H.E.L.P Debt in WealthSPEED®

The amount of which the repayment is set, is calculated based in the level of income being received in that year.

Moorr: Built for your Personal Wealth Story

Our Moorr® platform has purposely been built to look at individual’s financial circumstances and does not include calculations relating to company, trusts or any other structures when performing its tax or financial equations.

What do we want our SavingSPEED™ to do for us?

The quicker your hourly rate, the more money you are saving.

Benefits of SavingSPEED™

No one is going to go broke saving money and the more you save the better your financial position will become over time.

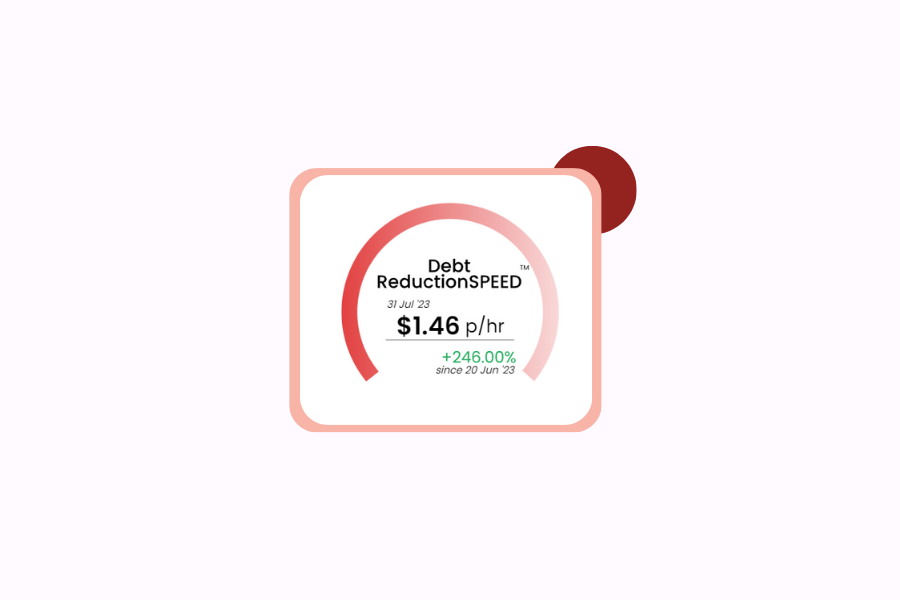

DebtReductionSPEED™

It’s always good to be paying off debt. You won’t go broke paying off your debts.

Why Use AssetSPEED™?

AssetSPEED™ is going to do the bulk of your heavy lifting over time, as the true power of compounding kicks in (that’s why it’s the turbo-charger).

What does a Successful WealthSPEED story look like?

That’s the objective here; make your WealthSPEED® go faster. The faster it goes, the better your financial story and future retirement will play out, and for some, the quicker you get to your financial peace destination.

AssetSPEED™

AssetSPEED™ is the sum of each of the four-investment asset sub-gauges, making up the total asset growth indicator.

SuperSPEED™

SuperSPEED™ is calculated as the total of your household superannuation balance growth at an hourly rate and includes employer contributions received while working, as well as any salary sacrifice or post-tax contributions to your superannuation.