Playlist

As one of our valued members of the Moorr community, it is our collective responsibility to ensure that you’re not missing out on any financial opportunities. One significant area where many Australians might overlook potential savings is in the interest paid on mortgages.

That is exactly why we have developed an educational series exclusively for our community members to empower you with the knowledge you need before engaging with your bank or lender. It’s essential to be well-prepared and informed about your options. Our teachings will equip you with insights into:

- Understanding the rules of the game.

- Navigating the mortgage landscape effectively.

- Formulating the right questions, and more importantly, discovering the correct answers.

Here are the six critical lessons to consider when fixed-rate mortgages come to an end:

Lesson 1: Lenders Offer Opportunities

Lesson 2: Fixed to Variable – Not Always the Best Choice

Lesson 3: Beware of Misleading Discount Ranges

Lesson 4: Negotiating Published Rates

Lesson 5: Embracing the Reality of Complexity

Lesson 6: New Borrowers Can Secure Better Deals

In today’s economic climate, where the cost of living is steadily rising, it makes sense to minimise your interest expenses whenever possible.

Are You Looking for Professional Help?

At Moorr, our mission is to see our vibrant community flourish. This entails helping you save more money and making your surplus funds work harder for your benefit.

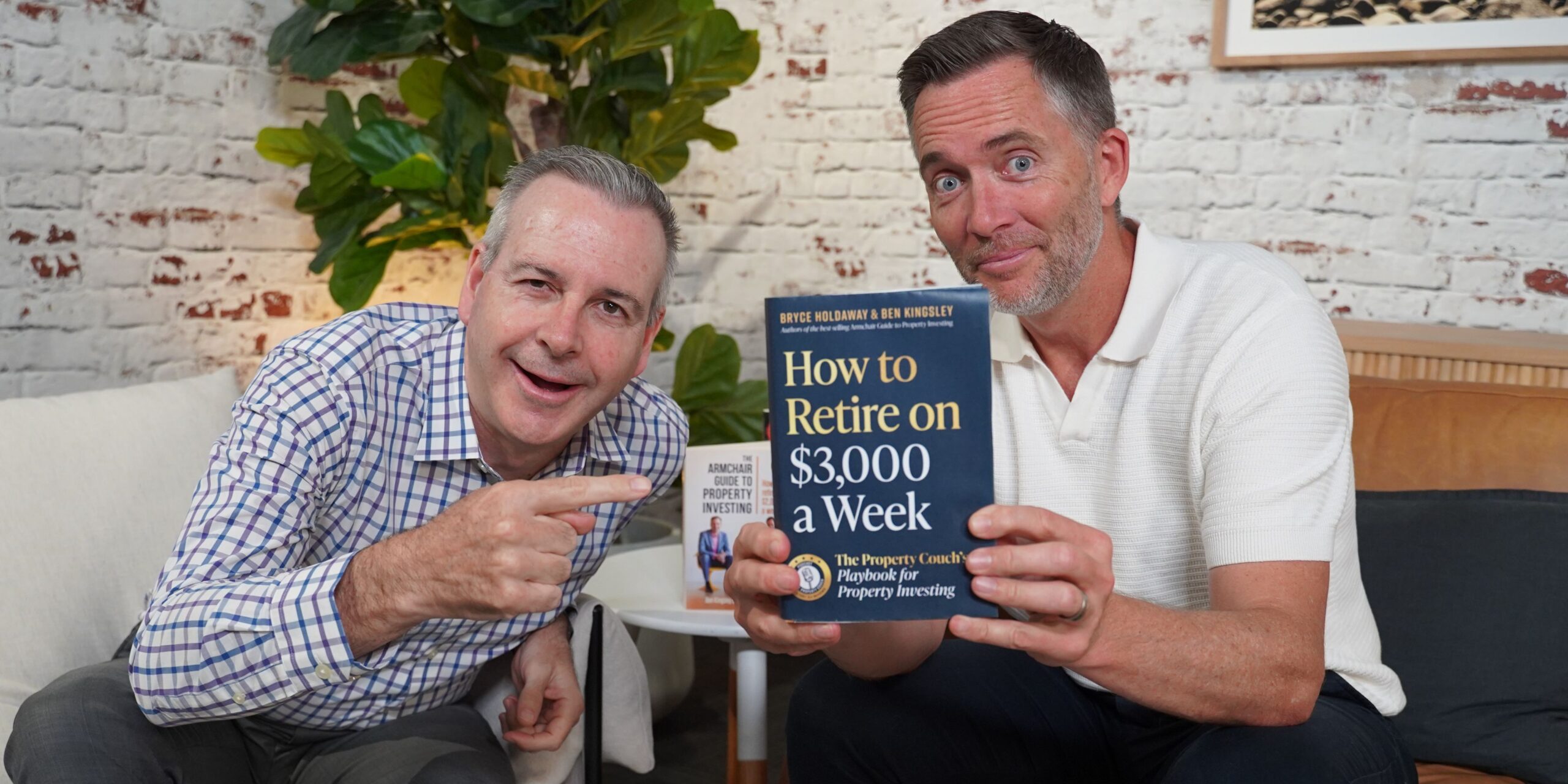

And we know firsthand what’s possible in this space, because for the past 15 years, we have watched our multi-award-winning Empower Wealth Mortgage Broking team work with hundreds of our clients, in helping them cut thousands of dollars in interest payments. Last Financial Year alone we are on track to save over $4 million in interest for our clients, as part of our mortgage review program.

If you’d like a free and no obligation finance review from our mortgage team, we’d love to help! Fill in the form below to get started:

Just in case you’re wondering, Moorr is our online platform that helps people get on top of their money habits and Empower Wealth is our advisory business that works directly with those who want qualified professionals to help them with their financial needs. As a valued Moorr member, if you’d like to have our expert team review your current mortgage, simply visit our Empower Wealth website today.

Best of all, there is no charge to you for this service! We do the shopping around and bidding to find you the best offers in the market. A lot of potential upsides and nothing to lose, at the very least by asking the question – “can they help me save money on my current mortgage?”

Remember, knowledge is empowering but only if you act on it.