Navigating the world of property investment as an experienced investor presents unique challenges and opportunities. Whether you’re looking to review your portfolio or considering new strategies for growth, having the right tips can make all the difference.

Here are the top five tips from previous podcast episodes of The Property Couch aimed at helping seasoned investors optimise their property portfolios.

Before we get started, please note that the tips below are general advice only and should not be the sole basis for making any investment decisions. Always consult with a professional and experienced advisor before making any financial decisions.

1. Regularly Review Your Portfolio

As an experienced investor, it’s crucial to periodically review your portfolio to ensure it’s structured for optimal growth. This involves evaluating the performance of each property, considering factors like capital growth, rental returns, and potential for future value-add. Be honest with yourself about underperforming properties; sometimes, it’s better to cut your losses and reinvest elsewhere. A thorough portfolio review can help you identify any “dead ducks” and make strategic decisions to maximise your returns. Remember, leaving ego at the door is essential in this process.

2. Understand How Many Properties You Really Need

Contrary to popular belief, you don’t need a massive portfolio to achieve financial freedom. Typically, having three to five well-chosen properties can be sufficient to create a substantial passive income. Focus on the quality and value of the assets rather than the sheer number. This approach allows you to manage your investments more effectively and reduces the complexity of your portfolio. It’s about working smarter, not harder, and ensuring each property contributes significantly to your financial goals.

3. Be Methodical and Patient

Growing your portfolio doesn’t have to be a race. Instead, adopt a methodical and patient approach to property investment. Avoid the temptation of “get rich quick” schemes and focus on long-term, sustainable growth.

If your risk tolerance is high, you can also consider a more active approach, such as property development or adding value through a renovation. However, these strategies need to be approached cautiously. If you’re doing it because of the glamour portrayed on shows like “The Block,” remember that it’s a TV series, and reality is far from that. 😉

Taking on property development or renovation projects requires a thorough understanding of the market, careful planning, and a realistic budget. These projects often come with unexpected challenges and costs, so having a contingency plan is crucial. Conduct thorough research and of course, engaging with experienced professionals can also help mitigate risks and ensure the success of your investment.

As a savvy investor, you need to prioritise properties with strong capital growth potential and manage your cash flow diligently. Diversifying your investments and keeping an eye on market trends can further enhance your portfolio’s resilience. Remember, property investment is a marathon, not a sprint. By pacing yourself and making calculated decisions, you set the stage for enduring success.

4. Consider Diversification Strategically

While diversification is essential, it’s crucial to do it strategically. Spread your investments across different geographical locations to mitigate risks and take advantage of various market conditions is an option. Focus on properties with solid land value and avoid overexposure to any single market. Strategic diversification can enhance your portfolio’s resilience and growth potential.

We’re often asked the property vs. shares question, but to be honest, it’s the wrong question to ask. It really depends on your unique circumstances and where you are in your investing journey. Having both property and shares can provide excellent diversification, and many successful investors do both. This combined approach can balance out the risks and rewards associated with different types of assets.

It’s about balancing your portfolio to withstand market fluctuations and ensuring steady growth over time. By carefully selecting a mix of assets, you can create a more stable and robust investment portfolio that can better weather economic changes and provide consistent returns.

5. Seek Professional Advice

Even as an experienced investor, seeking professional advice can provide valuable insights and prevent costly mistakes. Engage with qualified property investment advisors and financial planners to get tailored advice that aligns with your goals. Professionals can help you navigate complex decisions, from structuring your loans to optimising your tax strategies. Remember, investing in expert advice is an investment in your financial future. Leveraging their expertise ensures you’re making informed decisions that support your long-term objectives.

If you’re looking for some experienced professionals to help build a tailored plan that suits your unique circumstances, check out our award winning sister company, Empower Wealth. They have helped over 15,000 clients and offer a free and no-obligation initial consultation too. You can learn more about their Property Portfolio Plans here >

We hope you find this article helpful! By following these tips, you can optimise your property portfolio and continue to build wealth effectively. Of course, this is a guide only and once again, we don’t recommend you to make any financial decisions without consulting a professional. Regular reviews, strategic planning, and professional guidance are key to sustained success. Happy investing!

Keen for more?

Upcoming Webinar:

We’ve got a webinar coming up at 7:30pm (AEST), Tuesday, 20th August! It’s called Data to Decisions: Moorr’s Tools for Savvy Property Investors and is designed to empower property investors with Moorr’s latest tools: the Property Cashflow Projection Tool and the Rental Analysis Tool. Whether you are an experienced investor or just starting out, these tools will revolutionise the way you manage your property investments. Click here to register >

Free Report:

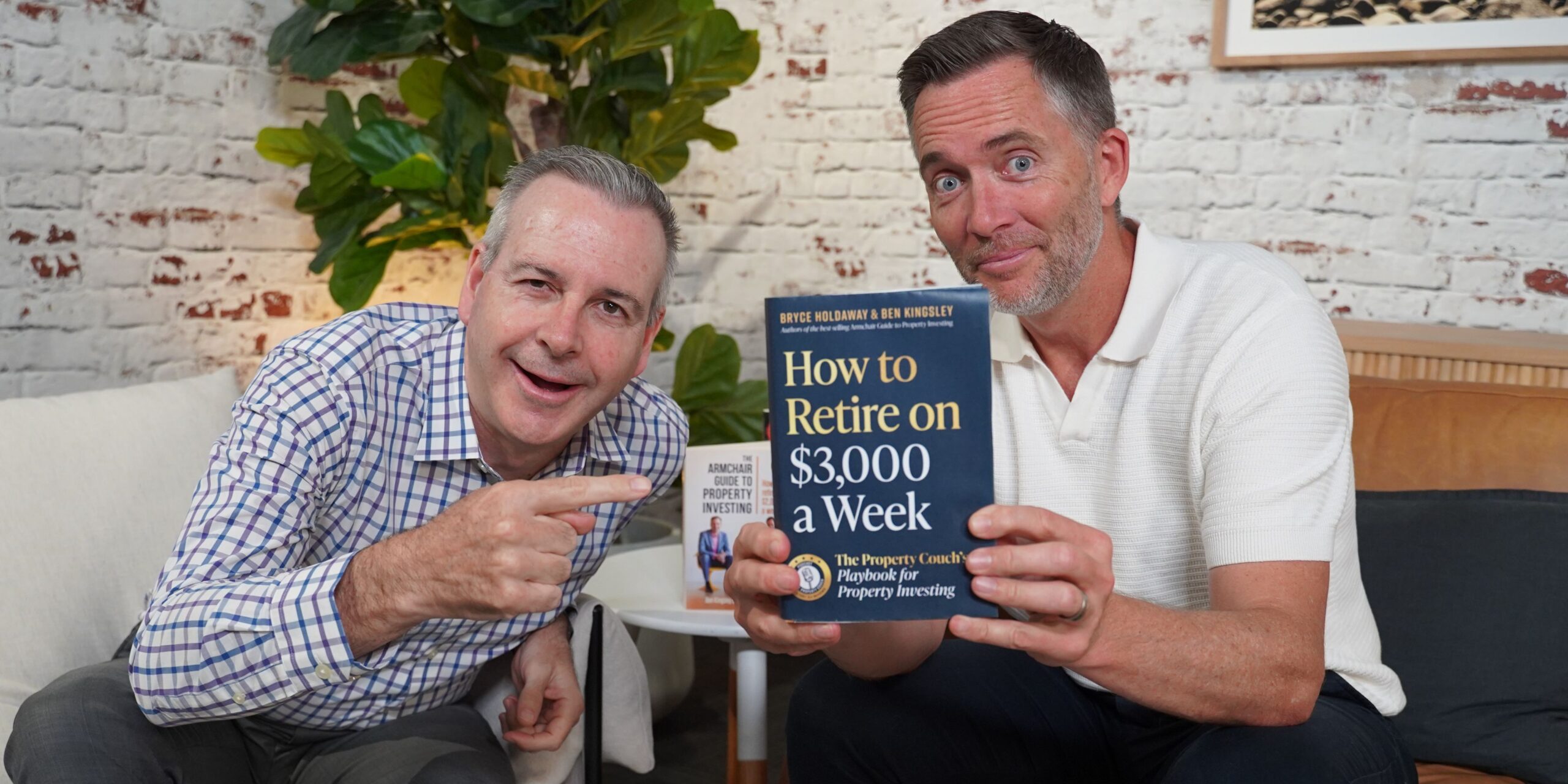

For more in-depth information and additional resources, be sure to download the free report below by The Property Couch. This report expands on these tips and provides further insights into optimising your property investments. Recorded in Episode 247, back in 2019, the fundamentals discussed are still highly relevant today. Fill out the form below to get your copy and continue your journey with the right knowledge and tools.