Let’s Us Show You What Moorr Can Do

Helps you stay on track with your goals by showing your surplus and spending patterns clearly.

Tracks your daily cashflow automatically so you always know what’s safe to spend.

Keeps all your property details, performance and research in one simple dashboard.

Shows your net worth, assets, debts and equity in real time so you can see your financial position at a glance.

Pick a time, meet with one of our Client Specialist, and see exactly how to use Moorr to manage your money and property more effectively.

Client Liaison Specialist

Client Liaison Specialist

Built for the bigger picture. With a bigger screensize, the web app is perfect for deep dives, full dashboards, and getting total clarity on your finances.

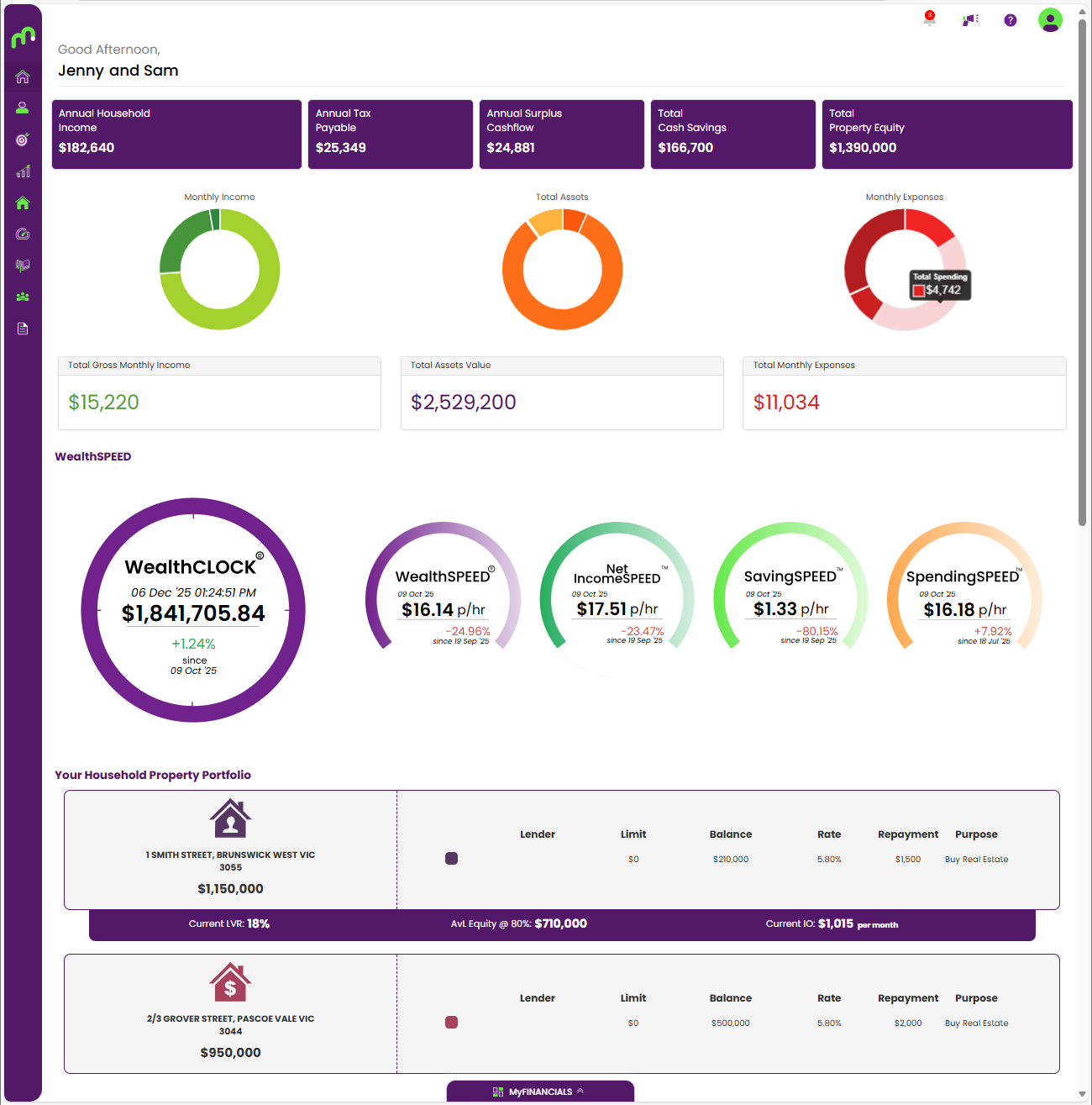

Start with the big picture.

Track your household’s position at a high level with Moorr’s all-in-one dashboard.

A high-level view of your household’s money position.

Use this section to quickly see where you stand—and where you’re headed. Learn more here >

Every expense tracked, from loans to lattes. Get clarity on where your money’s going each month.

See your net worth, assets, debts and momentum all in one place.

The Wealth Dashboard gives you a clear, high-level view of where you stand — and how you’re progressing.

See how your portfolio is tracking with clear insights into property values, loan balances, LVR and monthly repayments.

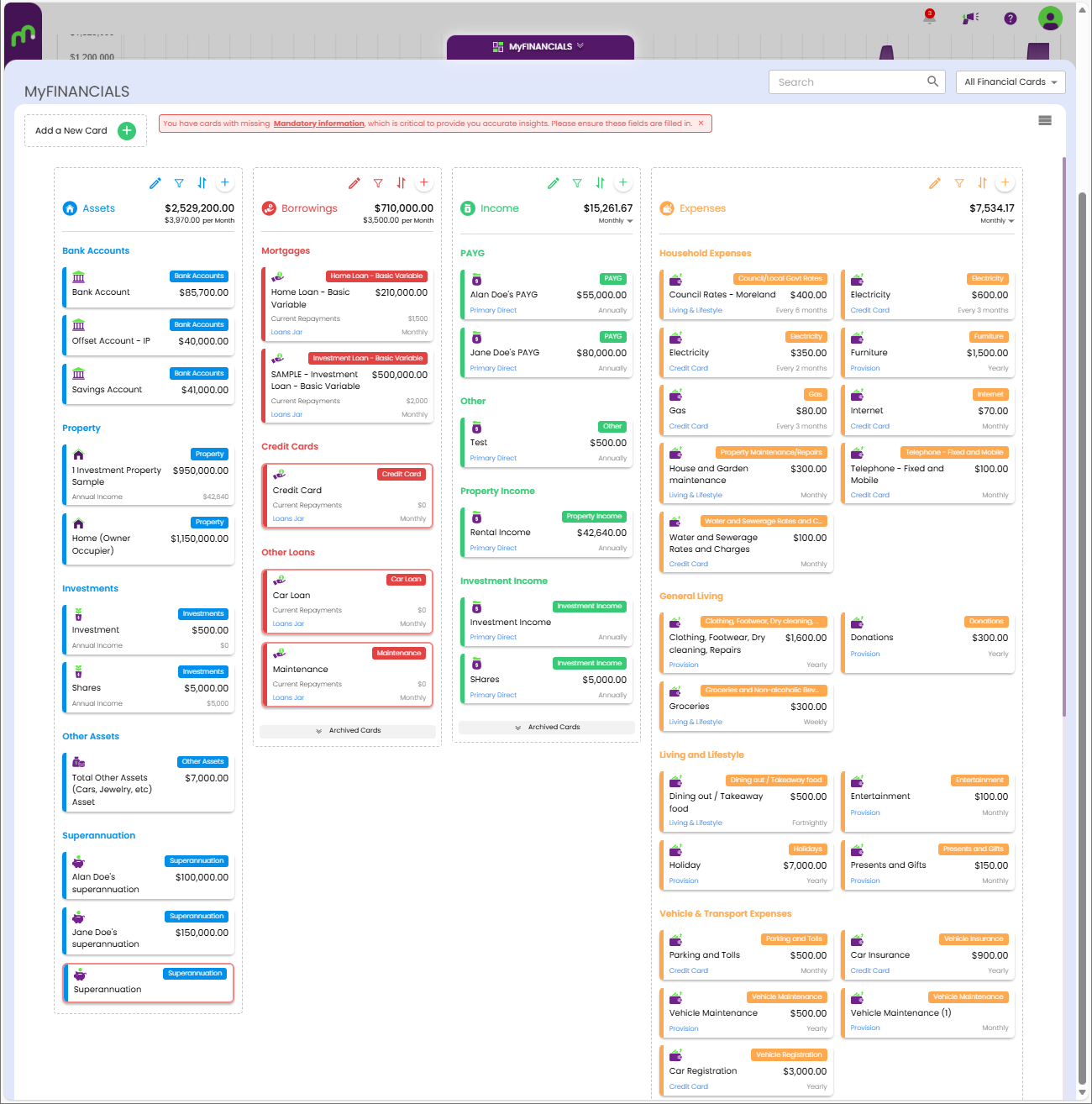

The engine room of Moorr.

MyFINANCIALS helps you organise your money the smart way—assets, loans, income and expenses—all connected and easy to understand. No Excel, no stress.

Track anything that matters—accounts, loans, income or expenses—by adding a new card here anytime.

In Moorr, a “card” is a financial item—like a bank account, home loan, or household bill.

You can add, edit or remove cards to reflect your real-life money situation. Learn more here >

See all the things related to your finances – assets, borrowings, income and expenses—organised in one place and categorised neatly for easy access.

Quickly filter by card type, sort by name, value or date modified,

and bulk edit or add multiple cards at once. It’s built to handle

the messy, real-life stuff—fast.

Quickly find any card by name—no scrolling, no digging.

Perfect when your dashboard’s packed with

property, income, and expense data.

Dive deeper into your financial details.

Open any card to explore detailed graphs, breakdowns and projections. From loan amortisation to property performance and cashflow insights, everything you need is organised in one place. Here are some examples.

Each card has a Details tab where you can enter & see key details.

This example is a loan card so detailes like

balance, value, repayments, rates or income at a glance.

This section gives you a clear snapshot before diving deeper.

This is the insights tab of an

investment property card.

The Insights tab gives you a clear visual

summary of your property’s performance

over time. You can track changes in

market value, rental income, loan balance

and overall contribution to your

household assets. Each chart highlights

long-term trends—showing how the

property has grown, how income has

shifted, and how your debt position has

changed—so you can easily understand

how this investment is tracking within

your broader portfolio.

This is the management tab of an

investment property card.

The Management tab brings together

everything related to your tenancy and

compliance. You can see lease timelines,

rental agreements, property manager

details and key safety obligations all in

one place, making it easy to keep track of

who’s living in the property and what

maintenance or compliance tasks are due.

This is the insight tab of an investment

loan card.

The Insights tab visualises how your loan

balance is tracking over time. You can see

your outstanding balance, offset impact,

interest savings and how this loan

contributes to your total borrowings —

all in one simple view.

This is the insight tab of an offset

account card.

The Insights tab tracks how your offset

balance has changed over time and how it

contributes to your total assets. You can

also see the estimated interest savings your

offset provides, helping you understand its

impact on your loans and overall finances.

This is the rental analysis tab of an

investment property card.

You can see the estimated weekly rent,

the full rental range for comparable

properties, key metrics like median rent

and days on market, plus a historical

chart showing how rental values have

changed over time. It’s a powerful way to

understand whether your rent is

competitive and how the market is

moving.

For a full breakdown of this feature,

explore the blog here.

This is the cashflow tab of an

investment property card.

A simple breakdown of your property’s

income and expenses for the next 12

months, helping you see your

estimated cashflow before and after tax.

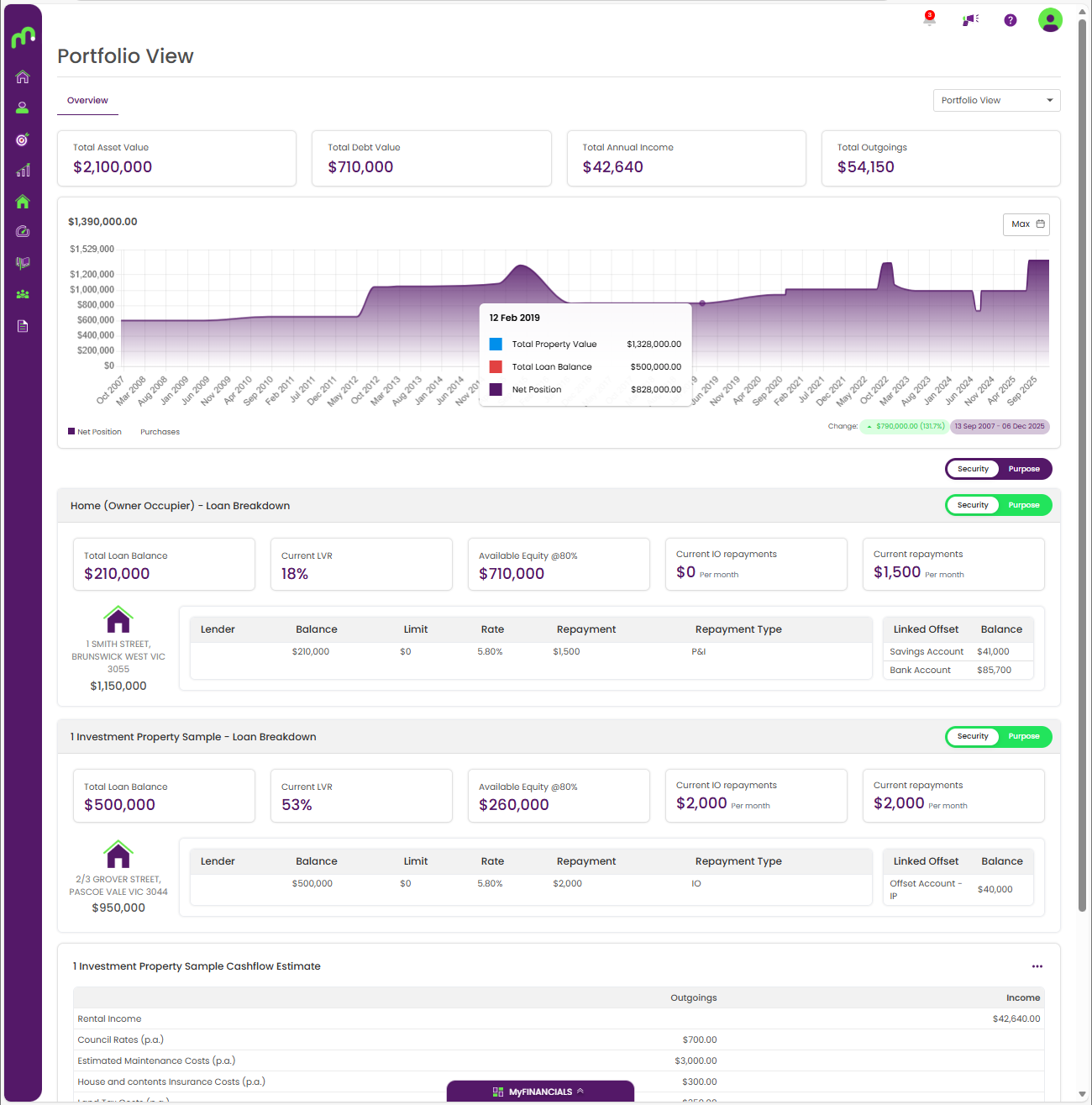

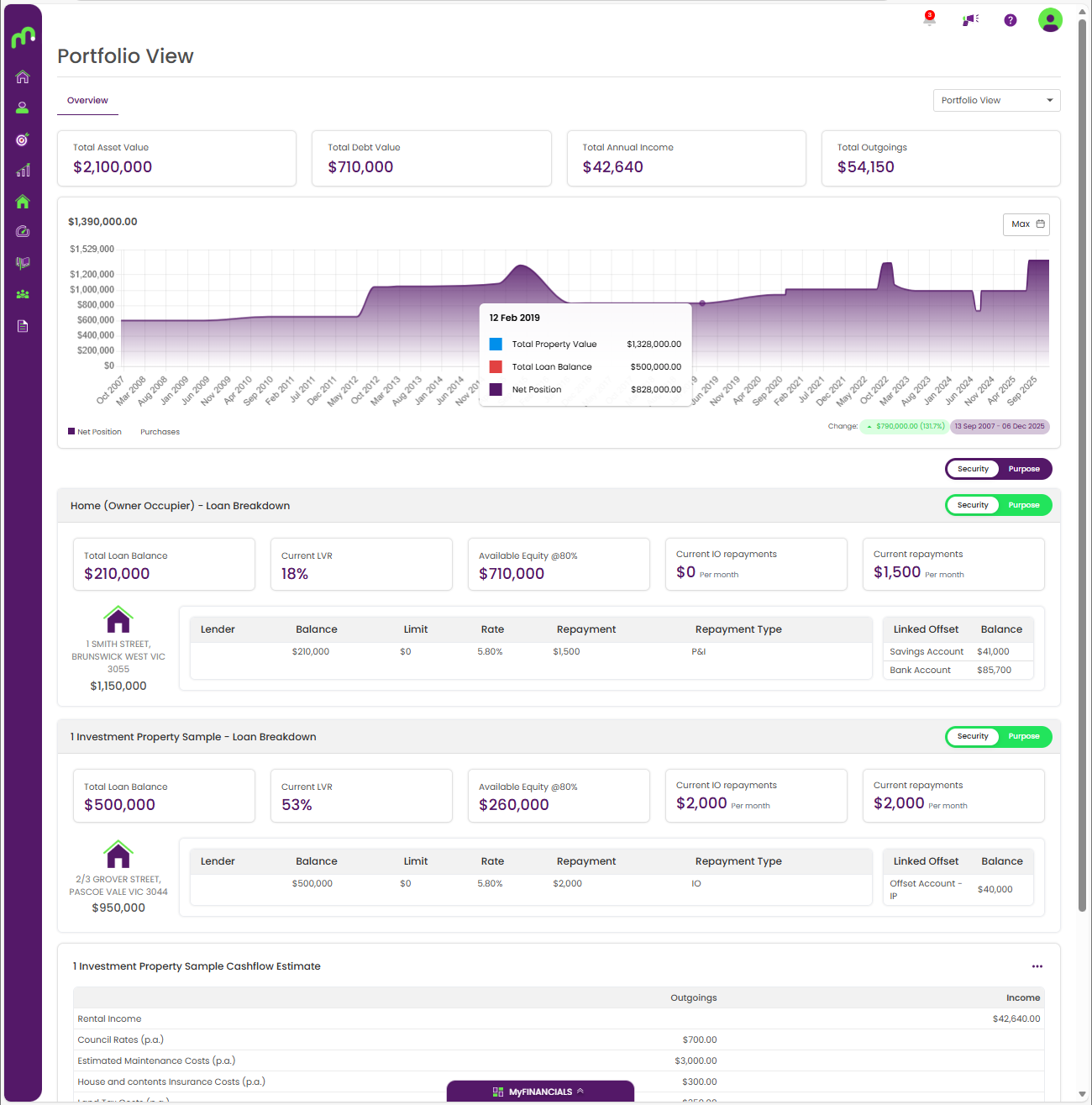

See Your Entire Property Portfolio in One Place

MyProperty brings together your property values, loans, equity positions and cashflow so you can understand your full portfolio at a glance. Track performance over time, view loan breakdowns and see how each property contributes to your overall wealth.

You can filter the view to look at your

entire portfolio or filter it down to

individual properties.

See your total asset value, total debt, total

rental income and total property-related

outgoings — your whole portfolio in four

tiles.

Track how the combined value of your

properties and loans has changed over time

and see how your net position is evolving.

Each property shows its loan balance, LVR,

equity position and repayment details,

giving you a clear snapshot of performance

and risk.

You can toggle it to see the loan breakdown

based on security or based on purpose.

Review estimated rental income, expenses

and loan repayments for each property to

understand individual property

performance.

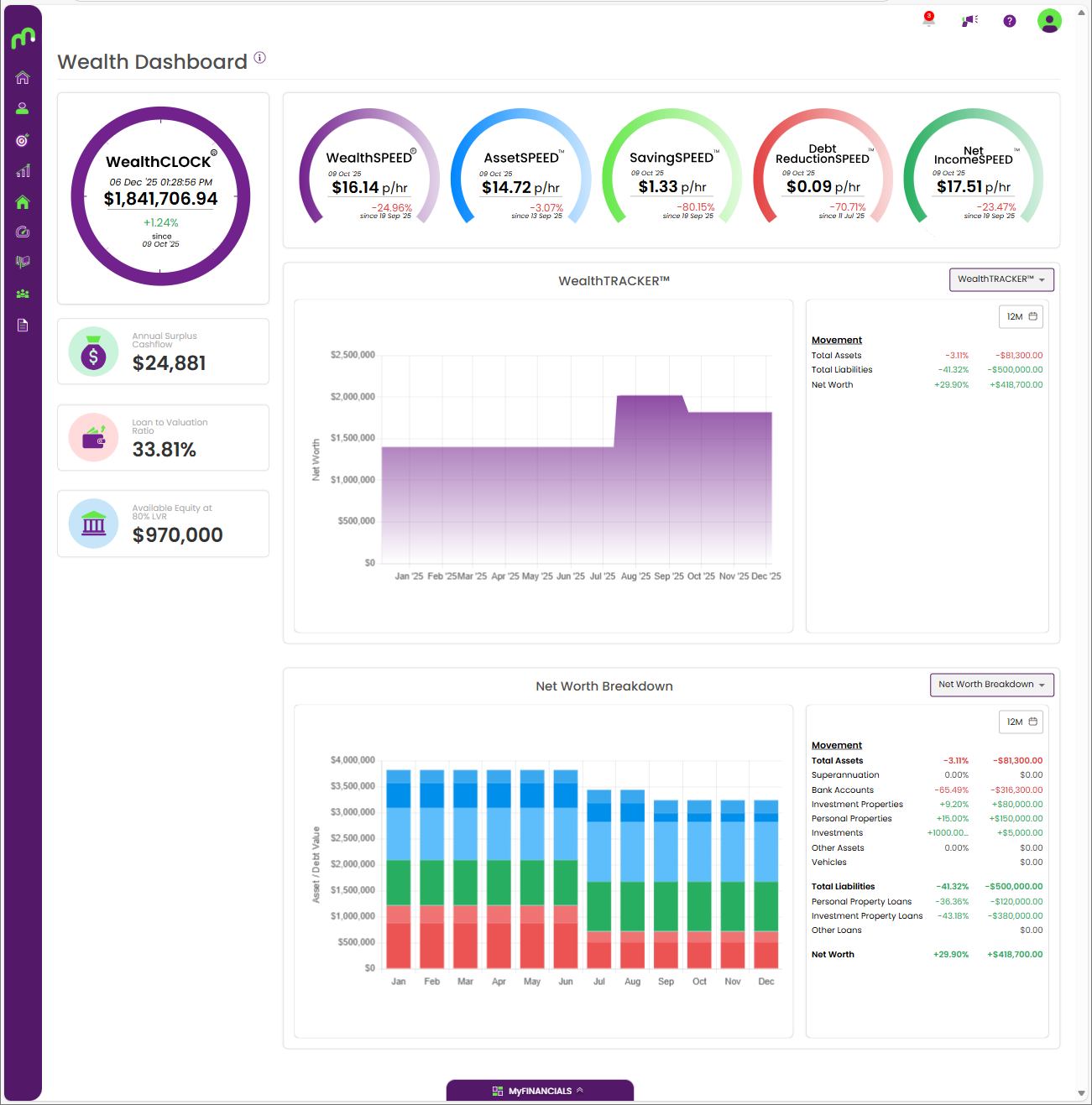

Your financial progress, made visible.

See your financial world in motion—track your wealth, equity, and progress in one powerful view.

Your net worth… ticking in real time. WealthCLOCK® shows your total position and how it’s growing—minute by minute.

This shows how fast you’re building wealth—measured in dollars per hour.

The higher your SPEED®, the faster you’re moving forward.

See what’s driving your wealth. From growing assets to reducing debt, each speed shows your financial momentum.

A visual snapshot of all your assets and liabilities over time—so you can track your growth month to month.

A month-by-month breakdown of your assets and liabilities.

Understand which parts of your financial life are growing — and which need attention.

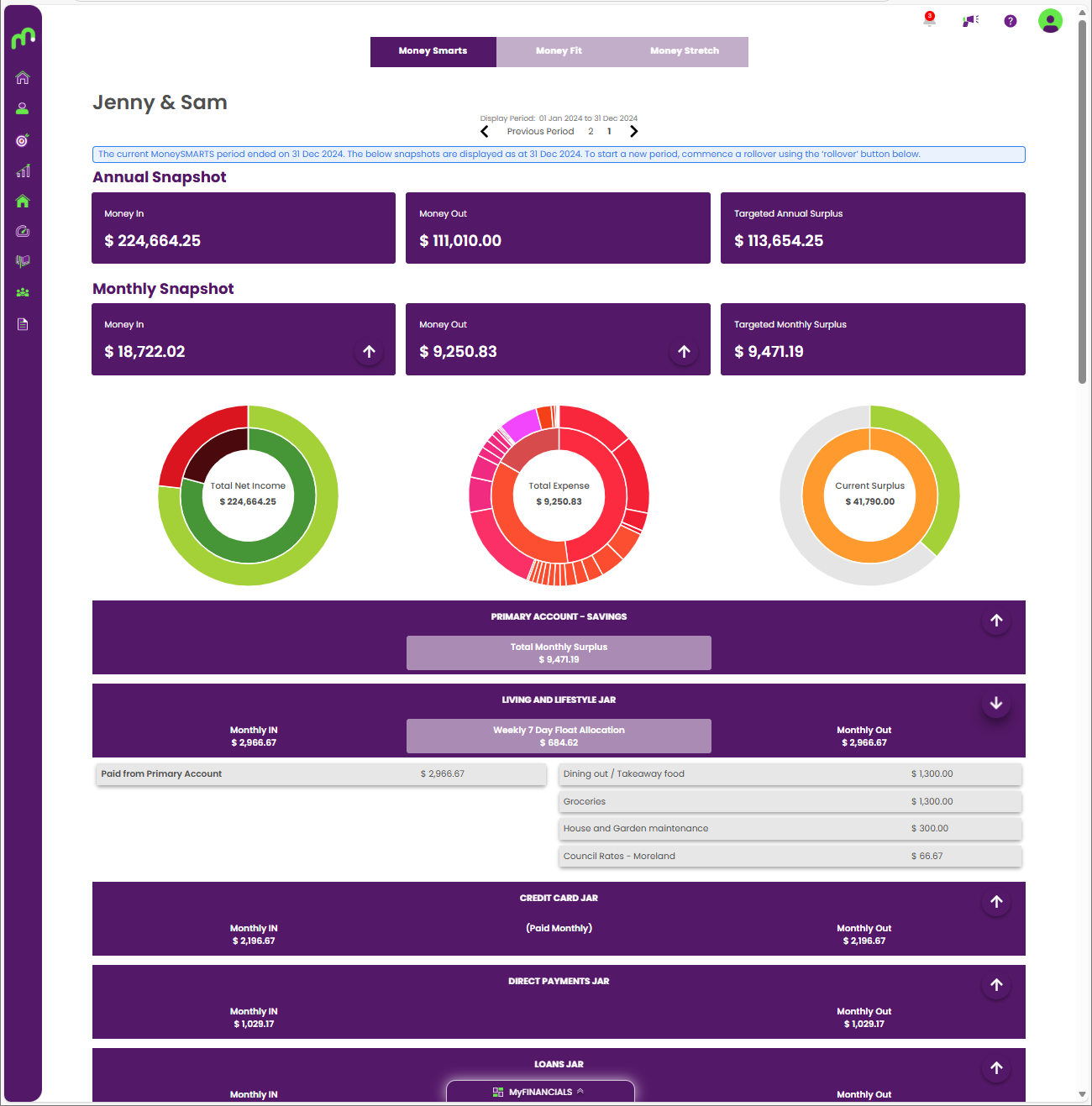

The budgeting system thousands rely on.

MoneySMARTS helps you understand how you spend, save and build surplus. Track your income, expenses and allocations in one place so you always know what’s safe to spend — and what needs to be set aside.

Here’s the suite of our MyMONEY Features – including MoneyFIT & MoneySTRETCH.

See what you earn, what you spend, and what you’re aiming to keep.

This gives you the big picture of your money over the year & month.

Visualise how your money moves.

See the breakdown of your total income and total expenses

to understand your spending patterns.

Your day-to-day spending jar. Set once, automated, and easy to track so you always stay in control without micromanaging.

The MoneySMARTS page includes even more charts and detailed breakdowns.

To explore the full view of your cashflow, create your free Moorr account today.

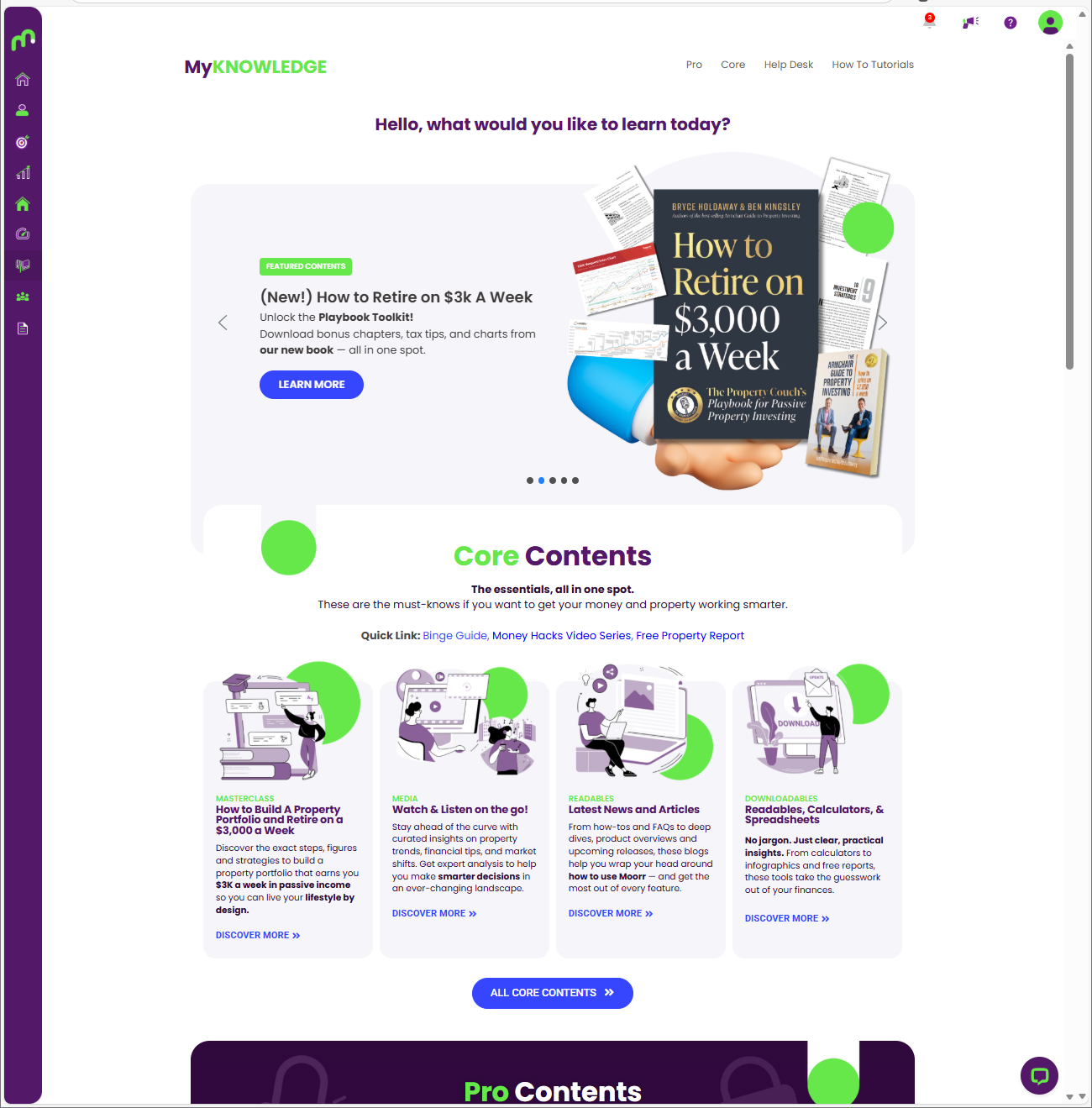

Learn Smarter. Build Faster.

Your library of tools, tutorials and expert insights to help you master money and property. From quick wins to deep-dive courses, everything you need to level up your financial know-how lives here.

Quick access menu to all our core (free)

resources, pro (premium workshops),

helpdesk and other useful tutorials.

Spotlight on the latest or most important

learning resources — from new tools to

major courses, free guides and premium

content.

Your essential starting point. Core

resources include must-know guides,

tutorials and videos to help you understand

money and property fundamentals.

With 50+ free resources, there’s definitely

one that suits you unique circumstances!

Your Whole Property Portfolio, Clearly Laid Out

View your property values, loans, equity and cashflow all in one clear portfolio view.

See your total asset value, total debt, total

rental income and total property-related

outgoings — your whole portfolio in four

tiles.

You can also edit the view to either see

your whole portfolio as a group or filter

it down to specific properties.

Track how the combined value of your

properties and loans has changed over time

and see how your net position is evolving.

Each property shows its loan balance, LVR,

equity position and repayment details,

giving you a clear snapshot of performance

and risk.

Review estimated rental income, expenses

and loan repayments for each property to

understand individual property

performance.

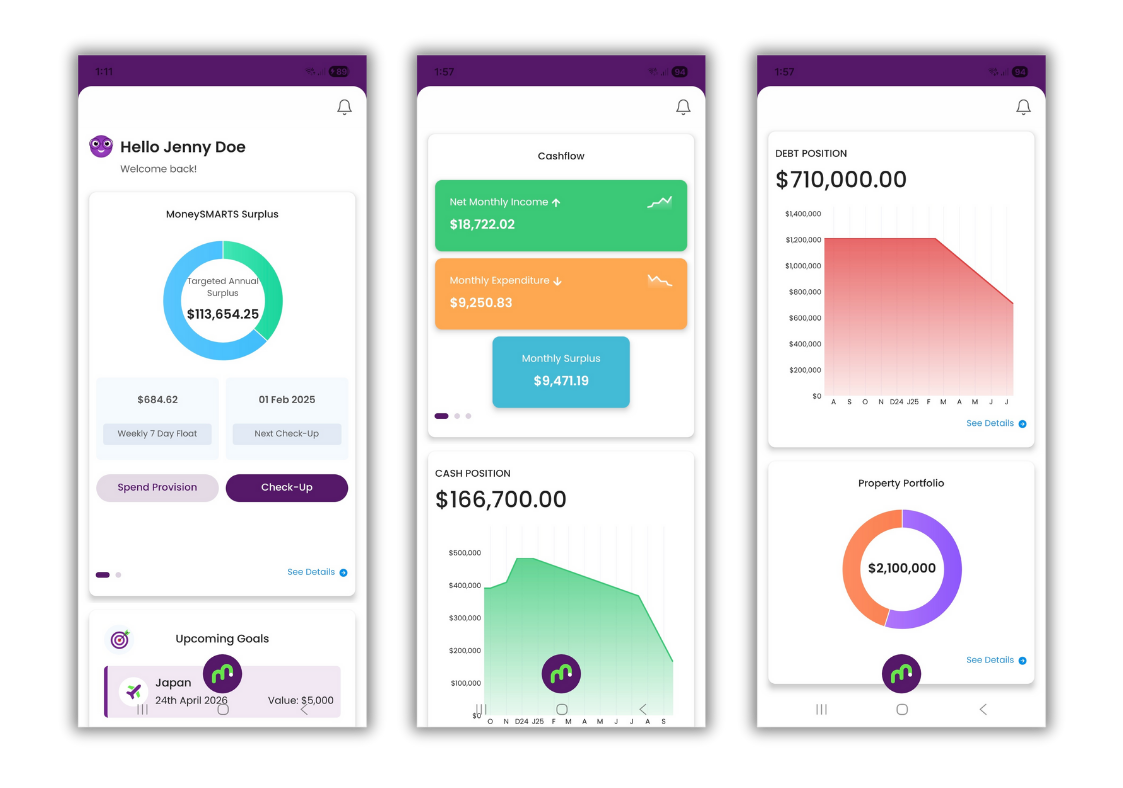

Built for life on the go. The mobile app focuses on the tools you need most, helping you stay across your money and property anytime, anywhere.

Your Money, At a Glance.

The Moorr mobile app gives you instant visibility over your cashflow, debt, savings and goals — all in one simple, swipe-friendly dashboard. Quick insights, real numbers, zero overwhelm.

See how your monthly and annual surplus

is tracking so you always know how much

you’re keeping — not just spending.

Your day-to-day spending guardrails.

Track what’s safe to spend and stay aligned

with your money rhythm.

Stay motivated with a clear view of what

you’re saving towards and how close you

are to achieving it.

A fast breakdown of what’s coming in,

what’s going out, and what’s left over.

Perfect for quick clarity.

See how your savings and buffers move

over time so you know exactly where you

stand.

Track how your total debt is trending —

and whether you’re moving closer to

financial freedom.

View your total property value at a glance

and tap through for deeper insights.

Master Your Money, One Smart Move at a Time

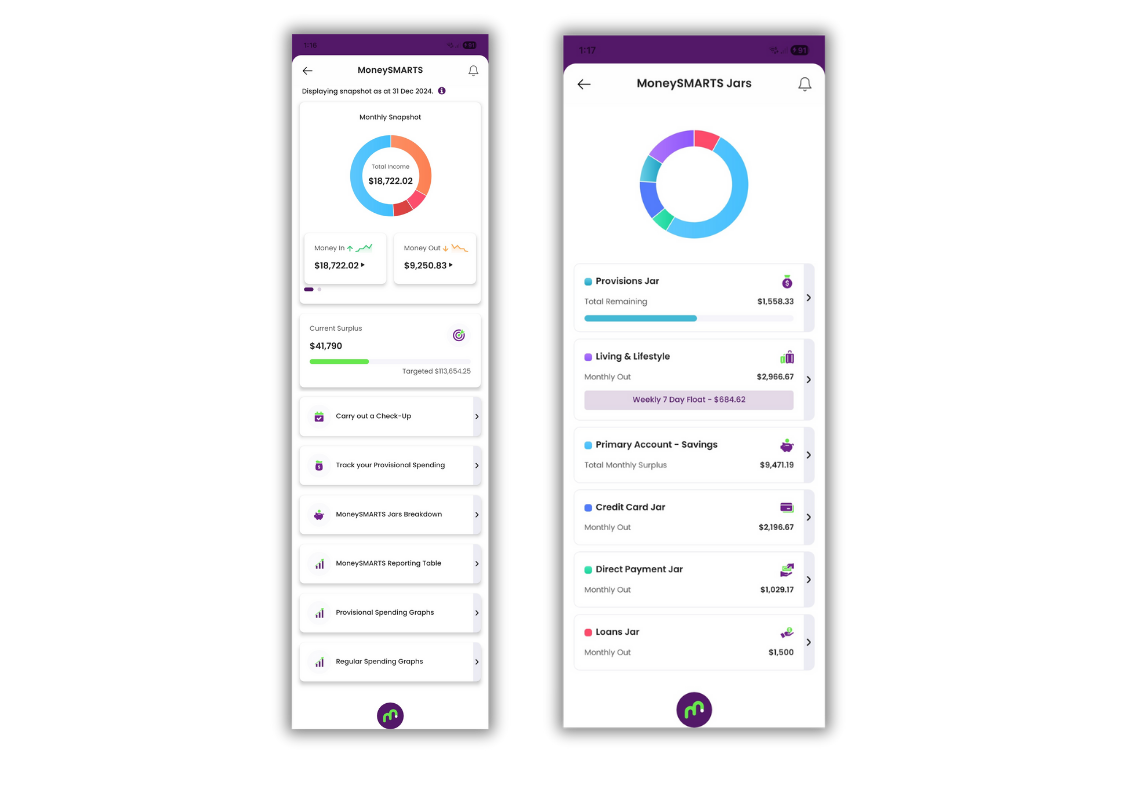

MoneySMARTS on mobile gives you a live, crystal-clear view of where your money goes each month — your income, spending, surplus and every jar working behind the scenes. Check-in, track your spending, and stay on top of your weekly float with zero guesswork.

Quickly see your total income, total

outgoings and the balance between them —

updated in real time.

Instant clarity on exactly what’s flowing

into your household and what’s flowing out.

Watch your surplus build toward your

annual target — your progress bar for

financial momentum.

Some of the common actions when

you’re updating MoneySMARTS on the go!

Run a MoneySMARTS Check-Up anytime

to instantly recalibrate your numbers or

check up on how much provisions you’ve

got left for the year!

Your whole financial world in a single visual

— each jar, each category, perfectly

displayed.

See how much is left in your annual

Provisions pool and stay ahead of irregular

expenses.

Track your weekly 7-day float — the heart of

MoneySMARTS — and stay in control of

day-to-day spending.

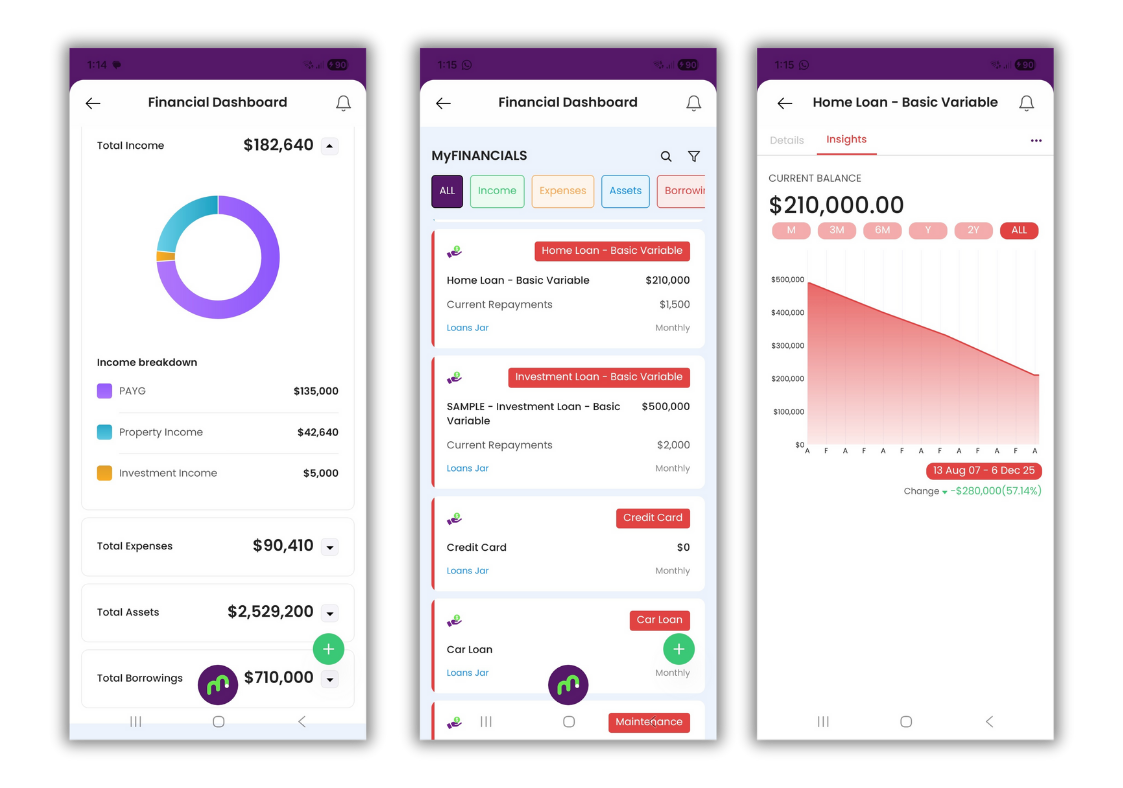

Your Finances, Organised Instantly.

Your whole financial position — income, expenses, assets, loans — all at your fingertips.

Quickly switch between categories to see

just what you need — no scrolling through

long lists.

If you need to, you can also quickly add

a card with this plus button.

Easily filter or search for a particular

Financial Card here.

Tap any card to open detailed insights —

from loan balances to income sources to

spending categories.

Visualise loan trends over time with simple,

mobile-friendly charts showing balance

changes and progress.

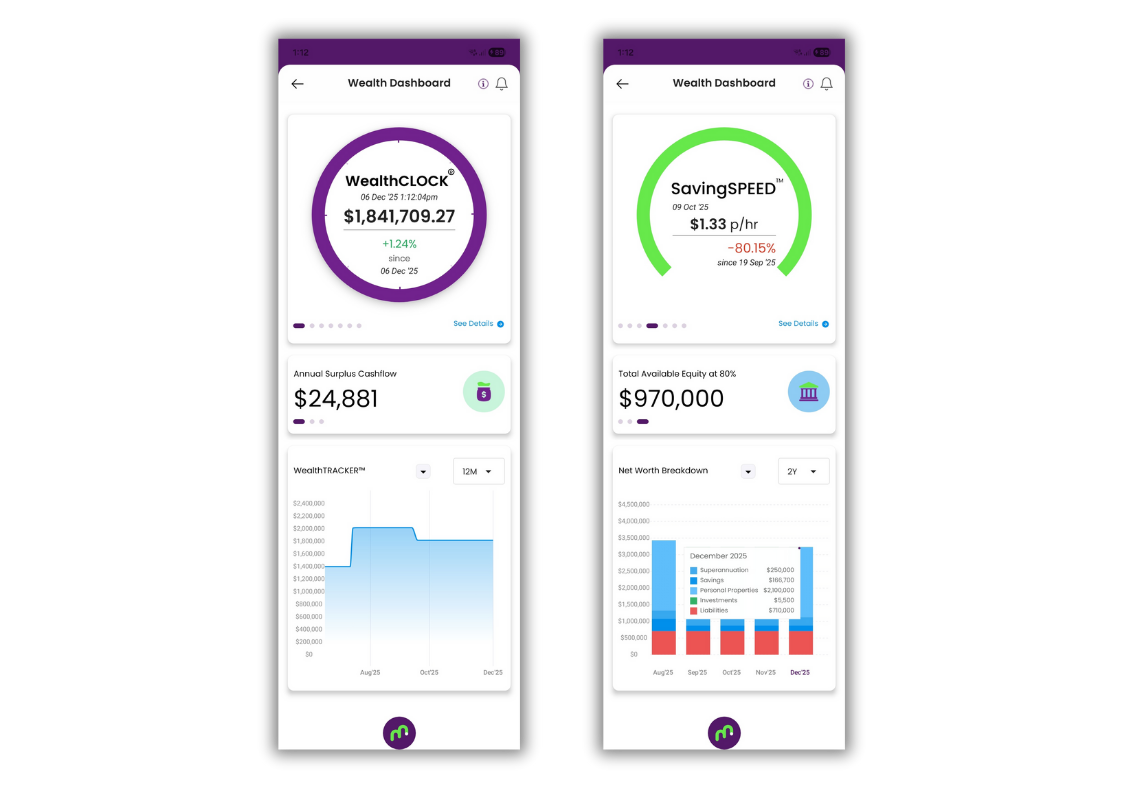

Track Your Wealth Like a Pro

See your net worth, equity, and wealth momentum at a glance — all from your phone. Track how fast you’re building wealth, spot opportunities instantly, and enjoy a dashboard that also happens to be a great BBQ conversation starter. 😉

A real-time view of

your total wealth.

Watch your number

change over time

and see your overall

growth since your

last check.

A quick read on how much surplus you’re

generating this financial year — your fuel

for investing and financial momentum.

Track how your wealth has shifted month-

by-month. Great for spotting turning points

or long-term trends.

Your financial velocity. See how quickly

you’re building wealth per hour — and

whether you’re speeding up or slowing

down.

There are a few other speeds too! Just

slide on your mobile app and you’ll see them.

Keen to check it out? Create your free

Moorr account today!

Instant insight into how much usable equity

you have across your properties — perfect

for planning your next move.

See the structure of your wealth: super,

savings, properties, investments, liabilities.

All in one simple, digestible visual.

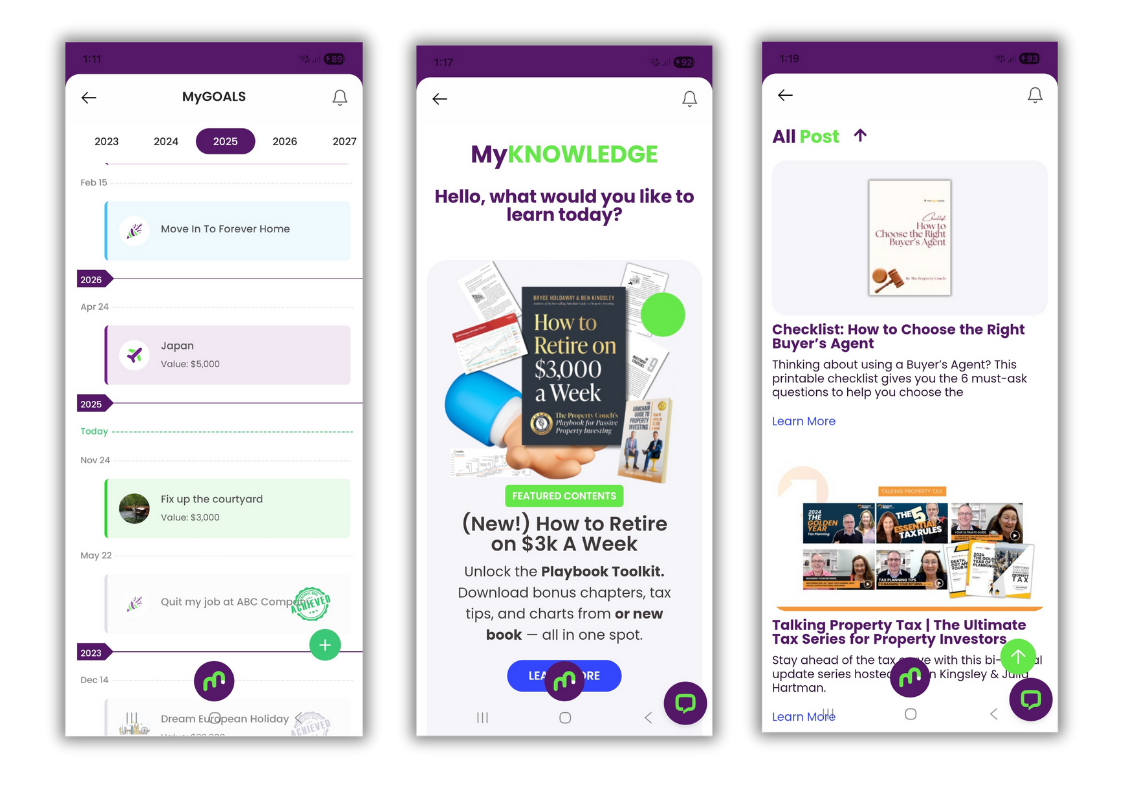

Plan Smarter. Learn Faster.

On mobile, Moorr helps you stay focused on what you’re working toward and what you’re learning next. MyGOALS keeps your lifestyle and financial goals organised and on track, while MyKNOWLEDGE lets you access tutorials, guides and resources wherever you are.

Swipe through future years and see how

your goals stack up over time.

Each goal shows the title, date and value at

a glance. Tap to view details, track progress

or edit.

Add a new goal instantly — whether it’s

lifestyle, travel, savings, home upgrades or

personal development.

Access featured content and new releases

instantly — including checklists, how-to

guides and the Playbook Toolkit.

Your super easy to set-up and use all-in-one personal finance and property management platform. Offering you and helping you achieve more.

Join tens of thousands of users, accessing their information anywhere, anytime

Sign up and start using Moorr in minutes

Your data is always secure and protected

Stay on track to your financial goals in under 10 minutes/month.

Use Moorr anywhere and anytime

Get help unlocking Moorr’s full potential

Check out our curated recommended steps on how to set up Moorr for whichever journey you are currently on!

Find out about our 7 Steps Process here and how to best use Moorr for Money SMARTS!

How would you set up Moorr to trap your every dollar and build wealth

Tips on how you can save for a home deposit as quickly as possible!

Step-by-step through the process of recovering from credit card debt and regaining control of your finances.

Keen to pay off your mortgage as quickly as possible and become debt-free? Check this one out!

Learn how to get started on Moorr via your computer!

Want to get Moorr on your fingertips? Step by step guide over here!

Need to activate Moorr for Empower Wealth? This is what you're looking for!

Designed by experienced and subject matter professionals in the disciplines of Money management, Finance & Debt management and Residential Property. Moorr is a Lifestyle-by-design platform that helps you plan out your future and master the science and art of managing your finances to help you live your full & best life.

Offering a range of proven tools and features and an ever-increasing range of next-gen tools and insights, Moorr will become your platform of choice to help you organise your and plan out your life, by helping track, manage, report and store in the cloud your progress, as it relates to your personal and financial goals.

There is no comparable platform on the market like it.

An all-in-one solution that goes beyond simple budgeting and cashflow management. If you’re looking to create financial peace, and your Lifestyle-By-Design, the Moorr platform can help you get there.

We understand the need to protect your data and we take this job very seriously.

Your Moorr account is protected by two-factor authentication (2FA) via SMS, Google Authenticator and email (depending on your preference)and complies with security best practices according to the OWASP (Open Web Application Security Project).

We’ve also enforced all methods of authentication (identifying and verifying users), and authorisation (only allowing permission users to access information) protocols in the platform while encryption is used on both the networking and database levels.

For your part in keeping your data safe, we strongly recommend you use a high-level and complicated password for additional security – so consider avoiding simple text and number passwords (that means thinking twice about using birthdays!).

We recommend passwords include:

• At least 1 upper case alphabet

• At least 1 lower case alphabet

• At least one number

• At least one character

We also understand that situations can change. So if you decide to cancel your Moorr account we’ll be sad to see you go, but as you leave we’ll fully delete your account and erase your data from the platform.

Yes!

As a platform, we offer users access to both the Desktop (web) as well as via mobile through IOS and Android. We are pleased to be one of a very exclusive list of providers, offer free account creation and access on both desktop and mobile.

Furthermore, we have made a pledge to our Moorr community that certain features, such as the existing MoneySMARTS tool, our existing MyGOALS tool, our existing MoneyFIT & MoneySTRETCH, our WealthSPEED and WealthCLOCK and the general budgeting and finance tools will be available free of any charges or fees.

No not all tools and features are available in both environments

We feel like some tools we designed are best suited to certain screen realestate, meaning some insights are best explained on a bigger screen so we make it easy for you to use, interact with, and make sense of your numbers on your desktop Moorr account, whilst some tools and features are better suited to a mobile, on-the-go type of use case.

That said, all the tools and features we judge as fundamental to the Moorr platform serving is community of users will be available on both desktop and mobile

For the is of what tools and features are available – click here to review our full list of features

Yes.

The taxation calculations within Moorr only support the Australian taxation system.

This means that Moorr’s financial dashboard and most of our widgets are calculated using Australia’s latest tax rates.

Whilst we know we have existing international users of Moorr, we cannot provide any customer service or support to those users in helping them correctly calculate their financials because, again we only use Australian tax rates, which put these users calculations out of balance.

Spend money on the things you want without guilt and save for the future with confidence. You can have the best of both worlds. Achieve more, with Moorr

So much to realise & gain,

nothing to lose.

Onboard with your hopes,

dreams & finances.

Start planning & living your

Lifestyle-by-Design.

*It’s 100% free. No Strings Attached.

So much to realise & gain,

nothing to lose.

Onboard with your hopes,

dreams & finances.

Start planning & living your

Lifestyle-by-Design.

*It’s 100% free. No Strings Attached.

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.