Your guide to historical tracking and insights

Moorr’s powerful built-in tracking functionality, including back-dating of historical data, is now here! This functionality will allow unprecedented insights, giving you the ability to finally retire any old static spreadsheets to update and centralise your financial world in one cloud-based tool like no other.

MyFINANCIALS is the personal money management solution built into the Moorr platform that can accommodate everyday Australians, right up to the most discerning of households that take their financial management duties seriously.

Rich Financial Insights are now available in Moorr! These are insights derived from the financial data you have entered, which results in a clearer and deeper understanding of:

Insights are a graphical representation of your financial data, and as the name suggests, provides you insight into your household’s financial situation in a way no other platform does.

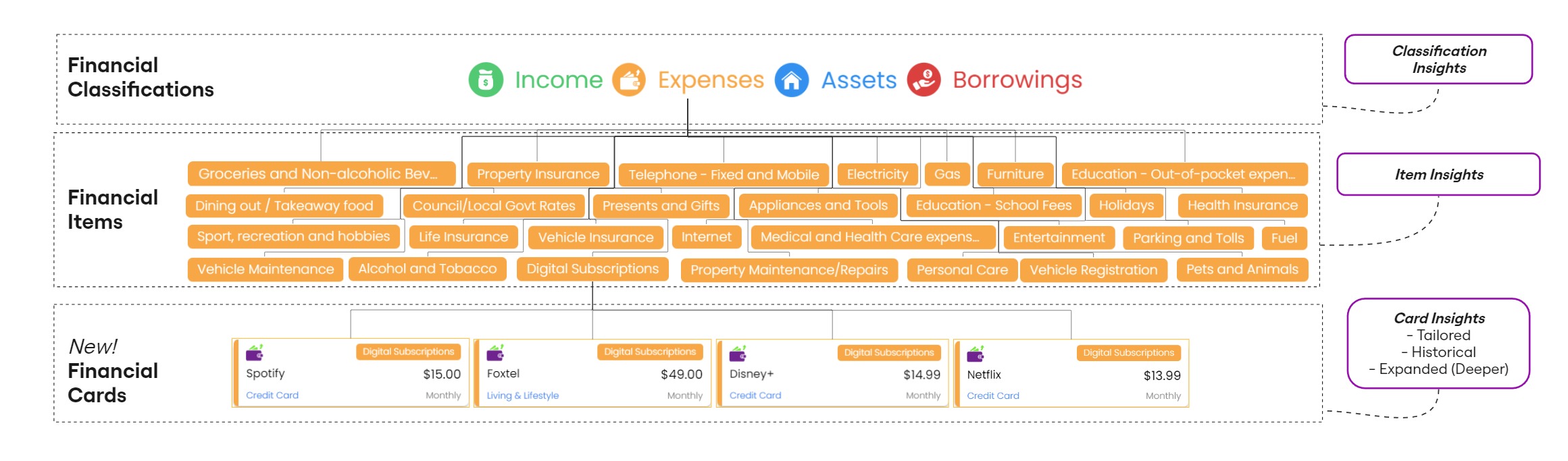

How does Moorr do this? As a refresher, Moorr is aiming to build insights on each of the following structure tiers:

Financial Classifications: This top tier has your traditional fundamental classes – Income, Expenditure, Assets & Borrowings.

Financial Items: Most item names will be familiar to most who have been exposed to some form of personal budgeting, money management, or banking apps, except in Moorr’s case, we go deeper in the number of item categories we offer, to allow for richer & deeper insights. Insights may include breakdowns of these classifications and as examples could show you how your Assets are distributed, what you spend the most on etc.

Financial Cards: A stand-out and signature feature of MyFINANCIALS is Moorr’s Financial card tier. Too often most tools stop at the Item tier and in doing so they limit the scope and functionality, which again limits the ability for richer and deeper insights at the granular level. Insights may include historical values of the card, and how the card is weighted in your overall classification.

There are hundreds, if not thousands, of examples where the Financial Card tier becomes a valuable knowledge source for a Moorr user. Here’s a couple of quick examples:

Given you have the Financial Card tier and the Financial Item tier, you get the best of both worlds. Easy to follow insights at the card level, but also the sum of what’s being spent at the aggregate Item level as well. And not forgetting you get also get totals at the Financial Classification tier as well 😊.

You can review the previous detailed information about MyFINANCIALS here.

The ability to back-date and edit your historical financial data is now here!

This functionality allows you to track and edit the details of your financial performance at the card level not only into the future,

but also into the past.

This truly gives you the ability to retire old spreadsheets and to centralise your financial world accurately in one cloud-based tool.

Editing and storing historical records of your information allows detailed insights to be presented to you, enabling you to better analyse not only your household’s overall performance, but even the performance of individual assets, borrowings, expenses and income. This gives you the power to visualise and understand the opportunities that may be available to you and your household.

![]()

As with all financial information, the accuracy of the insights are only as good as the inputs provided.

With accurate historical entries in the historical changelog, you’ll be able to accurately visualise your financial performance.

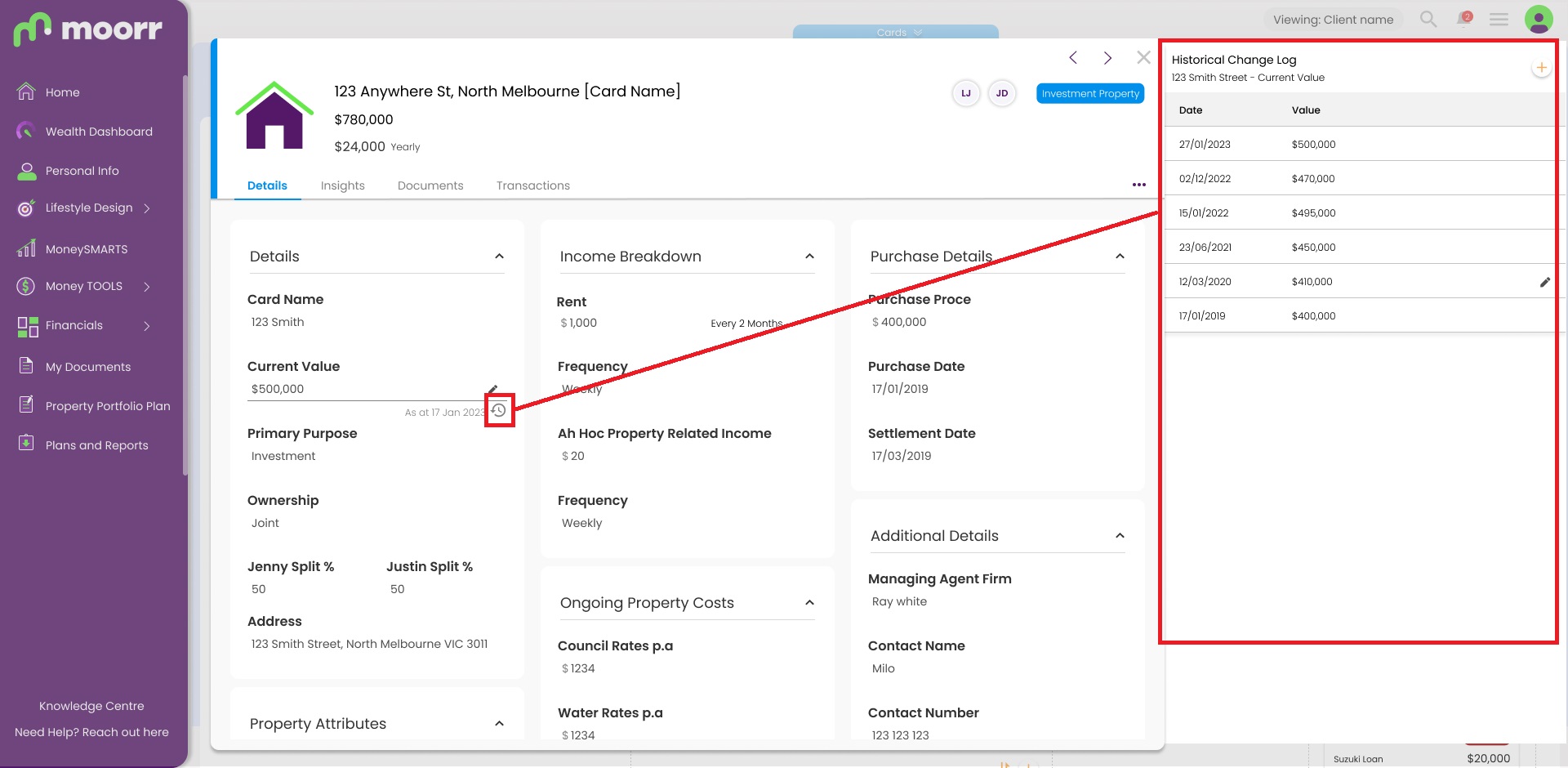

A historical changelog is available on most fields that are values or used in calculations.

To access the historical changelog for a field:

A couple of quick tips:

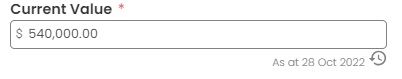

You’ll start noticing that each historically tracked field now shows an ‘As At’ date when you hover over it.

This field represents the value recorded for the field at the specific point in time, and is shown so you can see, at a glance, the last time you updated that field.

For example, if the Current Value of the Property Asset ‘123 Smith’ below was last recorded as $500,000 on 17 Jan 2023. In other words, the latest value recorded for the field, and the most up-to-date or current value, was $500,000 as at 17 Jan 2023.

You can quickly edit the latest value in the field through the card as you’ve always done, and the ‘as at’ date shown will automatically be preset to today’s date. You are able to update this in the as at field directly, or via historical changelog later.

When editing data in the Card directly, be mindful that:

Yes you can!

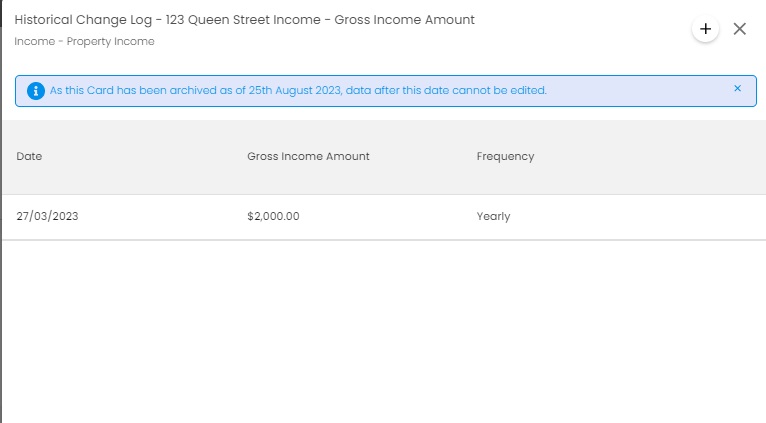

When archiving a card, you are effectively treating the card, and any historical values, as $0 from the archived date onwards.

This means that you can edit, add, or delete any historical data up until the archived date.

When editing archived information via the historical changelog, you’ll see a notification at the top letting you know the archived date and restrictions as per the below.

Initially, only a few select card insights are available.

However, we’re constantly improving and adding to Moorr, so expect to see a lot more, by way of item level insights and dashboards to allow you to better digest your data (such as the expense dashboard currently seen on the mobile app!)

Available card insights on release (January 2024):

The Wealth Dashboard is currently being upgraded! (as of 30 January 2024)

Prior to the release of MyFINANCIALS on 28 November 2023, data shown on the Wealth Dashboard charts was created based on changes to the data that was automatically tracked.

As these changes were tracking automatically, there are instances where the data may show inaccuracies due to timing variances. For instance, if you purchased a house in January 2023, but only entered it into Moorr in June 2023, the increase in total Asset Position would have only shown on the graph from June 2023, not January 2023.

With the introduction of the Historical Changelog, the Wealth Dashboard will soon be upgraded to use the data contained within the Historical Changelog, to give you full control over your numbers and your insights. These values will already be automatically loaded into the historical changelog of the respective fields.

You’ll be able to edit these fields by accessing the changelog. See “How do I access the Historical Changelog” above.

The short answer is no, not yet.

Currently, MoneySMARTS still records the Checkup balances independently, and historical MoneySMARTS data is also recorded in an independent way.

A significant update will be coming soon that will intergrate MoneySMARTS more completely with historical tracking and MyFINANCIALS including an update that will:

Had enough of trying everything else? Just keen to have a yarn with a real, living, most likely human being? No worries! We’re here to lend a hand with any questions, concerns, or issues you’ve got. Our Support Team is stoked to tackle any queries you’ve got about Moorr. Whether you’re battling to sort out tricky expenses, reckon you’ve found a bug, or perhaps you’ve got a great idea for the app, we’re all ears!

Let's Stay Connected

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.