Well, that depends on our stage of life and potentially even how old one is. Let me explain.

If you are in your teenage years using the Moorr® platform, your number one goal is making your SavingSPEED™ go as fast as you can for you. The quicker your hourly rate, the more money you are saving. Generally speaking, your biggest challenge is keeping a check on your spending. If you can build a habit of routinely saving and you build up a good amount of savings, you might even consider some share investing (InvestmentIncomeSPEED™ & OtherInvestmentValueSPEED) like EFT’s or adopt a dollar cost averaging strategy, subject to speaking to getting some advice first, of course.

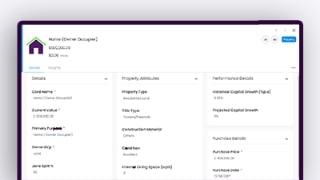

If you are in your twenties or thirties, you goal should be to get on the property ladder, this might come in the form of your own home or potentially buying an investment property first. If the latter is your chosen path, then you will start to move the dial on your RentalIncomeSPEED™ & InvestmentPropertyValueSPEED™ also, which then flows into your PassiveIncomeSPEED™.

For folks in their twenties and thirties – for a lot of you, having a family is a non-negotiable and speaking as a father of two boys, I completely support that call for those who want to have a family. My only critical piece of advice to you if you haven’t already started down the family building journey, is to hold off on starting a family until you have a home to live in or at the very least an investment property. It’s just so much harder to achieve a self-funded retirement if you do family before property. Raising a child or multiple children shows up in your SpendingSPEED™ and really restricts your SavingsSPEED™ during that couple of decades.

Traditionally we start thinking about our wealth accumulation phase of life between our thirties to early fifties. (A special shout out the those who are thinking about this in the twenties!). Anyway, for these folks, once you get your first look at the WealthSPEED® and see how your WealthCLOCK® is running, your eye should then be drawn to your PassiveIncomeSPEED™ and you should be comparing this to your WorkingIncomeSPEED™.

When you take a moment to think about it, it is logical. To stop work, you need to replace your exertion income with another form of income – we call this passive income. So, if your PassiveIncomeSPEED™ is significantly lower than your WorkingIncomeSPEED™ then you immediately know where your focus should turn: towards increasing your PassiveIncomeSPEED™, and that needs to happen via increasing your SavingsSPEED™ overall.

Let’s take a look at some examples that directly impact SavingSPEED™, plus gives you options, regarding building your PassiveIncomeSPEED™:

- Work for it: You can earn more money by getting a higher paying job; create a side hustle; take a second job etc – all focussed on getting your WorkingIncomeSPEED™ hourly rate higher. Outcome is you increase your NetIncomeSPEED™, which positively impacts your SavingSPEED™. This then gives you options to use make this money work harder for you, which improves your PassiveIncomeSPEED™

- Spend Less: Look at your current expenditure. What is absolutely essential versus discretionary spending. Cut out the discretionary spending, pay off /down, or consolidate discretionary debts. All focussed on getting your SpendingSPEED™ hourly rate lower. Outcome is your SavingSPEED™ increases. As per above, you can put that money to work for you to increase your PassiveIncomeSPEED™

- Sell Stuff: By selling anything you no longer use or need. This cash will be added to either your savings account balance, which will generate interest returns, within InvestmentIncomeSPEED™ or if you have an offset account, it will reduce your SpendingSPEED™, with all roads leading back to an improved SavingSPEED™ position. Giving you more wealth creation options.

- Tweak Mortgage Repayments: You might want to get a professional opinion on this, but you could look at adjusting your mortgage repayments, if appropriate to do so. Meaning extending out the current term of the loan or potentially switching over to Interest Only repayment, for a period. This would reduce the DebtReductionSPEED™, as you could opt to reduce the amount of principal you are paying, resulting in an increased SavingSPEED™. (Note: This only makes financial sense if you are going to ensure the total amount of this newly created surplus money is invested, otherwise all you’ll be doing is increasing the amount of loan interest you will be paying over the life of the loan.)

- Invest it: If your SavingsSPEED™ is already running at a healthy hourly rate, but your AssetSPEED™ or PassiveIncomeSPEED is not, it might be time to explore whether this money will achieve a better return for you within the AssetSPEED™ domain, which could also improve your PassiveIncomeSPEED™ if the asset you invest in is income producing.

By now I’m sure you have released, these ideas and opportunities are best summarised as ways to help increase your SavingsSPEED™, which in turn gives you options as to what you do with these increase surplus funds. If your focus is on ultimately increase your WealthSPEED®, then this will help you understand the classic message: earn more, spend less and make sure your money work hard for you.

The SavingsSPEED™ lesson here is a story about learning from history. It tells us that to grow your wealth to a sound financial position, you need to ensure you are actively investing over time. This means sensible and diligent cashflow management, combined with routine release of surplus cash to acquire appreciating assets; some potentially higher value items like property; potentially with debt to manage and others investment assets, without. Plus, you need to consider assets that also produce regular income to help support one’s ongoing cashflow management and overall wealth creation journey.