Is the next logical learning step, as it has its origins in the cashflow story you just learnt about. The reason for this is, you have choices with how you use your surplus cashflow, one of which is to pay down debt. So, in this section you are learning about the treatment and impact of how we account for you paying down debt, as it relates to these financial indicator tools in Moorr and its impact on your overall WealthSPEED® result. Furthermore, whilst debt management has its origins in surplus cashflow, when you pay down certain debt like mortgage debt, you are in fact increasing your net equity (asset) and overall net worth position.

You can understand why I refer to debt as the radiator in our wealth creation car. The hotter the radiator gets, the greater the risk of a breakdown which could cause damage to the engine. Too much debt can, and will, put your car at risk of a breakdown or at the very least, force you to slow the speed of your car down if it gets too hot. A true high-performing car is designed to run hotter, but in our case, running hotter means the right type of debt, being asset-building ‘productive’ debt and NOT personal use debt.

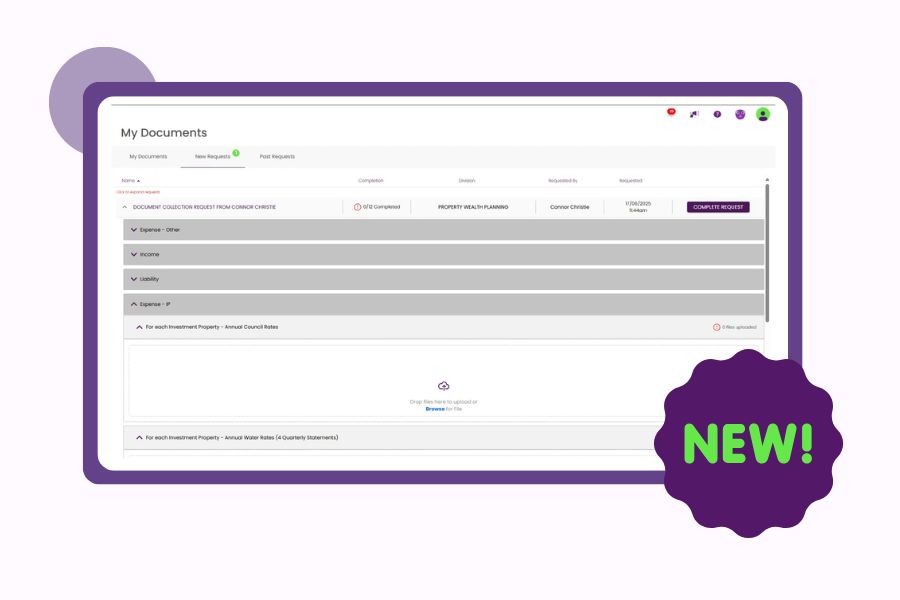

Let’s learn more about to application of DebtReductionSPEED™