And an Introduction to the Financial Card View

The MyFINANCIALS tool is the engine room for your money management within the Moorr Platform, accessible via the mobile app or web (desktop) browser version.

Unlike most simple budgeting and tracking options in the market, MyFINANCIALS has been built from the ground up, by money management professionals who have years of experience & a deep understanding of the many ways in which individuals or households go about managing their personal finances.

No longer are you trapped in operating within a basic and restricted budgeting and money management environment with limited features and functionality, and no ability to design your money your way.

With MyFINANCIALS, you can know choose to operate with a simple, yet productive set-up or given we have designed MyFINANCIALS with a tiered insights approach, you can choose to operate your finances like a money pro.

By taking full advantage of creating multiple Financial Cards, under the Financial Items tier, you know have an out-of-the-box solution, enabling you to create your own tailored set-up.

The benefits are far richer financial insights, which results in a clearer and deeper understanding of:

Plus coming really soon is Moorr’s powerful built-in tracking functionality, including back-dating of historical data, at the financial card level. This functionality will allow unprecedented insights, giving you the ability to finally retire any old static spreadsheets to update and centralise your financial world in one cloud-based tool like no other.

MyFINANCIALS is the personal money management solution built into the Moorr platform at can accommodate everyday Australians, right up to the most discerning of households that take their financial management duties seriously.

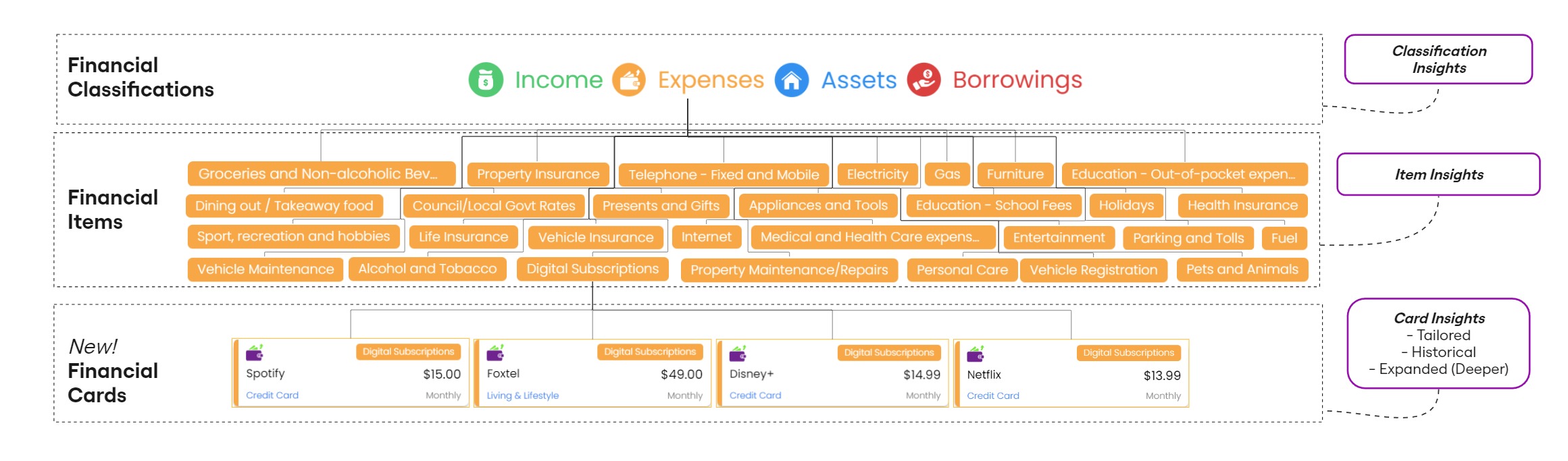

The MyFINANCIALS tool is built and operates with the following structured tiers:

Financial Classifications: This top tier has your traditional fundamental classes – Income, Expenditure, Assets & Borrowings. Users create Financial Card starting here.

Financial Items: Most item names will be familiar to most who have been exposed to some form of personal budgeting, money management, or banking apps, except in Moorr’s case, we go deeper in the number of item categories we offer, to allow for richer & deeper insights. When creating a Financial Card, users select an item from the pick list conveniently provided

Financial Cards: A stand-out and signature feature of MyFINANCIALS is Moorr’s Financial card tier. Too often most tools stop at the Item tier and in doing so they limit the scope and functionality, which again limits the ability for richer and deeper insights at the granular level. Users will name each Financial Card, in the knowledge that the card’s structural relationship with the Financial Item and classification remains in place

There are hundreds, if not thousands, of examples where the Financial Card tier becomes a valuable knowledge source for a Moorr user. Here’s a couple of quick examples:

Given you have the Financial Card tier and the Financial Item tier, you get the best of both worlds. Easy to follow insights at the card level, but also the sum of what’s being spent at the aggregate Item level as well. And not forgetting you get also get totals at the Financial Classification tier as well 😊.

A Financial Item is the second tier of a particular Income, Expense, Asset or Borrowing Financial Classification under the MyFINANCIALS tool within Moorr.

The list of Financial Item names have been pre-determined for you ease & convenience. They have their origin story based on their successful use in the best-selling money management book – Make Money Simple Again, (Access your free copy here). Furthermore, this book has introduced tens of thousands of readers to the very popular MoneySMARTS money management system – which is also freely available to implement and use within Moorr.

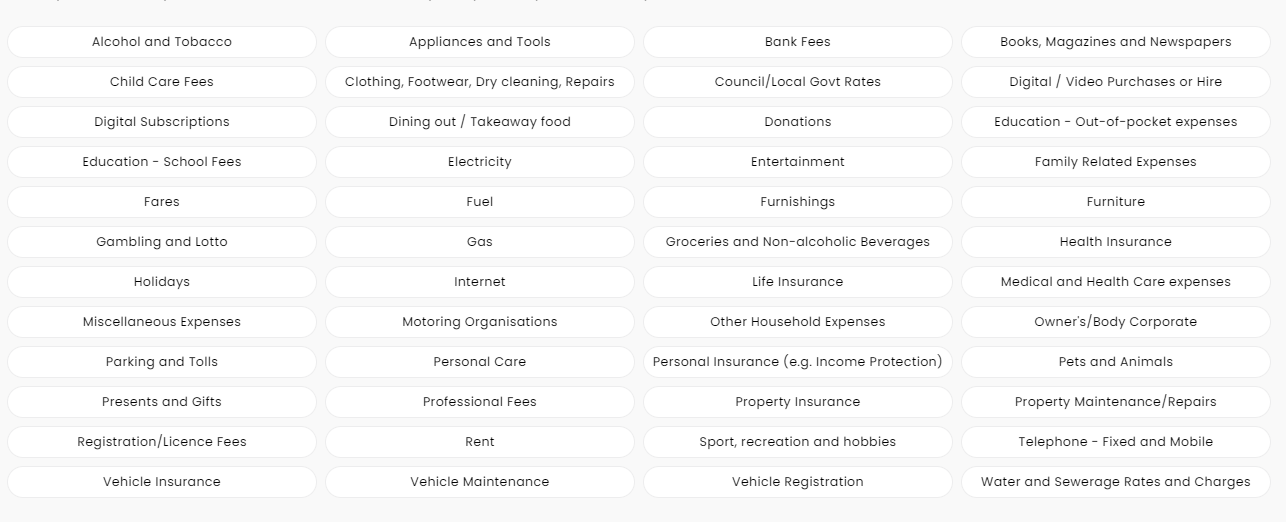

What separate our list of Financial Items, is the extensive number of options available to Moorr users, especially when it comes to the list of Expense Items, as many of our competitors have limited lists which means very limited insights.

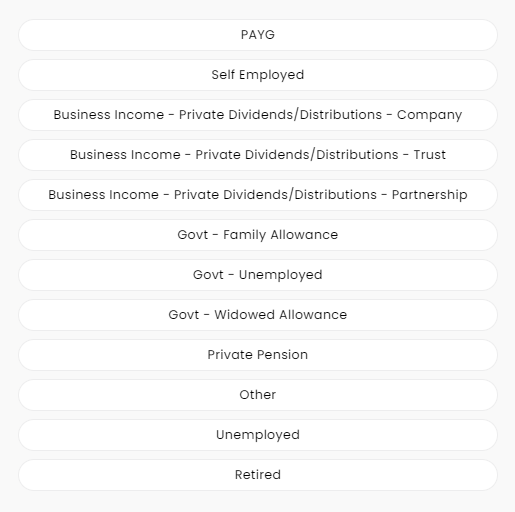

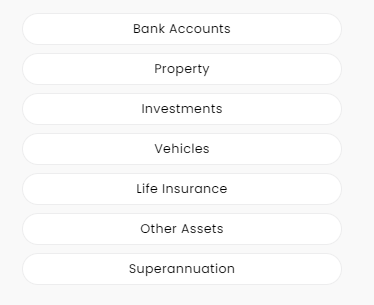

Here is a helpful look at each of our Financial Item lists:

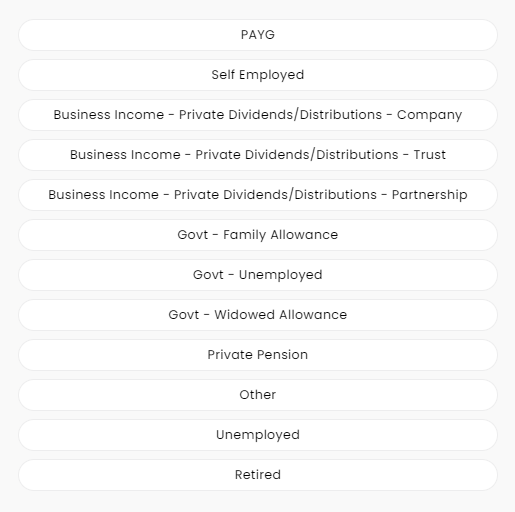

Income Items:

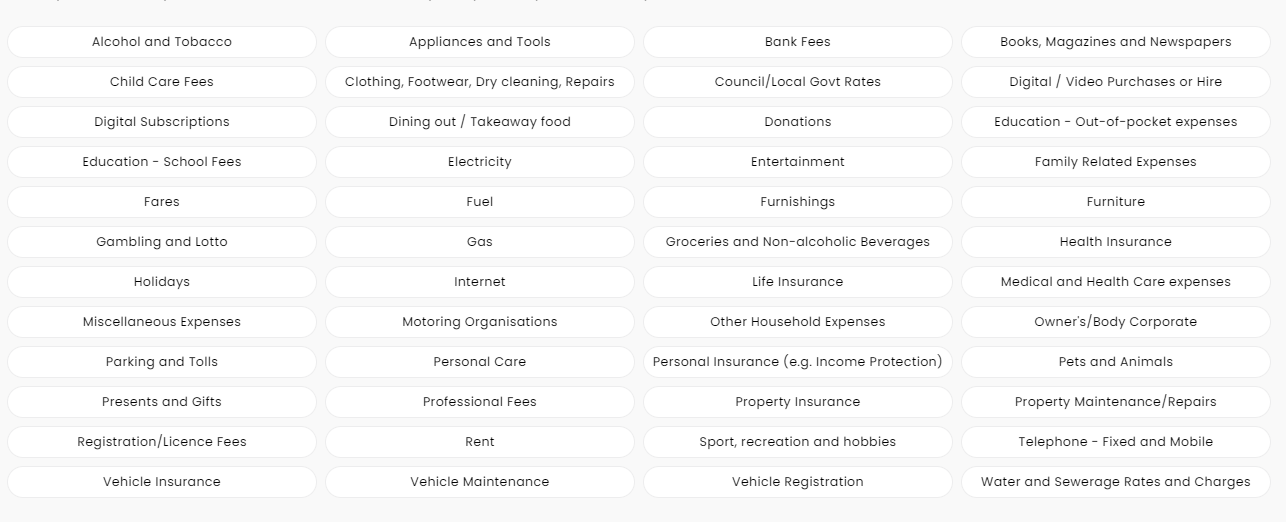

Expense Items:

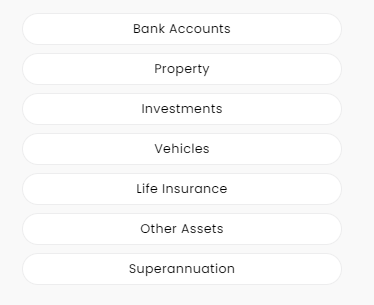

Asset Items:

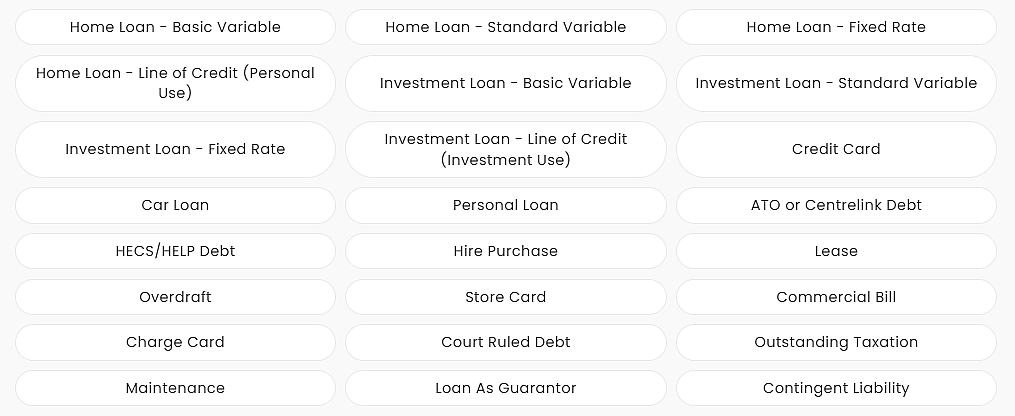

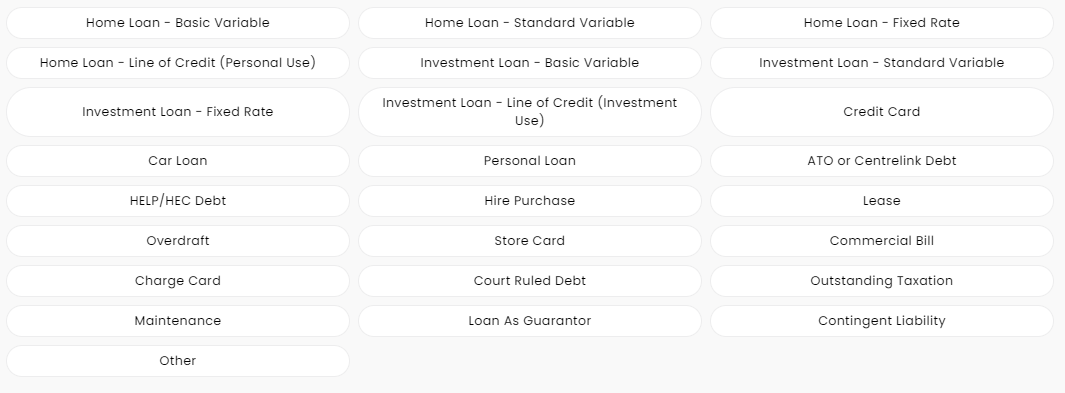

Borrowing Items:

Using the data you provide with MyFINANCIALS, Moorr will gather and provide you with meaningful and detailed insights.

For example, if you want to view your key expense insights, such as gaining a breakdown and understanding on out what category of expense you spend most of your money you can find this out at the Financial Item tier.

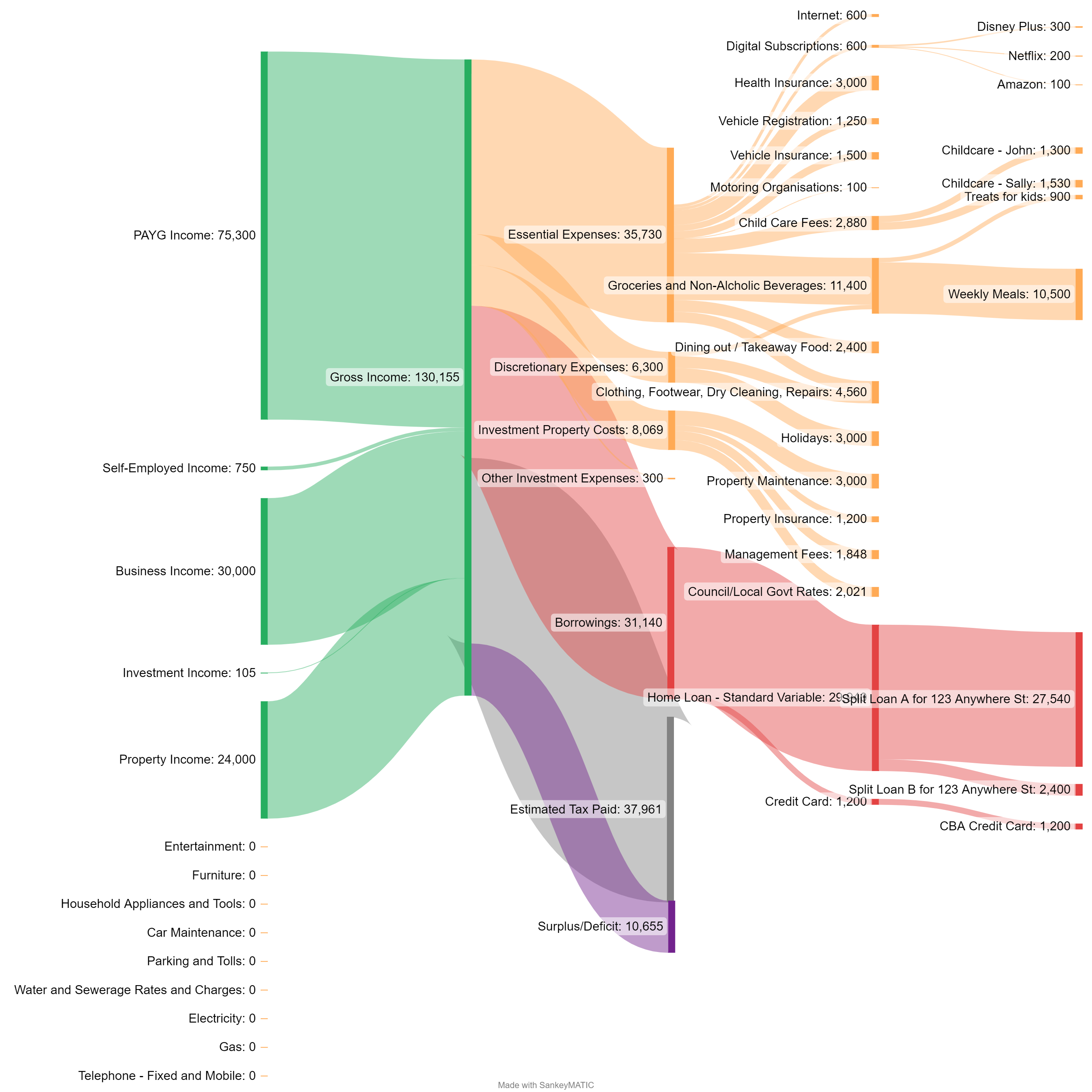

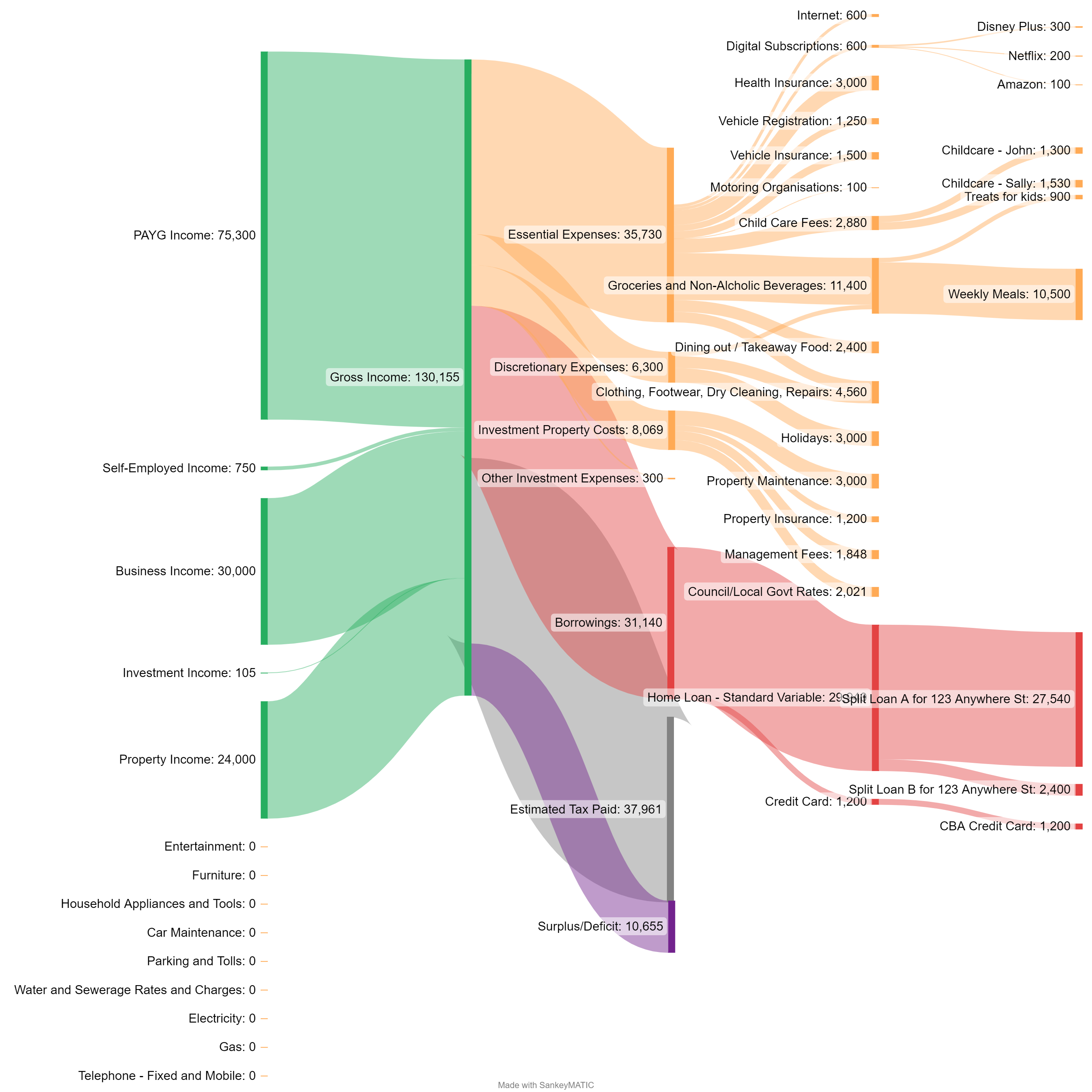

Another powerful example below, illustrates cashflow allocations and how the flow of money works within your household set up and the relationship at the Financial Classification and Card tiers.

When you are able to break your financial situation down into Financial Items (and then further customise your financial situation via Financial Cards), you are able to gain insights at all levels of your financial position.

A Financial Item is the second tier of a particular Income, Expense, Asset or Borrowing Financial Classification under the MyFINANCIALS tool within Moorr.

The list of Financial Item names have been pre-determined for you ease & convenience. They have their origin story based on their successful use in the best-selling money management book – Make Money Simple Again, (Access your free copy here). Furthermore, this book has introduced tens of thousands of readers to the very popular MoneySMARTS money management system – which is also freely available to implement and use within Moorr.

What separate our list of Financial Items, is the extensive number of options available to Moorr users, especially when it comes to the list of Expense Items, as many of our competitors have limited lists which means very limited insights.

Here is a helpful look at each of our Financial Item lists:

Income Items:

Expense Items:

Asset Items:

Borrowing Items:

Using the data you provide with MyFINANCIALS, Moorr will gather and provide you with meaningful and detailed insights.

For example, if you want to view your key expense insights, such as gaining a breakdown and understanding on out what category of expense you spend most of your money you can find this out at the Financial Item tier.

Another powerful example below, illustrates cashflow allocations and how the flow of money works within your household set up and the relationship at the Financial Classification and Card tiers.

When you are able to break your financial situation down into Financial Items (and then further customise your financial situation via Financial Cards), you are able to gain insights at all levels of your financial position.

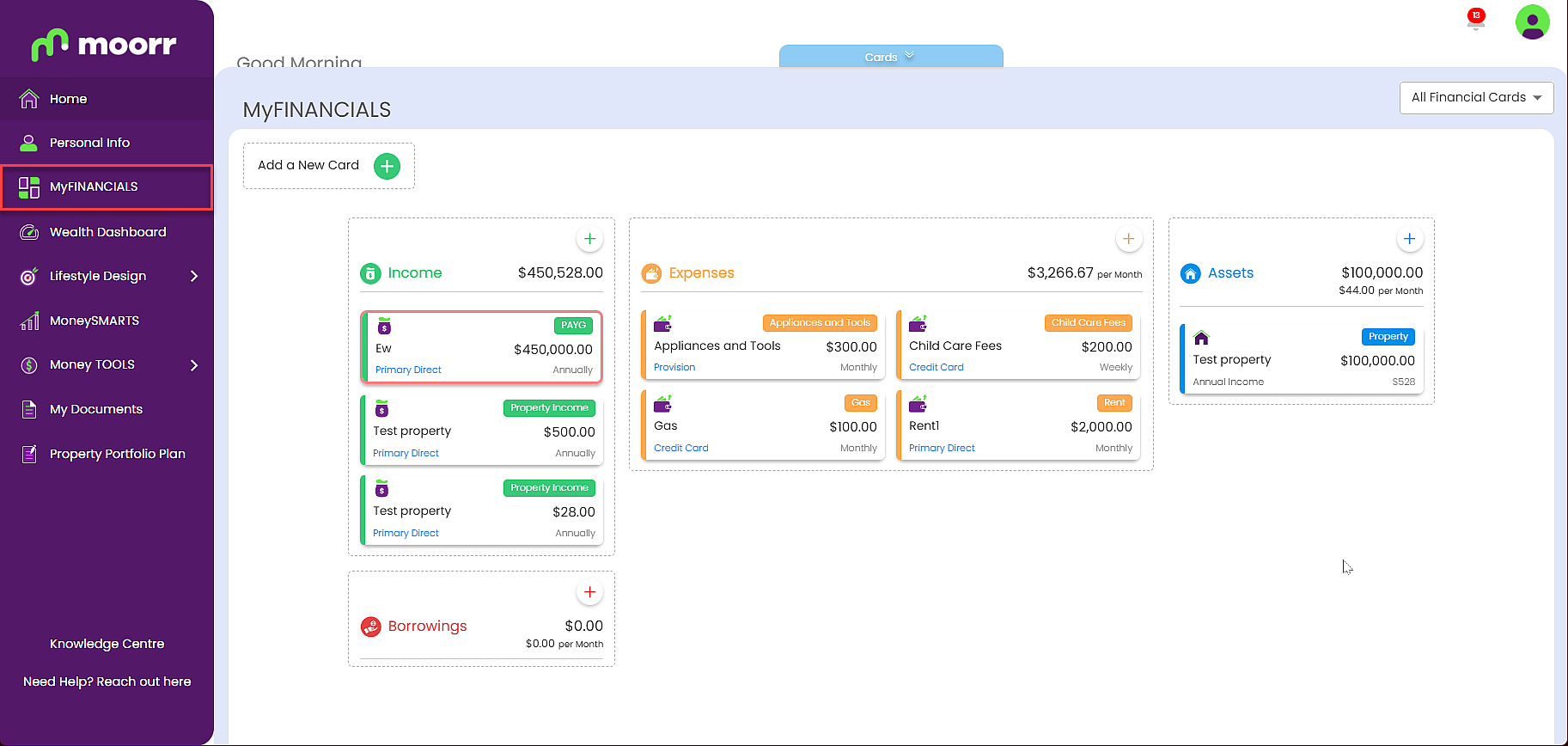

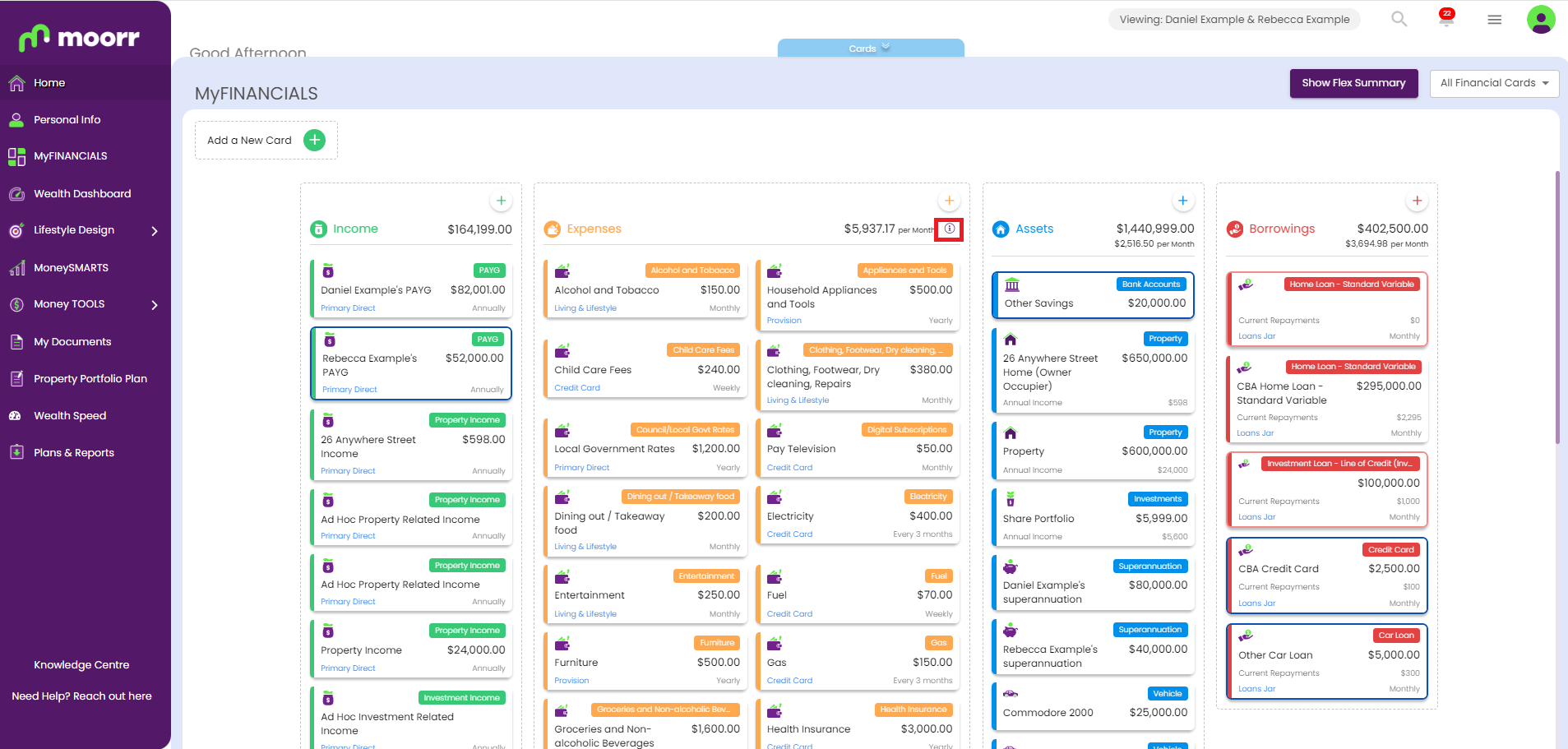

Financial Cards are the new way to organise and manage your financial information easily and set the foundation for the Moorr platform in providing you with improved insights and tracking.

Financial ‘Cards’ are an independent record of financial information. This allows for multiple Financial Cards of a particular Item Type to be created. The organisation of this data into individual Cards allows for better organisation and subsequently will allow for better insights and tracking, at both the Item Level and the individual Card Level.

A Financial Card can be located and edited within the Card Tray.

A summary of the card details can be seen in the top header, showing you a key summary such as the Card’s Name, Item Category, Ownership and Value.

Within the Card itself, you’ll be able to:

Under ‘More Options’ you’ll also be able to Archive a Card, ensuring that you maintain an accurate historical record of your past information without impacting your current financial position. Additional options will be presented to users in the future.

The Card Tray is an area you can view, sort and manage all of your financial information. The Tray is accessible on all pages of the Moorr Platform, allowing you to quickly access, view and edit your Financial Cards.

To access the Card Tray, click either the ‘My Financial Cards’ tab on the left side menu, or the ‘Cards’ tab at the bottom of every page.

A summary of each Financial Card is presented as a tile within the Card Tray, succinctly displaying key information. In the future, additional functionality will be added to sort, search and filter your Cards. 👉

Our Product Team has made sure to keep this process as simple as possible. 😊

To learn how to create a new Card, check out this article here.

When your financial circumstances change, you’ll want to record these changes accurately to ensure a historical record is maintained and historical insights can be displayed.

As such, we’ve now given you the capability to Archive a card so that it can be treated as a past, editable record. This ensures that the historical financial performance of your Cards can be maintained and managed. Data from your Financial Cards can now be archived or deleted.

To learn how to Archive, Delete or Restore a Card, check out the article here.

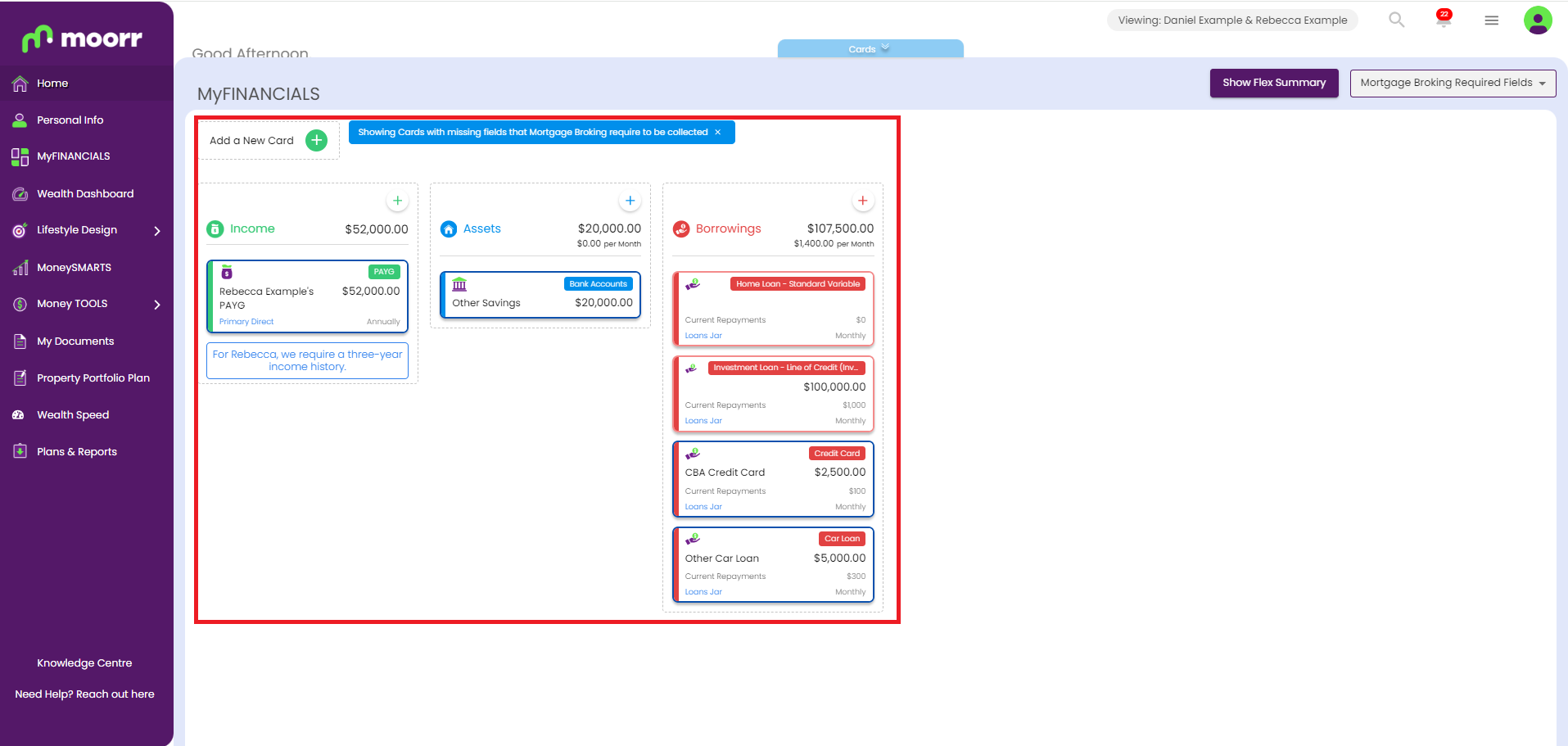

Currently, you’ll be able to filter the card tray to view all cards that have missing information.

These are classed by two classifications:

To activate these filters:

Note that additional card filtering and search functionality will be available in the near future, such as by value, A-Z and more.

For additional advisor functions such as FLEX summaries read the article here. Note that these are only available as an advisor.

Keen to learn more on how to best use this tool in Moorr? Or is simply interested in other tools such as MoneySTRETCH and MoneySMARTS?

That’s great! Check out our How To section on the blog page! You’ll find hundreds of posts that will help you master the platform in no time.

Good news is none of your existing data is affected or lost. All we have done is enhance your user experience with more features and functionality with this upgrade and it now allows us to build the new functionality that we’ve mentioned is going to be coming soon in 2024.

If you are taking advantage of the MoneySMARTS money management system built into Moorr, then more good news – the upgrade to MyFINANCIALS doesn’t impact you running your MoneySMARTS program.

And in further good news, given MyFINANCIALS is the central home of all financial record keeping and activities, any changes made in MyFINANCIALS will also integrate with MoneySMARTS going forward, as it has done since the release of the first release of our platform.

Card tray is the first fundamental release of our exciting new tool, MyFINANCIALS. In order to unlock the unlimited potential of the Moorr platform in providing useful and insightful information to our users, we needed to improve our way of capturing them. And this card tray is part of that improvement.

Here’s what you can expect from Card Tray:

As Moorr users ourselves, we know how tricky it can be when you’re trying to look for a single irregular expenses. Especially when you don’t quite remember if it was linked to an asset or a borrowing!

So in a couple of months time, we will be releasing search and filter options on Moorr. All you need to do is enter a part of the expenses title and “voila” there it is. 😊

When you’re filling in Moorr for the first time (or any money management app for that matter), it can take some time. You’ll need to go through the different expenses that you’ve got, find out how much you’ve spent on them, link them to different people in the household, link them with a specific asset, and much more!

Can you imagine how many clicks or taps that would take?

A LOT.

That’s why we’ve rolled out updates to MyFINANCIALS in stages, and the first one is Financial Cards. There was a significant amount of “replumbing” that we needed to do in the background to ensure that MyFINANCIALS evolves to its true potential. This first step is fundamental and involves making sure that the data is collected and structured in a sustainable manner. The best part is that by doing this replumbing, we’re able to build an almost endless number of insights based on your financial data with ease!

Once Financial Cards are rolled out, our next target is to allow our users to “Bulk Add Cards” and potentially even import them! And of course, Opti will be there to guide users and offer recommendations as well. This feature is definitely on the short-term horizon, so keep your eyes peeled, folks.

Curious about what else is coming? Check out our Blog page here >

With the introduction of Financial Cards, we’ve gained a lot more flexibility and ‘digital real estate’ to showcase even more insights within each card!

The possibilities are vast regarding the graphs, widgets, trends, and useful data that our users might desire for each card.

Our team of superstar Product Managers already has a substantial wishlist of insights they would like to incorporate into the cards. If you’re interested in seeing some mockups (these are just drafts at this stage), please check out the blog below:

The next release for this feature is Historical Tracking!

For months, our users have asked for a way to see how their household’s finances have changed over time. We wanted it ourselves too! So that’s why we’ve made changes to our system to make this possible.

Although you can’t add or change historical info just yet, we’ll add this feature in the coming months. Once it’s ready, we’ll also provide graphs and charts to show you how your finances have performed.

With the introduction of historical tracking, the importance of having the capability to edit previous data becomes increasingly evident. And team of Product Managers know this which is why, our next feature of MyFINANCIALS will be the “Historical Side Tray”!

When you edit these fields, you can ensure that the insights we provide accurately reflect your financial performance.

Had enough of trying everything else? Just keen to have a yarn with a real, living, most likely human being? No worries! We’re here to lend a hand with any questions, concerns, or issues you’ve got. Our Support Team is stoked to tackle any queries you’ve got about Moorr. Whether you’re battling to sort out tricky expenses, reckon you’ve found a bug, or perhaps you’ve got a great idea for the app, we’re all ears!

Let's Stay Connected

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.