Managing your finances just got an epic upgrade! With the launch of MoneySMARTS 2.0, Ben Kingsley dives deep into how this revolutionary update can help you take control of your money, save time, and build better financial habits. Whether you’re a long-time user or just starting out, this blog offers a high level overview of what’s new and why it matters.

The Origin of MoneySMARTS: From Concept to Game-Changer

Ben kicks off by reflecting on the origins of MoneySMARTS, which began as a simple, rules-based system for wealth management within Empower Wealth. Its success led to the creation of the book Make Money Simple Again, spreading the system to tens of thousands of Australians who’ve used it to transform their finances.

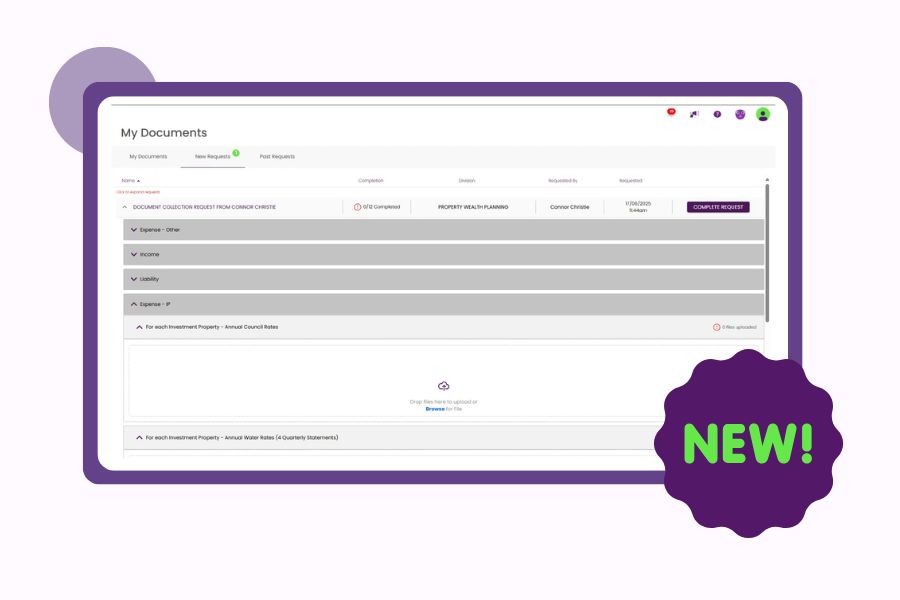

With this new release, the system evolves further, integrating seamlessly into Moorr for even more powerful tracking and management.

What’s New in MoneySMARTS 2.0?

Here are the standout features that make this update a game-changer or click here to learn the full release.

- Two-Way Tracking: Sync your bank accounts, credit cards, and offset accounts with MoneySMARTS to eliminate double entry and enhance accuracy.

- Enhanced Checkups: A streamlined process ensures your balances are updated in one place, saving time and reducing errors.

- Flexible Start Dates & Rollovers: Adjust start dates or roll over periods—even mid-year—giving you more control over your financial tracking.

- Clearer Insights: Improved tables, charts, and tooltips offer more clarity and make financial management even easier to understand.

- Future-Ready Platform: These updates set the foundation for exciting features like Open Banking integration and automated transaction imports.

Why MoneySMARTS is Different

Unlike traditional budgeting systems like the 50/30/20 rule or envelope methods, MoneySMARTS simplifies and automates your financial management. Ben explains the SMART Strategy, which stands for:

- Strategy: A structured approach to tracking and managing money.

- Mindset: Building conscientious habits for long-term success.

- Application: Using tools like Moorr to integrate and streamline your financial data.

- Resources: Efficient use of banking structures to maximise surplus.

- Timeline: Ongoing management with annual and monthly checkups.

Get Started Today

Ready to take control of your finances? Watch Ben’s full video for a detailed walkthrough and practical tips to make the most of MoneySMARTS 2.0.

👉 Learn More on the MoneySMARTS Page

👉 Download the Moorr App: iOS here and Android here.

With MoneySMARTS 2.0, managing your money has never been simpler—or smarter. Join thousands of Australians who are using this system to achieve financial freedom. What are you waiting for? Dive in today!