Hello there! Welcome to Moorr, your ultimate money management platform, designed to work seamlessly on both mobile and web.

You’re here, which means you’re ready to embark on an exciting journey to set up your brand new Moorr account on your trusty phone.

Fantastic! Buckle up because we’re about to dive into a world of financial empowerment and convenience. Let’s kickstart this thrilling journey!

At Moorr, we take pride in ensuring that your onboarding experience is as smooth as a summer breeze. To give you a sneak peek into what awaits you, we’ve got some helpful screenshots lined up.

Before you start, remember this:

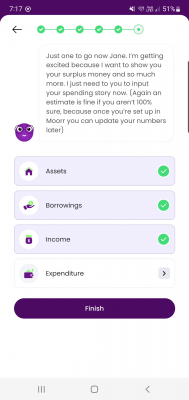

Don’t worry if you need to close the app in the middle. Your progress will be saved. You also get to choice to skip this whole process by clicking on “Finish” but we recommend you take the time to finish the onboarding so that you can optimise all the insights and dashboards later.

Ready to take a peek? Just click on the arrow icon, patiently waiting on the right side of each screenshot, and let’s embark on this visual journey through the onboarding process together!

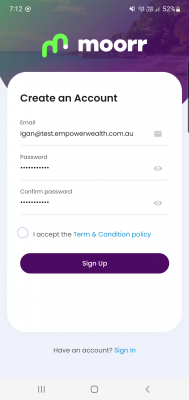

Step 1: Sign Up to your Free Moorr Account. We also strongly recommend using high-level and complex passwords to enhance security. Simple text, numbers, and birthdays of yourself, partners, or family members should be avoided. We recommend passwords to include:

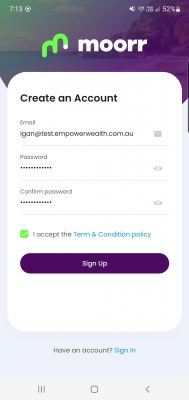

Step 2: Read through the Terms & Condition policy. Once you’re done and agree with it, tick on the checkbox for “I accept the Terms & Conditions policy” and click on the “Sign Up” button.

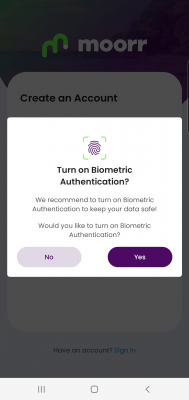

Step 3: A pop up will appear. You have the option to turn on your Biometric Authentication here. If it’s turned on, you’ll get the option to log in via your phone’s biometric authentication instead of your password. If you’d like to turn this on, click “Yes” and follow the prompts. If not, “click “No”.

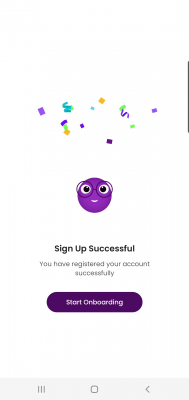

Step 4: And your initial sign up is done! The next steps are to fill in some basic information to get you started.

Step 5: Read through the Terms & Conditions on the page. Once you’re done, click “Accept”.

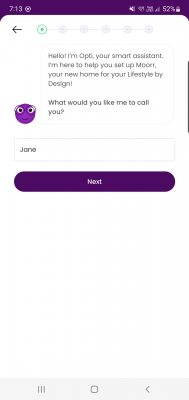

Step 6: The rest of your onboarding will be guided by Opti. Let’s start with your name.

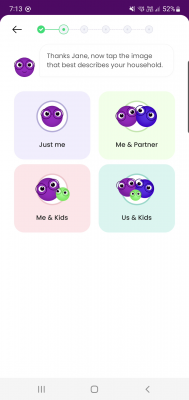

Step 7: Select the household that relates to you the most.

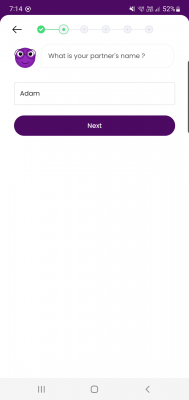

Step 8: (If applicable) Enter your partner’s name.

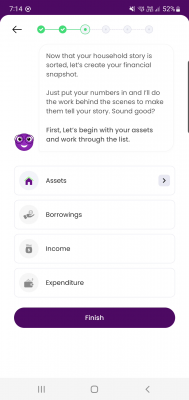

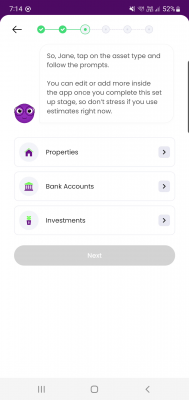

Step 9: And we’re now in the numbers side of things! Once we’ve started, don’t worry if you need to close the app in the middle. Your progress will be saved. You also get to choice to skip this whole process by clicking on “Finish” but we recommend you take the time to finish the onboarding so that you can optimise all the insights and dashboards later. Now, let’s start with “Assets”.

Step 10: Select “Properties”.

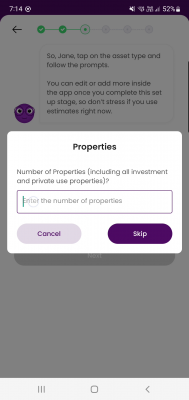

Step 11: Enter the number of properties. If you don’t own any properties, click on “Skip”.

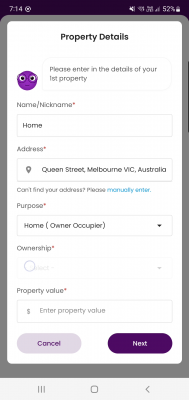

Step 12: Follow the prompts and enter the details of your properties. A rough figure will do since you’ll be able to update this later. Click on “Next”.

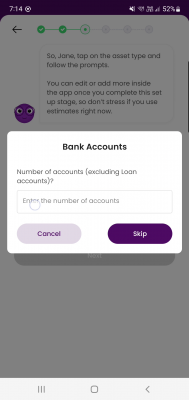

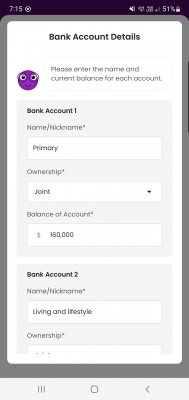

Step 13: Select “Bank Accounts”. Follow the prompts and enter the details of your accounts. A rough figure will do since you’ll be able to update this later. Click on “Next”.

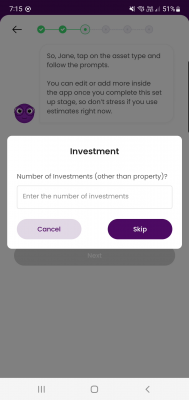

Step 14: Select “Investments”. Follow the prompts and enter the details of your investments. A rough figure will do since you’ll be able to update this later. Click on “Next”.

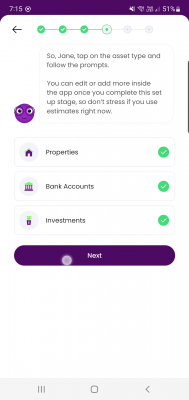

Step 15: And you’re done with Assets! Click “Next”.

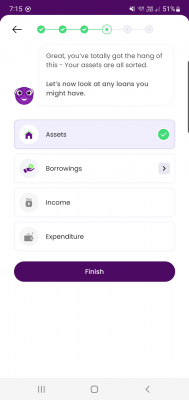

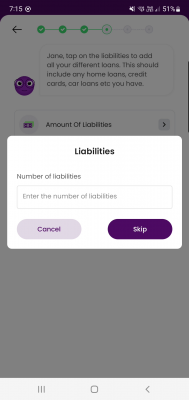

Step 16: Alrightey, let’s go with Borrowings next. Click on “Borrowings”.

Step 17: Enter the number of borrowings. If you don’t own any, click on “Skip”.

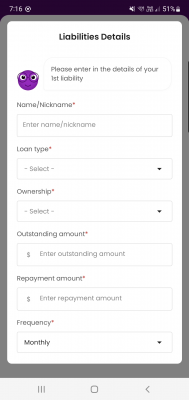

Step 18: If you do have borrowings (credit card, home loan, HECS etc.), follow the prompts and enter the details of your borrowings. A rough figure will do since you’ll be able to update this later. Click on “Next”.

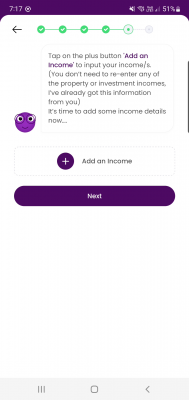

Step 19: And you’re done with Borrowings! Click “Income”.

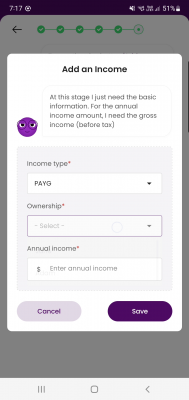

Step 20: Click on “Add an income”

Step 21: Follow the prompts and enter your income details. Once you’re done, click “Save”.

Step 22: Repeat the same steps if you have a partner. Otherwise, click “Next”.

Step 23: And you’re done with Income! Click on “Expenses”.

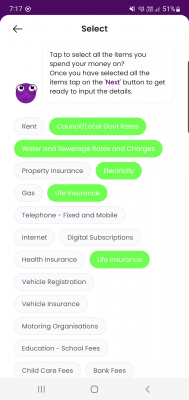

Step 24: Select the items that you spend your money on and click “Next”.

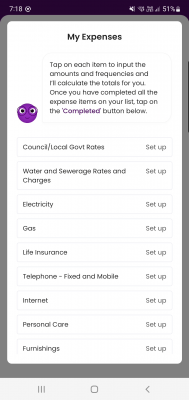

Step 25: You’ll now see the list of expenses items. Click on “Set Up” to enter the amount.

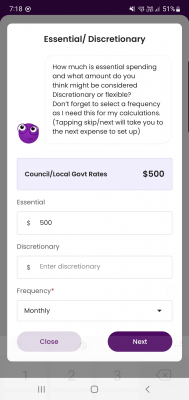

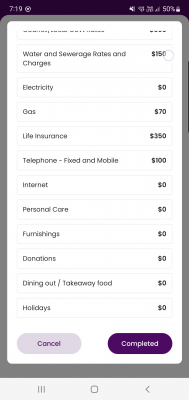

Step 26: Now, let’s enter a rough amount for each of the expenses category! Essential means it is a mandatory amount while discretionary are expenses that you can choose to not spend if you have to. If you don’t know the amount for each expenses, that’s ok! Click “Next” to skip it. You can add them later.

Step 27: Once you’ve gone through the expenses, click on “Completed”.

Step 28: Did you see al the tick marks? You’re very close! Click on “Finish”.

Step 29: AND THAT’S IT! You have now finished your onboarding for Moorr. Feel free to explore around and update those numbers so you optimise the reporting in this platform. 😊

Congratulations on completing your onboarding journey! 🎉 Now, you’ve unlocked a treasure trove of insights and features, all at your fingertips.

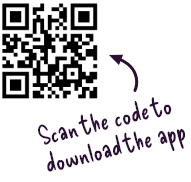

Now, let’s practice what you learn! Download our mobile app and supercharge your financial prowess. To make it even easier for you, just scan the QR code below with your smartphone, and voilà, the app is yours.

Now, what’s next? Here’s a roadmap for your financial adventure:

Spend money on the things you want without guilt and save for the future with confidence. You can have the best of both worlds. Achieve more, with Moorr

So much to realise & gain,

nothing to lose.

Onboard with your hopes,

dreams & finances.

Start planning & living your

Lifestyle-by-Design.

*It’s 100% free. No Strings Attached.

So much to realise & gain,

nothing to lose.

Onboard with your hopes,

dreams & finances.

Start planning & living your

Lifestyle-by-Design.

*It’s 100% free. No Strings Attached.

Let's Stay Connected

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.