Would it be better to transfer this out monthly to a savings account? Otherwise, no savings would be generated over the course of a year before the annual rollover. I assume this would however affect the accumulated surplus figure.

- The MoneySMARTS system was specifically designed considering the Australian banking system, which offers ‘offset’ accounts through major banks. These accounts work by not earning any interest themselves, but instead offset the interest on connected secured loans. This approach proves advantageous because loan interest rates are generally higher compared to savings account interest rates. As the balance in the offset account increases, the amount of interest owed on your loans decreases accordingly, resulting in overall savings.

- However, it seems that offset accounts in New Zealand are not common, so this option may not be available to you. In this case, it would be advisable to have your net income automatically deposited into a high-interest Savings Account, and then set up automatic transfers from there to your Living and Lifestyle account. Your credit card payments should be made in full each month directly from your Savings account, and loan repayments can also be deducted automatically from your savings.

- By having this sort of automation in place, the only thing you really need to track is your provisions, running bank balances and any amounts you want to designate as part of ongoing investment strategies.

- This approach allows you to earn interest on your core funds held in the savings account without the need for frequent transfers, while also maximizing the interest earned by paying off your credit card balance in full within the 40–55-day period.

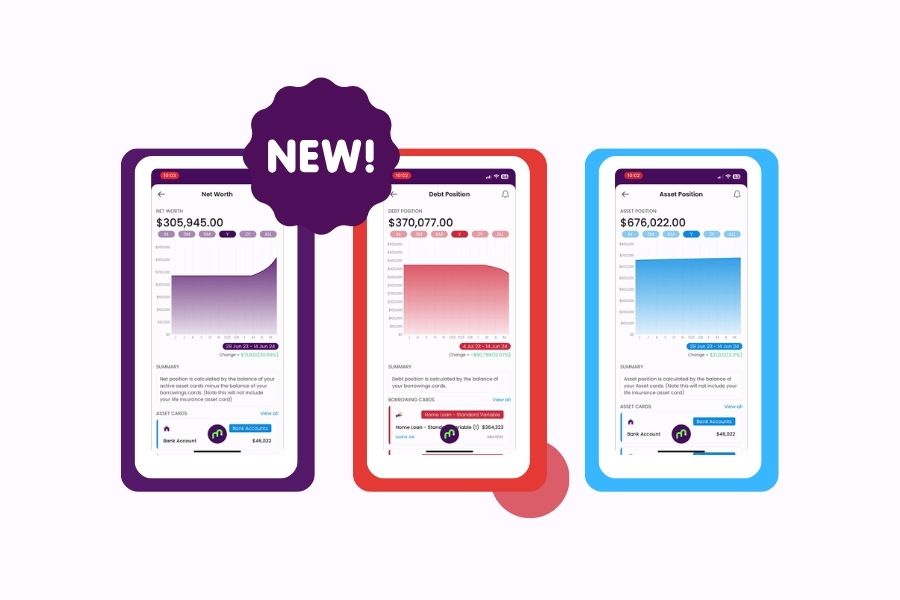

👉 Elevate your financial game plan with Moorr’s intelligent tools! Get it on App Store or Play Store, for a seamless journey towards financial prosperity.