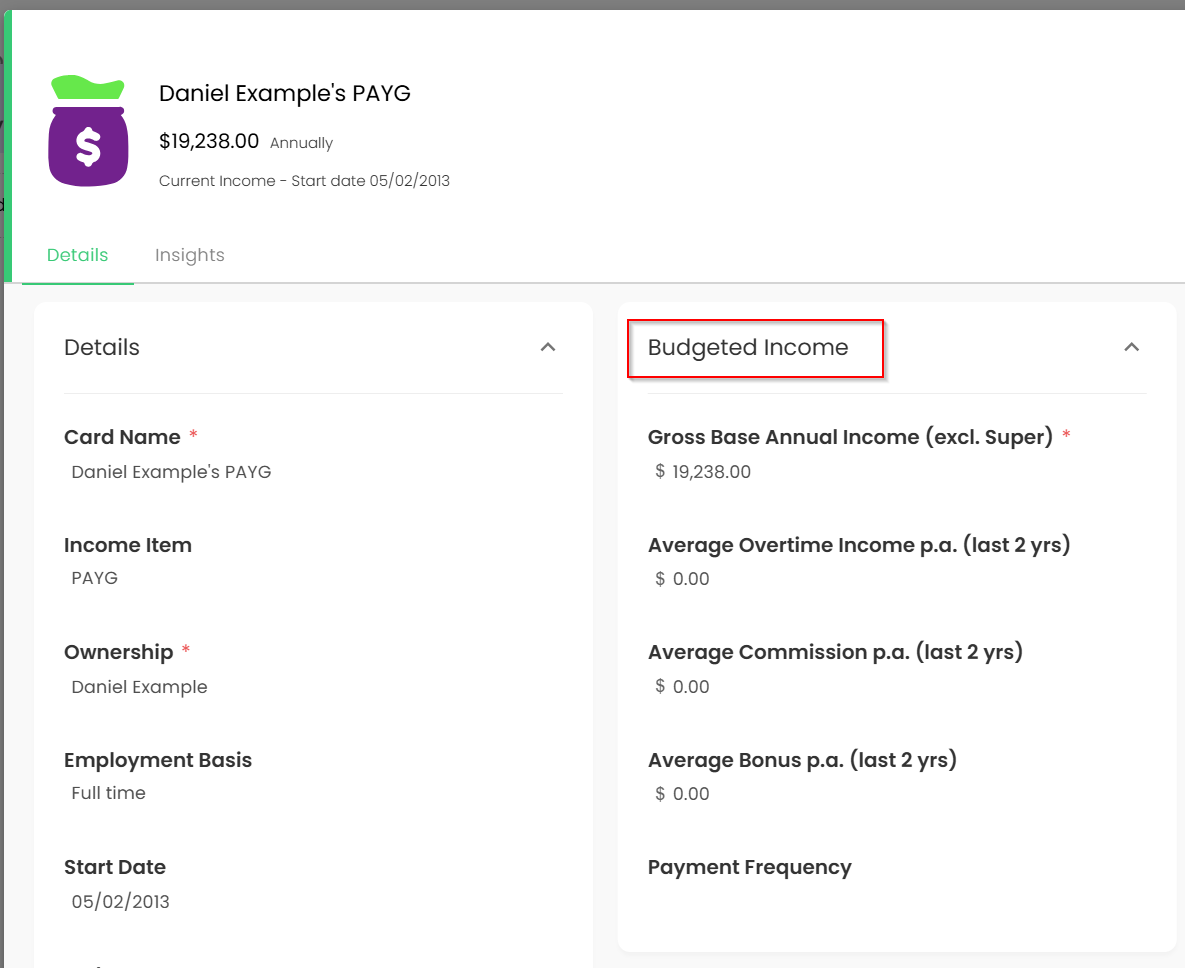

Income

Income Breakdown → Budgeted Income

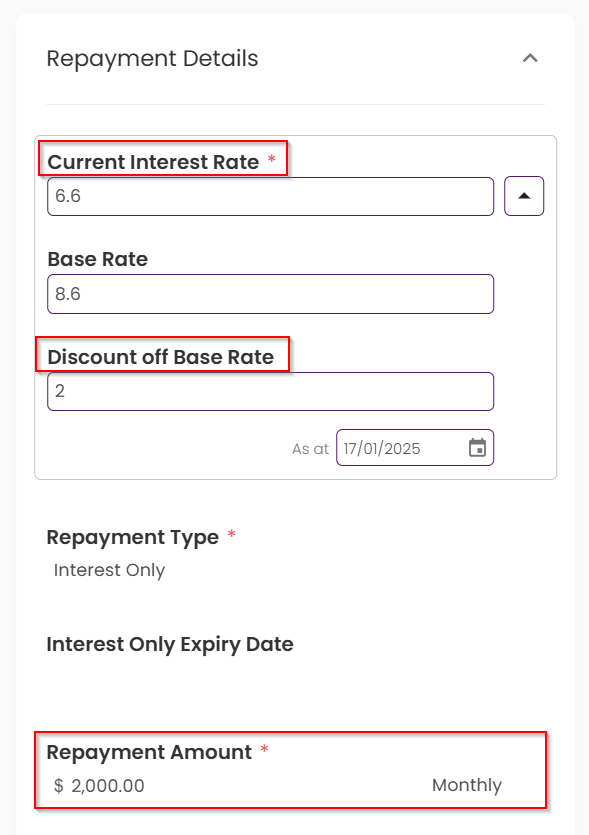

Borrowings

Interest Rate → Current Interest Rate

Discount Rate → Discount off Base Rate

Current Repayment → Repayment Amount

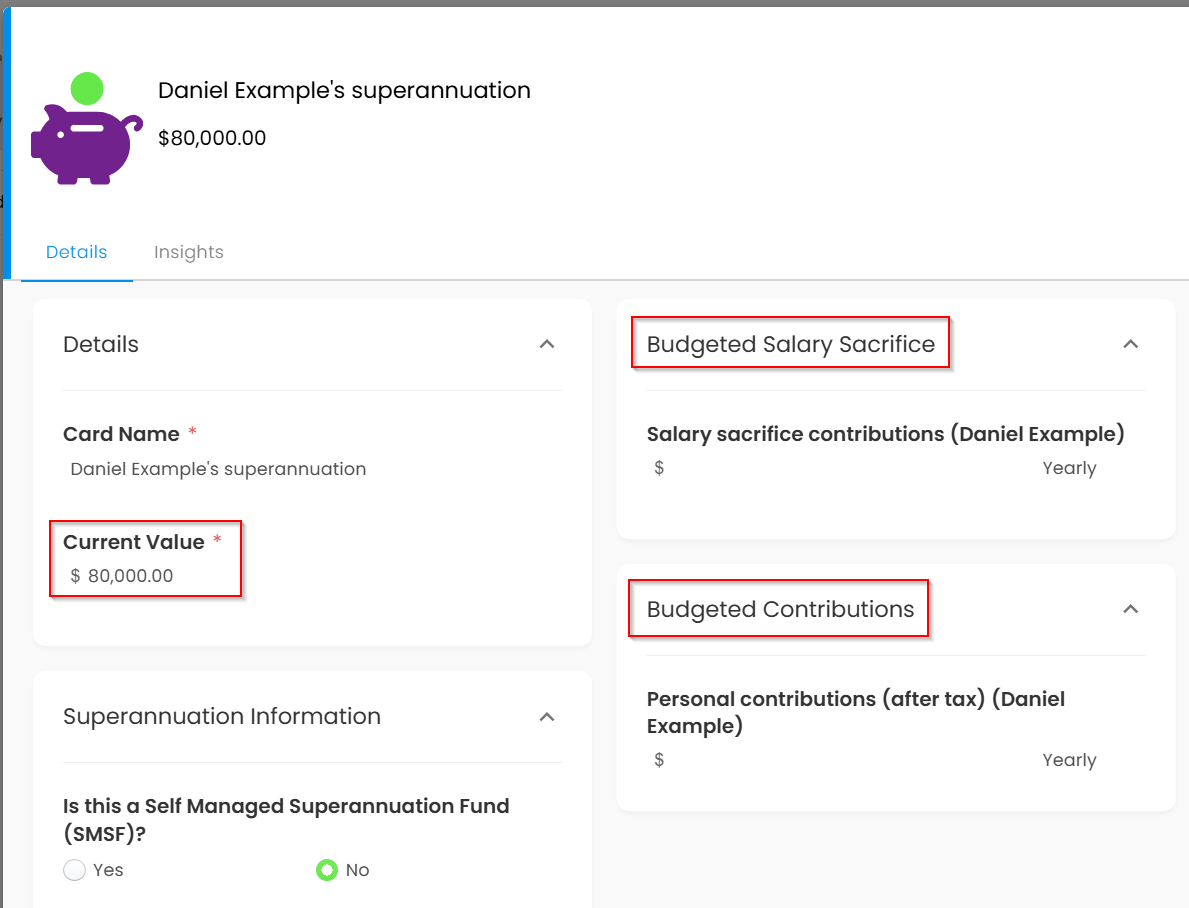

Assets (Superannuation)

Value → Current Value

Salary Sacrifice Contributions → Budgeted Salary Sacrifice

Personal Contributions (after tax) → Budgeted Contributions

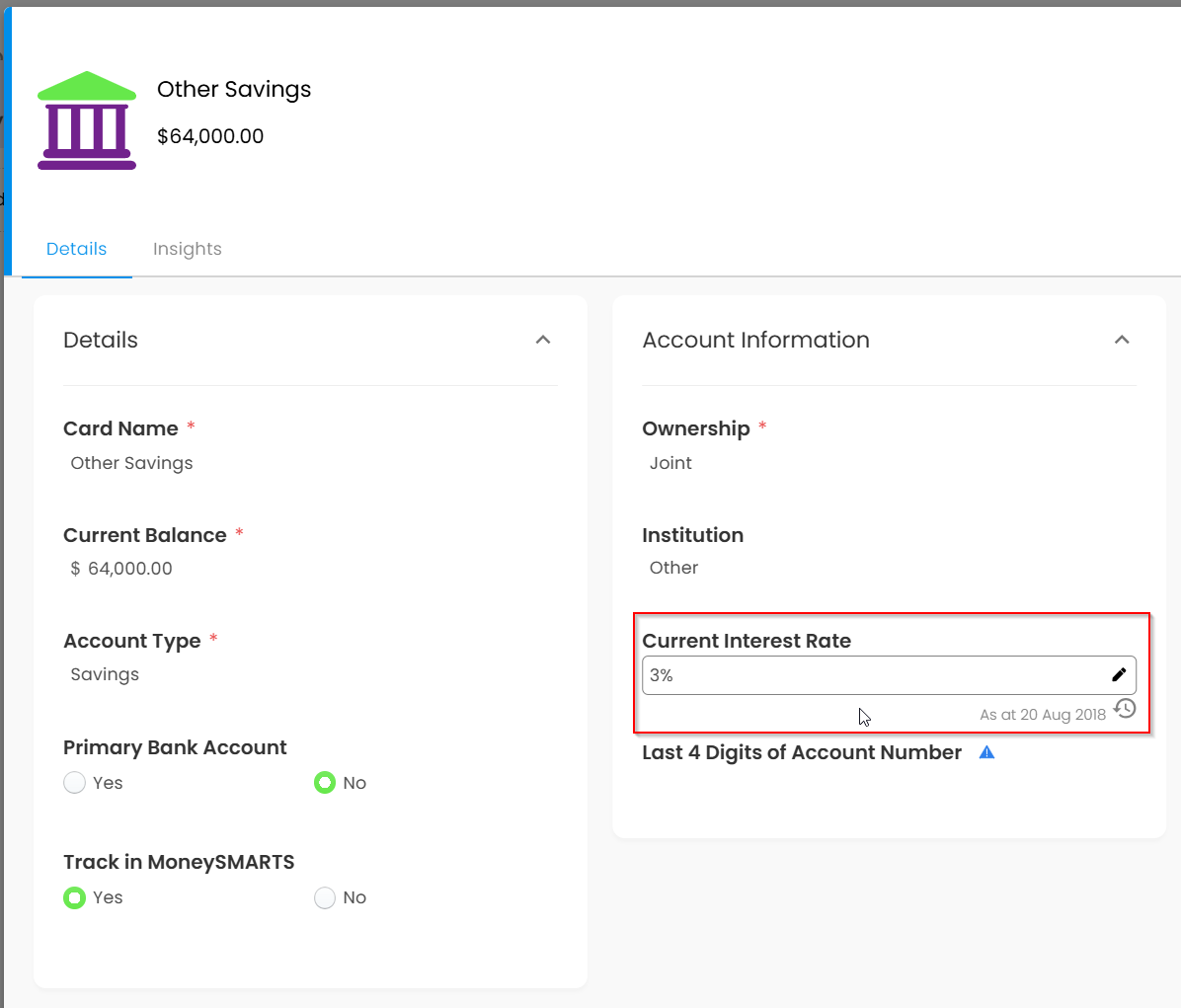

Assets (Bank Accounts)

Interest Rate → Current Interest Rate

This release is now available on both our webapp as well as our mobile app. These terminology updates make it easier to differentiate between budgeted projections and actual figures, giving you a more accurate view of your financial journey. Stay tuned for more improvements as we continue to enhance Moorr!