Set up a Line of Credit to pay only Interests on borrowings?

A line of credit is a type of financial arrangement offered by banks or financial institutions that allows you to borrow money up to a certain limit. I

How to Print Moorr Data

Users can still capture a screenshot of their data by using the PrintScreen function.

What Money Means to Australian Households

Moorr, a personal finance & wealth building platform, have just released the results of its ‘What Does Money Mean for You’ survey.

Thinking of selling something to combat rising interest rates? Think again.

There’s a lot of noise out there at the moment, and with a likely increase in cash rates in the coming months and an already high cost of living, you are not alone if you’re asking those questions.

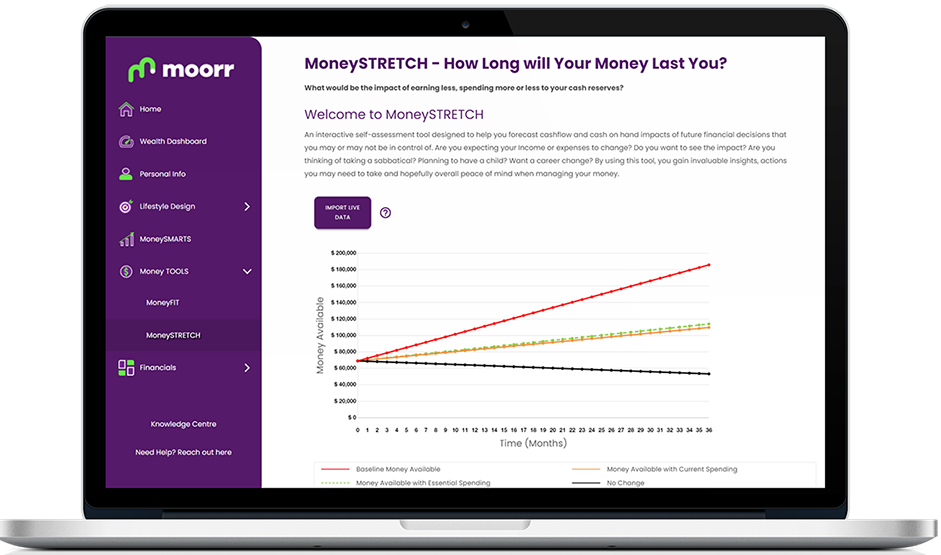

Managing one’s finances, just got a whole lot more interesting

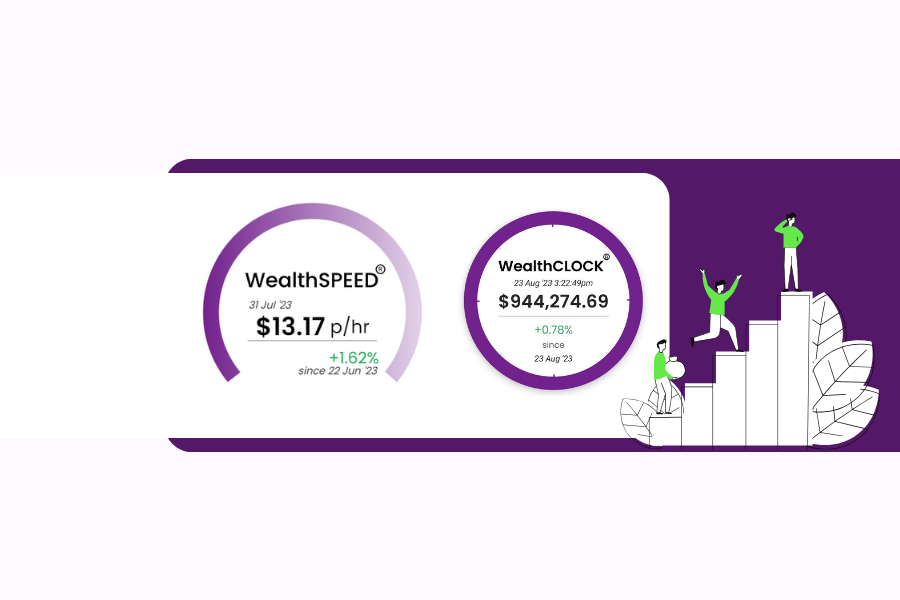

Introducing our WealthDASHBOARD: WealthSPEED, WealthCLOCK and WealthTRACKER.

The Bigger ‘Lifestyle by Design’ Moorr® Vision

You have just learnt how WealthSPEED™ and WealthCLOCK™ are powerful indicators that deliver powerful and actionable insights inside the Moorr® platform.

WealthSPEED® and WealthCLOCK®: A Powerful Combination

Track your financial growth in real time with WealthSPEED® & WealthCLOCK®. See your wealth story unfold and take control of your financial future with Moorr®!

Does WealthSPEED adjust for debt paid off within the year?

WealthSPEED® calculation is not built to automatically recognise when a debt might be fully paid out, it’s just looking at the next twelve-month picture.

What does a negative WealthSPEED® hourly rate means?

If you are still in negative territory after this audit, then in theory the negative number really shouldn’t be a surprise to you, if you are living a bit of pay cheque to pay cheque.