Navigating the world of property finance can be challenging, especially for first-time homebuyers and investors. Whether you’re diligently saving for your first deposit or stepping into property investment, having the right tips can make all the difference.

Here are the top seven tips aimed at helping you achieve your property goals.

1. Determine How Much You Need to Save

When saving for a deposit, it’s crucial to have a clear target. As a rule of thumb, aim to save at least 25% of the property’s value. This accounts for a 5% deposit plus additional acquisition costs such as stamp duty and legal fees. Ensure the property you’re targeting is one that banks favour, as this maximises your chances of obtaining favourable loan terms. Remember, aim for the properties that are “on fleek” with the banks.

2. Master Money Management

Effective money management is foundational to both saving for a deposit and succeeding in property investment. Start by creating a detailed budget, cutting down on discretionary spending, and focusing on essential expenses. Utilise high-interest savings accounts to grow your savings faster and of couse, consider employing budgeting tools like the MoneySMARTS system to keep track of your finances and maintain discipline. This way, you can stay in tune to where your money is going.

3. Avoid Lifestyle Inflation

One of the biggest barriers to saving a deposit and investing successfully is lifestyle inflation. It’s easier said than done but it really depends on your life goals and the compromises you are willing to make. If you want to save up your deposit quicker or if you would like to build up your property portfolio, then at some point, you’ll need to prioritise investing in assets over short-term lifestyle expenses.

For example, when saving for a deposit, you might need to make sacrifices such as eating out less and reducing entertainment expenses. Or if you want to 2x your saving speed, consider getting a second job. Time to flex those frugal muscles!

4. Seek Professional Advice

Navigating property finance and investment can be complex especially for a beginner. So to compensate for your lack of experience and to avoid common pitfalls, why not seek advice from qualified professionals? Professional advisors can provide personalised strategies that align with your financial situation and goals. Additionally, leverage free resources such as podcasts, videos, and community forums to build your knowledge and confidence. Because who doesn’t need a little squad support?

5. Start with a Clear Plan

Both saving for a deposit and investing require a clear, strategic plan. Set specific, measurable goals for your savings or investment journey. For first-time investors, focus on understanding the basics of property selection, finance structuring, and tax implications. Start small, learn as you go, and gradually build your property portfolio with a long-term perspective in mind. Remember, property investing is a marathon, not a sprint. Plan it out like a boss.

p.s. If you’re looking for some experienced professionals to help build a tailored plan that suits your unique circumstances, check out our award winning sister company, Empower Wealth. They have helped over 15,000 clients and offer a free and no-obligation initial consultation too. You can learn more about their Property Portfolio Plans here >

6. Consider Rentvesting

Rentvesting can be a smart strategy, especially for young professionals who want to live in desirable locations while investing elsewhere. By renting where you want to live and buying investment properties in more affordable areas, you can enjoy your preferred lifestyle while building wealth through property. This approach allows you to leverage rental income to cover mortgage costs and benefit from property appreciation. It’s a strategy that has gained quite a popularity in the last 10 years but it’s important to note that it’s NOT for everyone.

Please be very careful with this strategy because if you change your mind and the property has yet to achieve the growth it needed, there will be consequences to your investment journey. And your investment property also needs to stack up. So make sure to get your numbers right, do your due diligence, think long term and speak to a professional advisor before making any investment decisions.

7. Understand Your Borrowing Capacity

Knowing how much you can borrow is crucial for both saving and investing. Use tools like borrowing power calculators to get an estimate of your capacity. Ensure your credit score is in good shape, as this affects your loan approval and interest rates. When structuring your loan, consider options like interest-only vs. principal and interest loans, and choose what aligns best with your financial strategy. Get those ducks in a row for smooth sailing.

By following these tips, you can accelerate your journey towards owning your first home or building a successful property investment portfolio. Of course, this is a guide only and once again, we don’t recommend you to make any financial decisions without consulting a professional. Remember, the key to success lies in preparation, discipline, and leveraging expert advice. Happy saving and investing!

Keen for more?

Free Report:

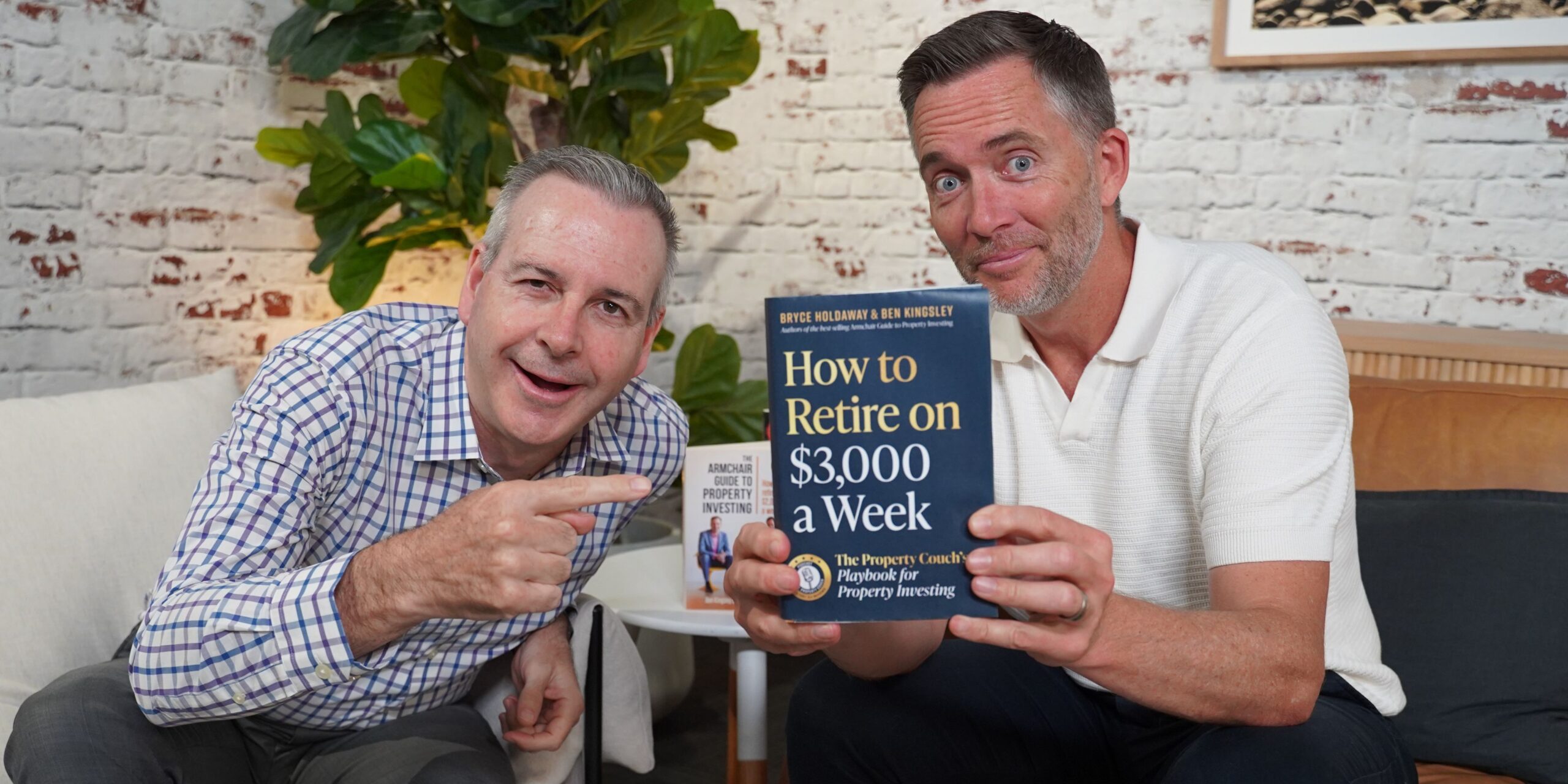

For more in-depth information and additional resources, be sure to download the free report below by The Property Couch. This report expands on these tips and provides further insights into saving for a deposit and first-time property investing. Recorded in Episode 246, pre-Covid, the fundamentals discussed are still highly relevant today. Fill out the form below to get your copy and start your journey with the right knowledge and tools.