Saving for your first home can feel like running a marathon with no finish line in sight. The deposit is usually the toughest hurdle, and for many Aussies, it’s the reason they stay renting longer than they’d like.

But here’s the game-changer: from 1 October 2025, the Government’s updated scheme will let you buy with just a 5% deposit. It’s the biggest piece of deposit help for first home buyers in Australia we’ve seen in years — no more waiting forever to hit that 20%.

So, what’s changing, what do you need to know, and how can you make the most of it? Let’s break it down.

What’s Changing from 1 October

- Buy with just 5% deposit — Under the Government’s First Home Guarantee, you’ll only need a 5% deposit to purchase.

- No Lenders Mortgage Insurance (LMI) — Normally, a smaller deposit means paying pricey LMI, but the Government will act as guarantor so you can skip this cost.

- Property price caps lifted — For example, Melbourne’s cap has increased from $800k to $950k, and Sydney from $900k to $1.5m.

- Unlimited access — No income caps, no place limits. All first-home buyers are eligible.

👉 See the full details on Housing Australia’s website.

Why This Deposit Help Matters

Let’s put this into perspective. On a typical home worth around $844,000, saving a 20% deposit would normally set you back nearly $170,000.

With the new scheme, you’ll only need about $42,000 — which could save you years of grinding it out. On top of that, you won’t get stung by expensive Lenders Mortgage Insurance (LMI), which means more of your money goes into your home, not into bank fees.

It’s not just about getting the keys faster — it’s about keeping thousands in your pocket and jumping onto the property ladder while you can.

Getting deposit help is one thing — but making sure you’re actually ready is another. That’s where Moorr comes in, with tools built to help Aussies save smarter and plan better:

- MoneySMARTS: track your money, trap more surplus, and grow your deposit faster.

- MoneySTRETCH: test how mortgage repayments and bills would impact your lifestyle.

- MyKNOWLEDGE: access expert guides, tips, and videos to understand the process.

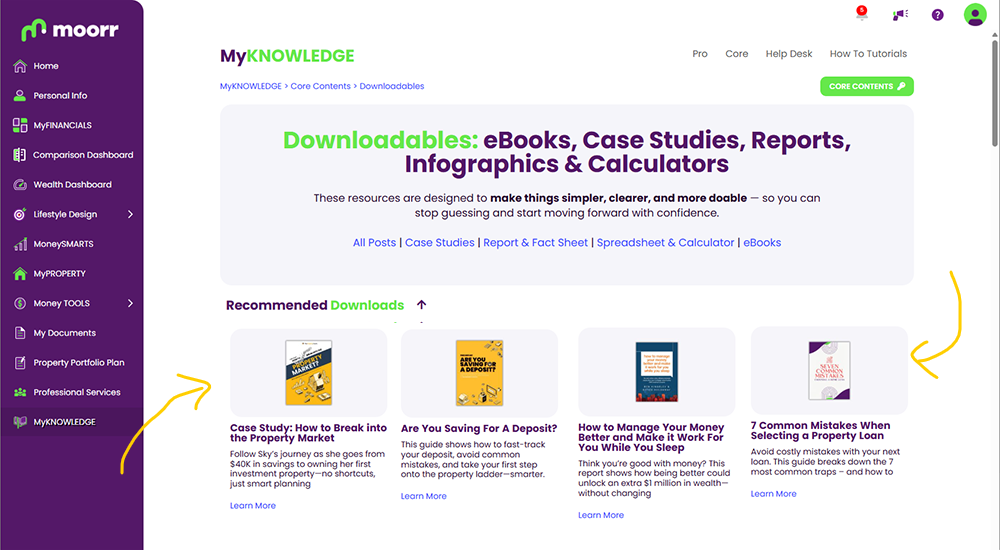

And here’s the kicker — with MyKNOWLEDGE inside Moorr, you can dive into practical guides, case studies, and videos to understand what to look for in a first home and how to spot a smart compromise.

Here are a few reports we’d recommend downloading right away:

- Case Study: How to Break into the Property Market

- Are You Saving for a Deposit?

- How to Manage Your Money Better and Make It Work for You While You Sleep

- 7 Common Mistakes When Selecting a Property Loan

These resources will help you avoid costly mistakes and give you the confidence to take advantage of the 5% deposit scheme. Create your Moorr Account here and download these resources to get started!

What This Means for First-Home Buyers

Recent analysis from Cotality’s September Housing Chart Pack shows just how big the opportunity is:

- Under the old caps, only about one-third of suburbs nationally were in reach.

- From 1 October, that jumps to 63.1% of suburbs — including over half of all house markets and nearly all unit markets.

- In Adelaide, eligible suburbs for houses exploded from 8 to 130.

- In Brisbane, 97.5% of unit markets will now fall under the new caps (up from just 36.9%).

In short: it’s not just about a smaller deposit — it’s about more choice in more suburbs.

Beyond the Deposit: Mindsets and Realities

The “No Place Like Home” report from Great Southern Bank also highlights how first-home buyers are thinking differently about property:

- 58% of Gen Zs see their home as a source of income.

- 24% plan to eventually turn their home into an investment property.

- 19% would rent out a room to help cover repayments.

But remember — getting the keys is just the start. Many buyers face unexpected costs:

- 35% ran into higher insurance or utility bills.

- 20% needed to renovate sooner than expected.

- 15% had more upkeep than planned.

- 10% had to learn DIY skills to save money.

That’s why it’s important to look beyond the deposit and think about the bigger picture. Moorr’s MoneySTRETCH feature lets you run “what if” scenarios so you can see the real impact of mortgage repayments, bills, and lifestyle changes on your cashflow before you commit.

Think of It as Your First Step, Not the Final Destination

Here’s the thing: your first home doesn’t have to be the dream home. In fact, for most people, it won’t be.

Property should be seen as a stepping stone. Sometimes that means starting smaller, maybe even compromising on location or size, so you can build equity and move up later. A unit today could be the launch pad to a bigger house tomorrow.

At Moorr, we know this. Our data shows that many of our users use the equity they’ve built in their first property to help fund their next one. That’s why we built MyPROPERTY — so you can see at a glance how much equity you’re building and what options it could unlock for your future.

We like to think in five- to seven-year windows. Ask yourself: will this property work for you in the short term, and help you unlock the next step? If yes, then you’re not just buying a home — you’re setting yourself up for the journey ahead.

This is where real deposit help goes beyond the government scheme: your deposit today can become the foundation for your next deposit tomorrow.

Ready to Get Started?

If you’re serious about making the most of this scheme, now’s the time to act. Loan applications and planning take time, and with thousands of other first-home buyers jumping in from 1 October, being ready early could be the difference between getting your foot in the door or missing out.

And that’s exactly why we built Moorr. To give you that advantage in living your lifestyle by design.

- MoneySMARTS to help you save and track your deposit.

- MyKNOWLEDGE to give you the insights to make smart decisions.

- MoneySTRETCH to test how repayments fit into your lifestyle.

- MyPROPERTY to track your equity and long-term position.

👉 Create your free Moorr account and start preparing today!

p.s Feeling overwhelmed and is keen to get professional and experience help instead? If you ever want tailored professional support beyond Moorr’s tools, our sister company at Empower Wealth are always here to help.