This is probably our busiest quarter ever with so many releases! We’ve been hustling to make managing your finance even easier, and we’ve got a ton of cool stuff to show you! 🚀

From the new Cash Position Chart on our mobile app to the Offset Tracker on the webapp, we’ve got tools to help you stay on top of your finances. Plus, we’ve added Change Over Time tools for income and expenses, and Bulk Add & Bulk Edit features for borrowings, assets, and income. It’s all about saving you time and making your financial journey smoother.

In our latest educational content, Evan Lucas dives into biases affecting investments and tackles common bad habits holding back wealth creation. And there’s more good stuff coming soon, so keep an eye out for our monthly updates.

What’s New This Month?

1. NEW Mobile Insight! Cash Position Chart

This new feature consolidates all your account balances—transaction, offset, savings, and more—into one easy-to-understand chart, providing a single source of truth for your financial standing. Available now in the Moorr mobile app, this tool helps you manage your money more efficiently. Learn more about the Cash Position Chart here >

This new feature consolidates all your account balances—transaction, offset, savings, and more—into one easy-to-understand chart, providing a single source of truth for your financial standing. Available now in the Moorr mobile app, this tool helps you manage your money more efficiently. Learn more about the Cash Position Chart here >

2. Outstanding Loan Balance vs Offset Insights (Offset Tracker) on Webapp:

This innovative tool allows you to track your mortgage balance alongside your offset balance, providing a clear visual of your progress in reducing your mortgage over time. By updating your balances, you can see the impact of your offset account on your mortgage, highlighting interest savings and helping you pay off your mortgage sooner. Learn more here >

3. Change Over Time – Income & Expenses:

These tools allow you to visualise historical graphs of your budgeted expenses and income, helping you identify trends and combat lifestyle creep. With precise filtering options, you can track your financial journey over months or years, providing a comprehensive overview of your spending and income growth to ensure you stay on track with your financial goals. Check out each of them below:

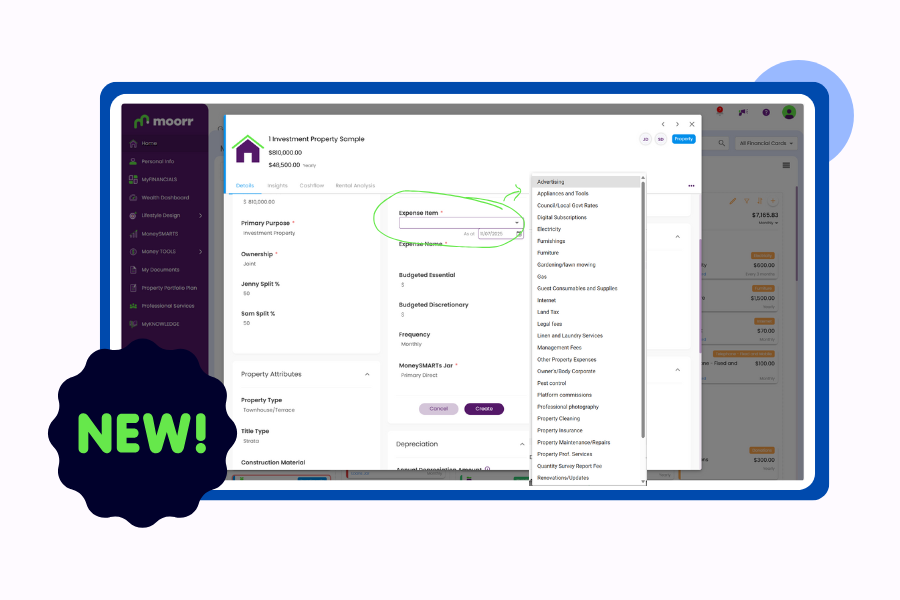

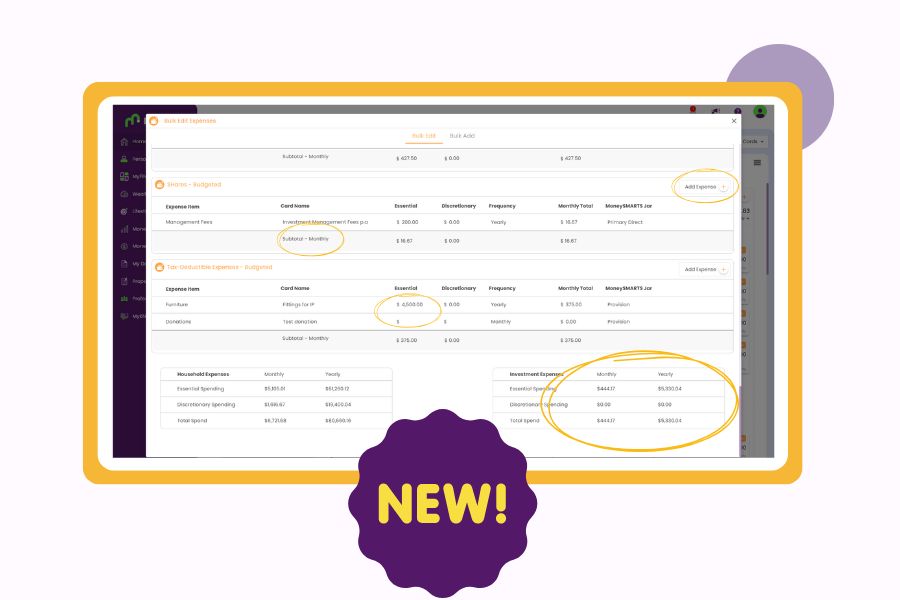

4. Bulk Add & Bulk Edit for Borrowings, Assets and Income

Following the success of our bulk add and edit features for expenses, we have extended this functionality to borrowings, asset and income as well! These enhancements allow users to efficiently manage multiple income streams, assets, and borrowings, saving time and reducing the complexity of financial management. Below are the links to learn more about each of these updates:

- Income – Learn more

- Borrowings – Learn more

- Assets – Learn more

5. And heaps of other mini-updates and improvements such as:

- Added additional card view on MyFINANCIALS you can now view cards horizontally and grouped under headings.

- Non-Taxable Income is now included in the Annual Income tile at the top of the Home Dashboard Summary

- Archiving expenses cards in the bulk edit section

- Added additional information under ‘Purpose’ on borrowings cards.

You can learn more about our regular updates here >>

New Educational Content Released

1. Webinar Replay: Moorr’s Best Tools for the Job: What to Use When

Did you know that Moorr is built on four core pillars – Lifestyle, Money, Property & Wealth, boasting over 25 features and tools, offering 100+ insights, and continually growing? Join our webinar for a deep dive into understanding key features, optimizing Moorr for financial management, and reaching your property, wealth, and personal goals. Through case studies, discover the best tools and witness how data converges for meaningful insights using our “track your progress” approach to money management.

Don’t miss this webinar for unlocking Moorr’s full potential in mastering finances and achieving your goals. Watch the replay here >

2. How THIS Particular Bias Shapes Your Investments

Evan Lucas, Moorr’s new ambasaddor has been busy producing lots of educational contents. In this video, he explores hyperbolic discounting and its impact on your investments in his latest blog. Discover why we favour immediate rewards over long-term gains and how this bias affects financial decisions. Learn practical tips to improve your investment strategy by thinking long-term. Don’t miss this insightful piece from Moorr’s new ambassador! Watch now to understand your financial habits better.

3. The Surprising Bad Habit Holding You Back

In this blog, Evan Lucas tackles the bad habits that hinder long-term wealth creation. He explains “tunneling,” the tendency to focus on small details and mistakes rather than the big picture, and “planning fallacy,” our tendency to be overly optimistic about time and costs. Learn more here >

What’s Coming

And of course, we have an array of incredible tools and features lined up for you in the near future:

- (June 2024) Depreciation Fields for Investment Properties

- (June 2024) Video – 99% Have AAC Biases. Do You?

- (June 2024) Video – The Real Cost of Holding On

- (Q3 2024) Asset & Debt Position Charts: Our Mobile App will see some updates too when it comes to richer and deeper insights available right at your fingertips.

- (Q3 2024) Offset Benefits Insights & Offset Assignment Restrictions

And that’s just a taste of what’s to come; we have plenty more surprises up our sleeves so make sure you look out for our monthly updates in your mailbox. 😉